Observations

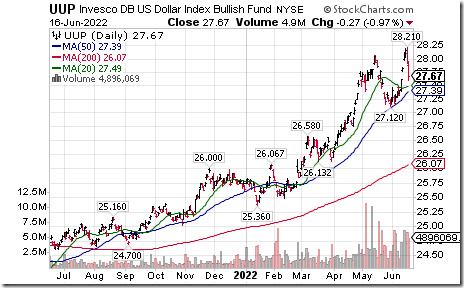

The U.S. Dollar Index and its related ETN moved significantly lower yesterday, the largest one day drop in over two years.

Gold, gold stocks and related ETFs responded with significant gains. ‘Tis the season for the sector to move higher!

Technical Notes for Yesterday

S&P 100 and NASDAQ 100 stocks moving below intermediate support extending an intermediate downtrend included BLK, CMCSA, MAR, WBA, ALL, AXP, AVGO, ADI, AMD, LRCX, MA, QCOM, NXPI, VRSN, PAYX, CHTR, KMI, EMR

ETFs moving below intermediate support extending an intermediate downtrend included XLY, CARZ, ITA, XBM.TO

TSX 60 stocks moving below intermediate support extending an intermediate downtrend included TRP, RY, NA, BNS, FM, BAM, CNQ, CTC.A, BIP/UN and POW.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 16th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for June 16th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for June 16th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from Valued Providers

Greg Schell says “Recession Data Is Arriving”

https://www.youtube.com/watch?v=2hPcTLrpmZ0

Tom Bowley says “I’m calling the bottom”.

https://www.youtube.com/watch?v=ajdiFHVjhtM

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 4.00 to 2.00 yesterday, lowest level since March 2020. It remains extremely Oversold, but has yet to show signs of a short term bottom.

The long term Barometer dropped another 5.20 to 13.00 yesterday. It remains Oversold, but has yet to show signs of a short term bottom.

TSX Momentum Barometers

The intermediate term Barometer plunged 8.37 to 9.20 yesterday. It is extremely Oversold, but has yet to show signs of a short term bottom

The long term Barometer dropped 2.93 to 25.52 yesterday. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed