The Bottom Line

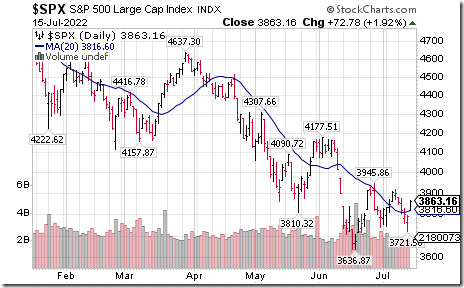

U.S. equity indices continue to develop intermediate base building patterns. Technical action was encouraging on Friday when indices and their related ETFs moved above their 20 day moving average. They included the S&P 500 Index, Dow Jones Industrial Average, NASDAQ Composite Index and Russell 2000 Index. A move by these indices above their indicated June 28th highs will complete classic double bottom patterns.

The same cannot be said about Canadian equity indices and related ETFs. Their exposure to the Canadian banking and commodity sectors weighed heavily last week. Indices have yet to show technical signs of an intermediate bottom.

Earnings and Revenue Outlook for S&P 500 companies

Consensus earnings estimates for S&P 500 companies on a year-over-year basis in the second quarter of 2022 eased slightly last week. According to www.FactSet.com consensus for second quarter earnings on a year-over-year basis is an increase of 4.2% (versus 4.3% last week) and consensus for revenues is an increase of 10.2% (versus 10.1% last week).

Consensus earnings and revenue estimates for S&P 500 companies beyond the second quarter on a year-over-year basis slipped slightly again last week. According to www.FactSet.com earnings in the third quarter are expected to increase 10.1% (versus 10.2% last week) and revenues are expected to increase 9.5%. Earnings in the fourth quarter are expected to increase 9.2% (versus 9.4% last week) and revenues are expected to increase

7.2% (versus 7.3% last week). Earnings on a year-over-year basis for all of 2022 are expected to increase 9.9% (versus 10.0% last week) and revenues are expected to increase 10.7%.

Economic News This Week

June U.S. housing starts released at 8:30 AM EDT on Tuesday are expected to increase to 1.585 million units from 1.549 million units in May.

Canadian June Consumer Price Index released at 8:30 AM EDT on Wednesday is expected to increase 1.0% versus a gain of 1.4% in May. Year-over-year, June Consumer Price Index is expected to increase 7.4% versus a gain of 7.7% in May. Excluding food and energy, year-over-year, June Consumer Price Index is expected to increase 5.9% versus a gain of 6.1% in May.

June U.S. existing home sales released at 10:00 AM EDT on Wednesday are expected to slip to 5.39 million units from 5.41 million units in May.

July Philly Fed released at 8:30 AM EDT on Thursday is expected to drop 2.5 versus a drop of 3.3 in June.

Canadian May retail sales released at 8:30 AM EDT on Friday are expected to increase 0.8% versus a gain of 0.9% in April. Excluding auto sales, May retail sales are expected increase 0.6% versus a gain of 1.3% in April.

Selected Earnings News This Week

Seventy three S&P 500 stocks (including three Dow Jones Industrial stocks) are scheduled to report quarterly results this week.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for July 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for July 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links from valued providers

Greg Schnell “Can oil start to rally”?

Can Oil Start To Rally? | The Canadian Technician | StockCharts.com

David Keller says “Financials rallied on Friday, but is it enough”?

Financials Rallied on Friday, But Is It Enough? | The Mindful Investor | StockCharts.com

John Hopkins says “Earnings season just might offer big time opportunities”.

Mary Ellen McGonagle says “Markets end week on high note. Here’s why they could stay there”.

Markets End Week on High Note — Here’s Why They Could Stay There | The MEM Edge | StockCharts.com

Links offered by Mark Bunting and www.uncommonsenseinvestor.com

The Three Best Canadian Dividend Stocks Right Now – Uncommon Sense Investor

Tech Crash Mirrors Path of Early 2000s – Uncommon Sense Investor

Rate Shock Has Economists Doubting Bank of Canada’s Rosy View (yahoo.com)

Canadian home prices continue to plunge in June as higher rates pinch (yahoo.com)

Goldman Goes Cold on Copper as Power Crisis Sparks Bearish Pivot (yahoo.com)

Michael Campbell’s Money Talks for July 16th

Note comments by Kevin Muir.

July 16th Episode (mikesmoneytalks.ca)

Victor Adair’s Trading Desk Notes for July 16th

https://victoradair.ca/trading-desk-notes-for-july-16-2022/

Bob Hoye asks “Could this be the last Fed Rate hike”?

Could This Be The Last Fed Rate Hike? – HoweStreet

Comments by Mark Leibovit: Inflation, US Dollar, Copper, Moons

This Week in Money – HoweStreet

Forward to 38th minute

Technical Scoop for July 18th from David Chapman and www.enrichedinvesting.com

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

U.S. bank stocks responded to encouraging guidance after Wells Fargo and Citigroup released quarterly results. Wells Fargo $WFC an S&P 100 stock moved above $41.36 completing a double bottom pattern.

Citigroup $Can S&P 100 stock moved above intermediate resistance at $49.11.

Semiconductor stocks responded to an encouraging quarterly report by Taiwan Semiconductor

Micron $MU a NASDAQ 100 stock moved above intermediate resistance at $60.47

Texas Instruments $TXN an S&P 100 stock moved above intermediate resistance at 158.99

Skyworks Solutions $SWKS a NASDAQ 100 stock moved above $100.70 completing a double bottom pattern.

Comcast $CMCSA an S&P 100 stock moved above $40.30 completing a double bottom pattern.

Sirius $SIRI a NASDAQ 100 stock moved above intermediate resistance at $6.33.

Chinese equities remain under technical pressure. Recurring COVID 19 concerns continue to weigh on equity prices.

NetEase $NTES a NASDAQ 100 stock moved below $83.94 extending an intermediate downtrend.

S&P 500 Momentum Barometers

The intermediate term Barometer added 9.60 on Friday and 0.20 last week to 28.60. It remains Oversold. Trend is up.

The long term Barometer added 1.40 on Friday, but slipped 3.60 last week to 19.80. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer added 2.94 on Friday, but dropped 3.36 last week to 20.59. It remains Oversold

The long term Barometer added 1.26 on Friday, but dropped 4.62 last week to 21.85. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.