by Ryan James Boyle, Senior Economist, Northern Trust

Strong employment and spending will help the economy grow through current shocks.

Manifestation is an exercise in self-motivation. By focusing one’s thought on an outcome, we steer our lives toward that end. It can be as simple as reframing a future thought with greater certainty, like starting a sentence with “When I get promoted” instead of “If I ever get promoted.”

Economically, we often see observers manifesting a poor outcome. Many in our audiences are no longer asking about the chance of a recession, but rather whether one has already started and how bad it will be. Among the chief sources of concern are:

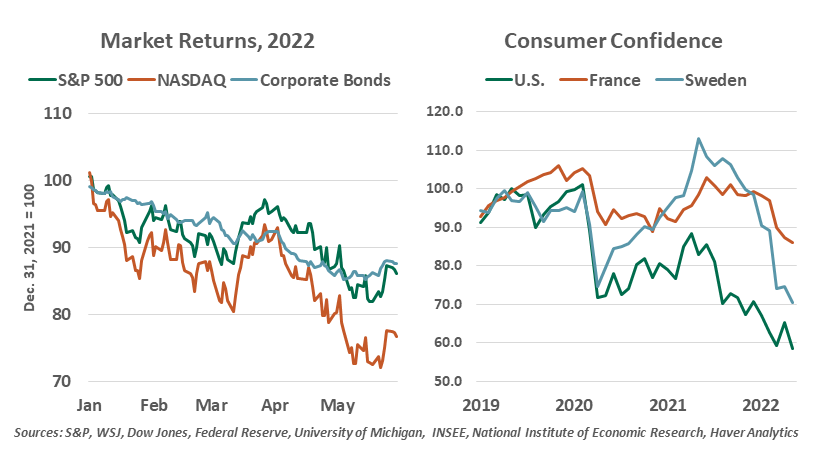

- Financial assets are having a bad year. After an exceptional run that began in the spring of 2020, many equity indices endured a correction this spring, losing 20% or more of their value. Bond markets have also struggled in the context of persistent inflation, tighter monetary policy and elevated uncertainty.

However, stock markets do not represent the full economy. Past selloffs have been unreliable indicators of economic contraction.

- The invasion of Ukraine caught most observers by surprise. Physical damage has been confined to a portion of Ukraine thus far, but the risk of a spreading conflict still looms, and the humanitarian consequences weigh on our consciousness. The direct impacts are of greatest concern to nations that are closest to the conflict, but indirect effects are being felt worldwide.

Risks from Ukraine traveled to the rest of the world immediately through energy markets, with oil prices settling at a higher level. Producers were burned when demand suddenly dropped in the 2020 downturn and have not responded to higher prices with greater supply yet. The results of all this are apparent in vehicle fuel prices, which have caused alarm among consumers.

- Energy and food prices are the tip of the iceberg of widespread, persistent inflation. Each month brings reports of higher prices in nearly every sector of every country, reducing real income. Wage gains across developed markets have not kept pace with prices: For example, average hourly earnings in the U.S. have risen by 5.2% in the past year, but consumer prices are up by more than 8% over that interval. Rent is rising at a particularly fast clip, squeezing those who do not own homes.

High inflation and falling stock markets are a recipe for low consumer confidence.

All of these factors have reduced confidence and raised concern. Anyone looking for policy support to push against these downward forces will be disappointed. Legislatures and central banks are looking to rebalance policy after putting themselves out to address COVID-19.

The poor performance of global economies in the first quarter added to the anxiety. The U.S., France and Sweden showed gross domestic product contractions in the first quarter, owing to the disruption of Omicron and imbalanced trade. Nations like the U.K. and Germany may face short slowdowns this year, as could China due to its zero COVID lockdowns. Thus far, these are brief anomalies, but they can become persistent.

In the face of so many risks, why do we continue to expect growth?

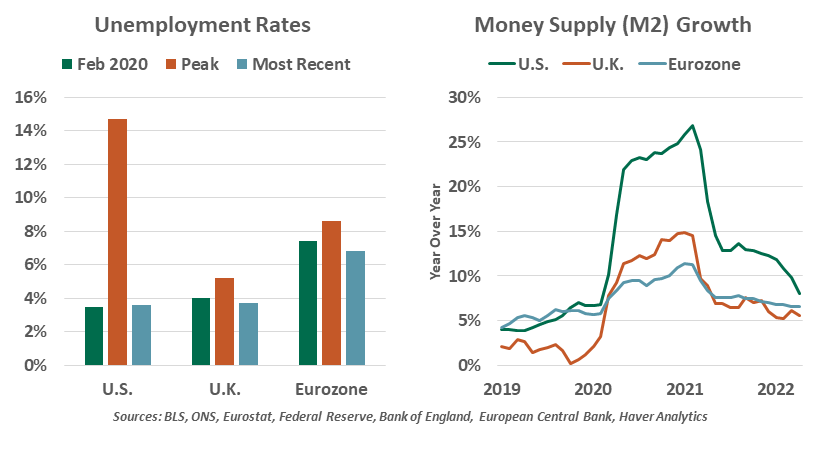

Labor markets are a continual source of cheer. Demand for employees has stayed high, even well after the peak of last year’s reopening frenzy. Most workers have returned and are earning higher wages, or are venturing out with their own new businesses.

And when consumers earn, they spend. Demand has been resilient. In the course of reopening, consumers are seeking to spend more on services. Restaurants are thriving while airplanes and hotel rooms are filling. Strong consumption is a tremendous force for growth.

Household balance sheets came out of the crisis in great shape, though higher credit utilization and lower rates of saving suggest some consumers have spent down their savings cushions. Those who need to borrow for major purchases like homes and autos will find interest rates are up from their recent lows, but still historically cheap. Demand for housing has pushed residential real estate prices to new highs, but even those high prices have an upside: Consumers who make major investments in housing are gaining wealth.

Inflation will fade. Supplies of goods are recovering, and demand will not persist at its frenzied pace indefinitely. To whatever extent recent price gains were opportunistic, that pricing power is unlikely to last forever. The rapid rise of the money supply to fund COVID interventions ended a year ago, and the Federal Reserve’s balance sheet runoff will now actively remove liquidity from the market.

An economy with strong employment and spending can withstand a lot of shocks.

Importantly, the world has learned to live productively with COVID-19. Advancements in prevention, testing and treatment have made an endemic outcome entirely livable. As the virus fades to the background, we can return to steady and more sustainable growth.

Accurately predicting a recession is difficult. Event risks can derail the business cycle, as COVID did in 2020. A resurgence of the virus, or an escalation of hostilities in eastern Europe would lead the list of candidates here. Should inflation prove more durable, central banks may have to tighten to a point that tips activity over. Some economists aver that expansions rarely die of natural causes: instead, policy kills them.

In the 2010s, the U.S. set a new record for length of a growth cycle, but many years of it felt like a slog. This time, the initial year of expansion was a blockbuster; a return to steady, gradual gains is desired. Slowing does not mean retreating. In the spirit of manifestation, we are not counting the days until the recession starts. We are contemplating how many years this cycle will play out.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Ryan James Boyle

Ryan James Boyle

Vice President, Senior Economist

Ryan James Boyle is a Vice President and Senior Economist within the Global Risk Management division of Northern Trust. In this role, Ryan is responsible for briefing clients and partners on the economy and business conditions, supporting internal stress testing and capital allocation processes, and publishing economic commentaries.