Technical Notes yesterday

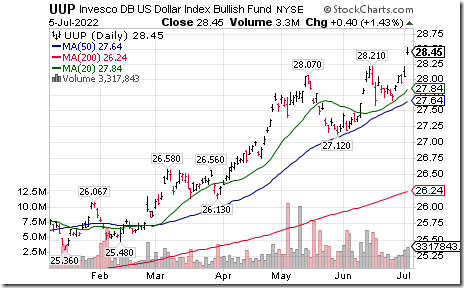

U.S. Dollar Index ETN $UUP moved above $28.21 extending an intermediate uptrend.

The Canadian Dollar moved below US76.47 cents on U.S. Dollar strength extending an intermediate downtrend.

The Euro dropped below 103.50 to a 19 year low on U.S. Dollar strength extending an intermediate downtrend.

Encouraging technical action by the NASDAQ 100 Index and related ETFs! $QQQ $ZQQ.TO $XQQTO moved above their 20 day moving average and are close to completing an intermediate bottoming pattern. A move by QQQ above $296.58 will complete the pattern.

International equity markets and their related Exchange Traded Funds responded to the U.S. Dollar Index breakout. ETFs moving below intermediate support extending a downtrend included EFA, IEV, ZEM.TO, EWA, TUR, VNM and ECH.

Energy equities and related ETFs are responded to weakness in crude oil prices. A break by USO below $78.49 has triggered intermediate breakdowns by OIH, FCG, ZEO.TO, XLE, COP, IMO.TO, CVX, SLB, HAL and PD.TO.

Auto stocks and related ETFs remain under pressure due to a shortage of computer chips. Ford moved below $10.90 and General Motors moved below $30.65 extending an intermediate downtrend.

Moderna $MRNA a NASDAQ 100 stock moved above intermediate resistance at $152.73.

Biotech ETF $BBH moved above $151.62 completing a double bottom pattern.

Restaurant Brands International $QSR.TO a TSX 60 stock moved above intermediate resistance at Cdn$66.32.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 5th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for July 5th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for July 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Tom Bowley asks “Secular or Cyclical Bear Market”?

Secular or Cyclical Bear Market? | Tom Bowley | Trading Places (07.05.22) – YouTube

Dave Keller talks about trend lines.

Best Practices for Trendlines | David Keller, CMT | The Final Bar (04.12.22) – YouTube

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.