Technical Notes for yesterday

S&P 100 and NASDAQ 100 stocks breaking intermediate support yesterday included:

CPRT, GM, F, TGT, MNST, BAC, BK,C, COF, MS, MET, ABBV, ALGN, MRNA, BMY, HON, UNP, AAPL, AMAT, ASML, ADSK, EBAY, FISV, MCHP, MSFT, MRVL, META, ORCL, MELI, SWKS, SIRI, DD, EXC, SO,

ETFs breaking intermediate support yesterday included:

TLT, IEV, SPY, RSP, DIA, QQQ, MDY, XLK, XLB, XLF, XLI, XLV, XLU, EWU, EWY, EWG, EWI, EWA, EFA, EIS, EPP, PIN, VNM, IHF, KBE, KRE, IAI, IAK, IHI, BBH, PPH, IYT, IYZ, XHB, WOOD, SMH, SOXX, PHO, PALL JETS, COW.TO, XRE.TO

TSX 60 stocks breaking intermediate support included:

BMO, CM, TD, CNR, BCE, CP, T, GIB, CSU, QSR, WN, SHOP and GIL.

Trader’s Corner

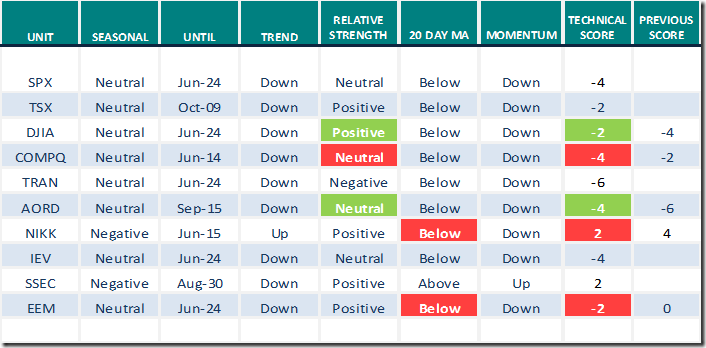

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 13th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for June 13th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for June 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Erin Swenlin says “This ETF Is Weathering The Storm”.

This ETF Is Weathering The Storm | Erin Swenlin | Your Daily Five (06.13.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 7.60 to 4.60 yesterday, the lowest level since March 2020 when the COVID 19 panic in equity markets reached its peak. It remains Oversold. Trend is down and has yet to show signs of a bottom.

The long term Barometer dropped 6.00 to 19.40 yesterday, the lowest level since April 2020. It remains Oversold. Trend is down and has yet to show sign of a bottom.

TSX Momentum Barometers

The intermediate term Barometer dropped 10.68 to 18.41 yesterday. It remains Oversold. Short term trend is down.

The long term Barometer dropped 7.18 to 30.54 yesterday. It remains Oversold. Short term trend is down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.