by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Gold can be an effective hedge, depending on what you’re hedging against, says Russ Koesterich, Portfolio Manager of the Global Allocation team.

Gold is having a decent year, if only by not losing. Year-to-date returns highlight gold as one of the few asset classes in the green, albeit with a modest 2% return. For investors looking for hedges, should they allocate more to gold? My view is it depends on what you’re hedging against. Gold, along with every other asset class, is struggling with the Federal Reserve’s tightening cycle. That said, gold can still hedge the most chaotic and uncertain of events: war.

Stuck between war and the Fed

I last discussed gold in October last year. At the time I suggested that investors looking for market or inflation hedges should look elsewhere. I thought gold would struggle with volatile real rates and a firmer dollar. That was too pessimistic. Gold’s gains may be small but they’re far better than double-digit losses in equities, credit, and U.S. Treasuries.

What I failed to account for was war. Looking at gold’s recent performance, the turnaround occurred in February, when attention turned to the invasion of Ukraine.

This dynamic is evident when you look at daily price returns. Gold has staged impressive rallies on days when oil spiked, defined here as a daily gain of more than 3%. On these days gold’s average gain has been around 1.3%. On all other days, gold returns have been close to flat.

The tendency for gold to trade with oil could be interpreted as simply an intuitive relationship with other commodities. My own read is that both gold and oil are responding to the same underlying fear: an escalating and hard to reconcile conflict with uncertain implications.

More recently gold has struggled as focus has shifted from Ukraine to the Federal Reserve. As a result, gold’s February gains have been mostly reversed as the dominant market narrative becomes a rapid tightening of financial conditions and surging real interest rates, a traditional headwind for gold.

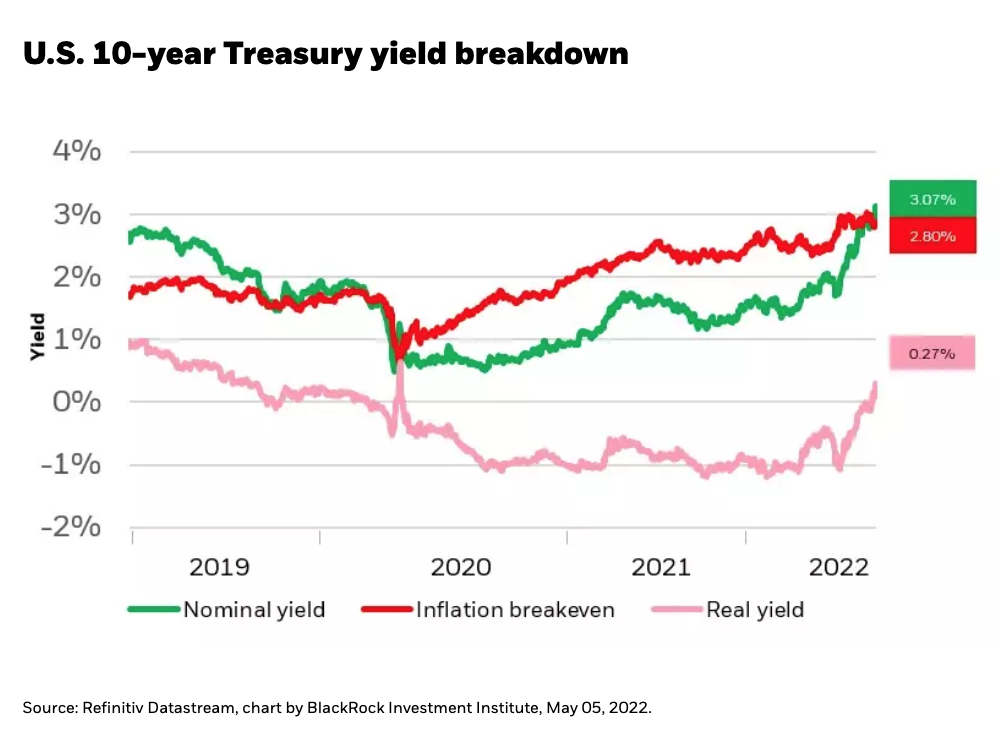

Consistent with history, during the past two years weekly changes in gold prices have had a -0.4 correlation with changes in real 10-year Treasury yields, i.e., interest rates net of inflation expectations. In other words, gold tends to fall as real rates rise. This dynamic has been on display during the past few months. Since 10-year real yields bottomed in March, they have risen by 1.50%, an unusually large and rapid move (see Chart 1).

Chart 1

Past performance is no guarantee of future results

Not coincidently, gold has struggled. Since hitting $2050 USD/ounce in early March prices have slumped nearly 10%. Adding to the pressure: A faster Fed tightening cycle has led to sharp appreciation in the dollar.

What are you afraid of?

Going forward gold’s efficacy as a hedge will be driven by the market’s largest headwind. To the extent volatility is mostly a function of central bank tightening, gold may continue to struggle as monetary conditions normalize. However, if attention re-focuses on the war in Europe and all the impossible to quantify outcomes, gold will probably hold up relatively well amidst the chaos.