by Kevin McCreadie, CEO, CIO, AGF Investments Inc.

AGF’s CEO and Chief Investment Officer discusses the possibility of a severe economic slowdown and explains which types of companies are feeling the pinch of higher prices the most.

Talk of a recession is ratcheting up as the U.S. Federal Reserve and other central banks aggressively raise rates to combat inflation. How worried should investors be?

The probability of recession is much higher than it was a few weeks ago. There was always a good chance of one happening next year, but it may be closer at hand given the extreme hawkishness of central banks right now. In fact, while some economies are still at nearly full employment, there’s no question that consumers are going to struggle with the combination of higher inflation and higher interest rates going forward and already there are signs of a slowdown in spending. In the U.S., for instance, retail sales unexpectedly fell 0.4% month over month in May and were also revised down for the previous two months, according to the U.S. Census Bureau.

What’s more alarming, however, is what other data is beginning to show about consumer spending. Not only has demand for goods started to slump, but now there’s evidence that spending on services like restaurants and bars as well as things like air travel, may also be waning. Remember, it was largely expected that our appetite for “stuff” would normalize and give way to “experiences” once economies reopened following the worst of the pandemic. And, generally speaking, that’s what has happened to date. Yet, this shift may be more fleeting than expected, according to Barclays Capital, whose analysis of credit card data shows both high and low-income Americans have spent less on services in the past four to six months.

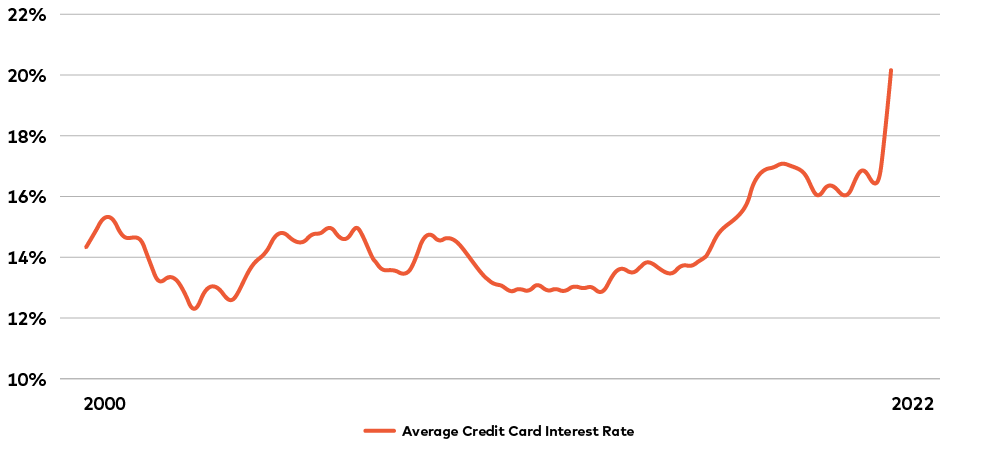

Of course, much of that can be traced to inflation and higher prices for gas and food, in particular. People simply need to be more careful about their discretionary spending because of it. But higher interest rates are also likely starting to bite. The average credit card interest rate, for example, has risen above 20% (see chart), which is especially hard on consumers that use credit cards to help finance their household budgets.

Spiking U.S. Credit Debt Interest Rate Charges

Source: Bloomberg LP, using historical data from the U.S. Federal Reserve and recent data point from Lendingtree. As of June 26, 2022

Moreover, it may only get more difficult for them from here. The Fed (and other central banks) seem dead set on quashing inflation by any means possible and will likely keep raising rates until they do. The question is whether they can achieve their goal without killing economic growth in the process.

All of that said, there may be a silver lining for the economy if inventories pile up due to sluggish demand going forward. That would force companies to pull back on ordering, which will weaken commodity prices and ease many of these inflationary pressures. As a result, central banks may not need to be as aggressive as the market is anticipating.

What does that mean for investors?

More volatility is almost certain. While equity markets have fallen significantly this year, they may not have fully priced in a recession if one were to happen. That said, valuations are starting to look more attractive than they have in a long time and buying opportunities should prevail over the next few months as a result.

Given this backdrop, asset allocation is going to be particularly important, but getting the balance right won’t be easy. Depending on individual objectives, it may still make sense for some to be slightly overweight equities in a 60/40 portfolio of stocks and bonds, but knowing what to do about fixed income is a trickier proposition. Yes, bond yields could rise even higher – sending bond prices lower – if central banks hike rates even more quickly in the months ahead, but they could also drop if evidence of an economic slowdown becomes more evident in the interim. In fact, that may already be happening.

The other part of the equation on this front is the potential for generating income. At current levels, nominal yields are more attractive now than they’ve been for several years, which, for many investors, may be incentive to increase their exposure to bonds, even despite what direction yields might be headed next.

Beyond that, it may be appropriate for most to maintain higher cash balances than normal, while at the same time allocating some of their portfolio to “alternatives” that may help dampen volatility, among other things.

From a securities perspective, meanwhile, one of the ways to separate opportunities from risks is to better understand what impact the current inflationary environment has on a particular sector or company. For example, most businesses are dealing with wage pressures right now, but if you’re a bank or a software firm, that’s about it. A goods manufacturer, on the other hand, must not only deal with the prospect of higher labour costs, but also the rising cost of raw materials and/or energy that is needed to mix, make and ship what they are producing.

That’s not to say companies dealing with multiple inflationary pressures can’t be good investments in this environment. Nor does it mean those with less to worry about are sure fire opportunities. What it does suggest, however, is that an emphasis on quality will be key for navigating through the next few months. After all, companies who hold up better against higher inflation and higher interest rates are probably going to be those with pricing power and, by extension, those with the strongest balance sheets and ability to keep generating free cash flow despite these higher costs.

Kevin McCreadie is Chief Executive Officer and Chief Investment Officer at AGF Management Limited. He is a regular contributor to AGF Perspectives.

Click to learn more about our fundamental, alternative and quantitative capabilities.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of June 27, 2022, and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

“Bloomberg®” is a service mark of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”) (collectively, “Bloomberg”) and has been licensed for use for certain purposes by AGF Management Limited and its subsidiaries. Bloomberg is not affiliated with AGF Management Limited or its subsidiaries, and Bloomberg does not approve, endorse, review or recommend any products of AGF Management Limited or its subsidiaries. Bloomberg does not guarantee the timeliness, accurateness, or completeness, of any data or information relating to any products of AGF Management Limited or its subsidiaries.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.