by Don Vialoux, EquityClock.com

Technical Notes for Monday May 9th

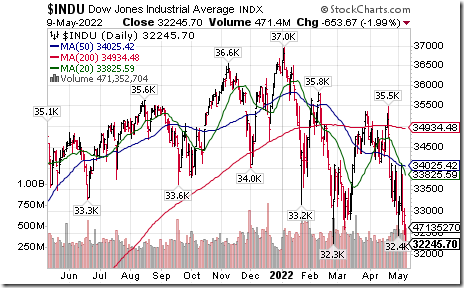

Dow Jones Industrial Average SPDRs $DIA moved below $321.85 extending an intermediate downtrend.

Editor’s Note: The Dow Jones Industrial Average moved below its February 24th low at 32,272.64

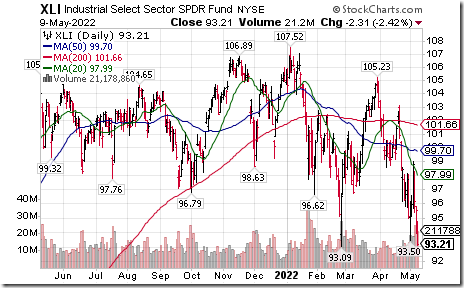

Industrial SPDRs $XLI moved below $93.09 extending an intermediate downtrend.

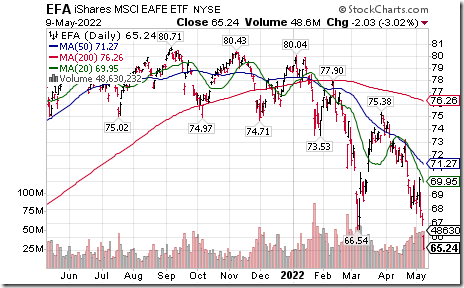

EAFE iShares $EFA moved below $66.54 extending an intermediate downtrend.

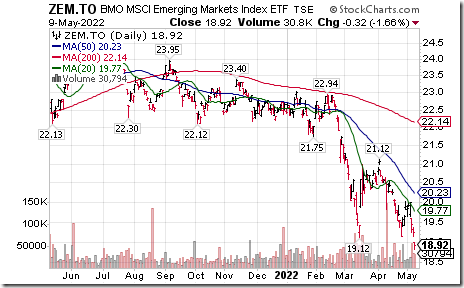

BMO Equal Weight Emerging Markets ETF $ZEM.TO moved below $19.12 extending an intermediate downtrend.

Pacific ex Japan iShares $EPP moved below $44.40 extending an intermediate downtrend.

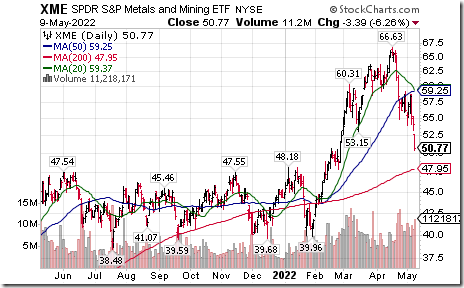

Metals & Mining iShares $XME moved below $53.15 extending an intermediate downtrend.

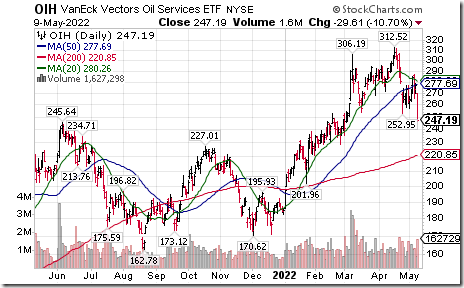

Oil Services ETF $OIH moved below $252.95 completing a Head & Shoulders pattern.

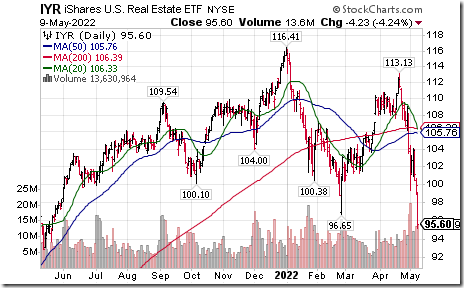

U.S. REIT iShares $IYR moved below $96.65 extending an intermediate downtrend.

Docusign $DOCU moved below $71.00 extending an intermediate downtrend.

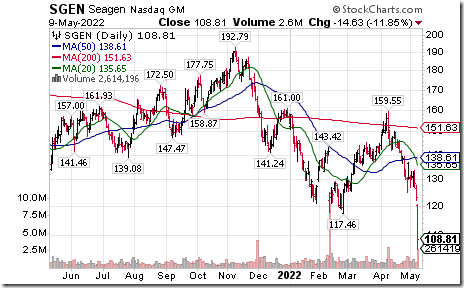

Seattle Genetics $SGEN a NASDAQ 100 stock moved below $117.46 extending an intermediate downtrend.

BHP $BHP one of the world’s largest base metals producers moved below $63.37 and $63.85 completing a Head & Shoulders pattern.

ManuLife Financial $MFC.TO moved below $24.48 completing a double top pattern.

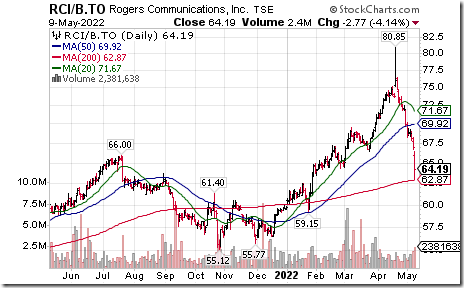

Rogers Communications $RCI.B.TO a TSX 60 stock moved below Cdn$66.40 and Cdn$64.31 setting an intermediate downtrend.

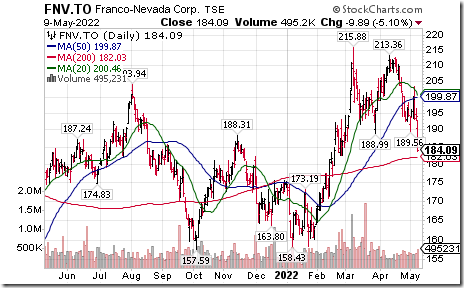

Franco-Nevada $FNV.TO a TSX 60 stock moved below Cdn$188.99 completing a double top pattern.

Agnico-Eagle (AEM.TO) a TSX 60 stock moved below $70.43 completing a Head & Shoulders pattern.

First Majestic Silver $AG $FR.TO moved below US$9.28 and Cdn$11.86 extending an intermediate downtrend.

Trader’s Corner

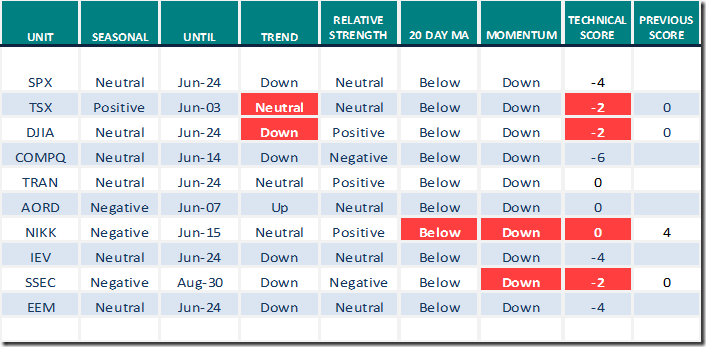

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 9th 2022

Green: Increase from previous day

Red: Decrease from previous day

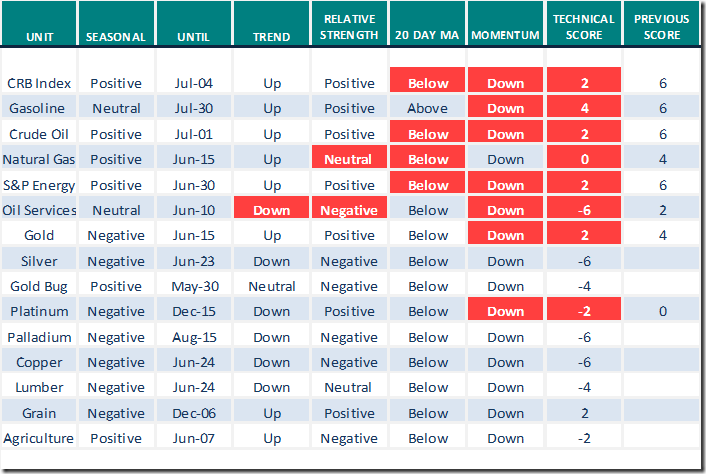

Commodities

Daily Seasonal/Technical Commodities Trends for May 9th 2022

Green: Increase from previous day

Red: Decrease from previous day

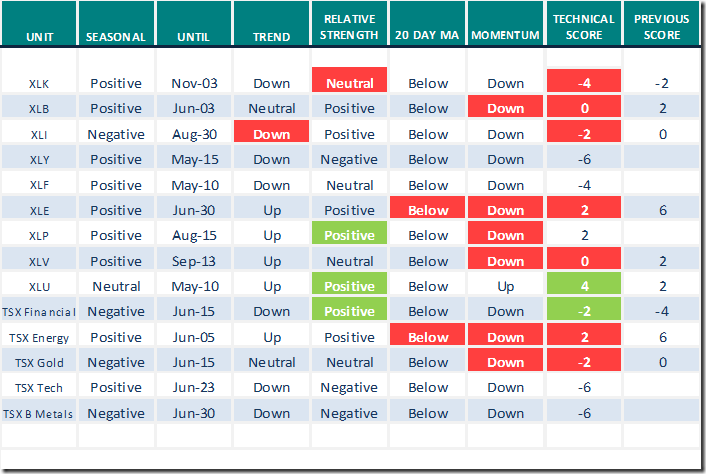

Sectors

Daily Seasonal/Technical Sector Trends for May 9th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 7.01 to 20.84 yesterday. It remains Oversold. Trend remains down. No signs of a bottom yet!

The long term Barometer dropped 3.61 to 31.46 yesterday. It remains Oversold. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer plunged 9.05 to 15.84 yesterday. It remains Oversold. Trend remains down. No signs of a bottom yet!

The long term Barometer plunged 8.14 to 34.39 yesterday. It changed from Neutral to Oversold on a move below 40.00. Trend remains down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.