by Edward D. Perks, CFA, Franklin Templeton Investments

Key Points:

- The US equity and fixed income markets are facing challenges due to a slowing US economy along with a significant pivot in monetary policy towards a more hawkish stance.

- Combating inflation has become a priority, and investor focus has shifted towards the uncertain impact of rising interest rates on the economy and markets.

- Despite challenges, US corporations are faring well so far in 2022, and the strength of the US labour market could delay or prevent a US recession.

Equity and Fixed Income Markets Facing Challenges

Looking back to the latter part of 2021, the US market environment was robust for equities, with strong economic growth that led to stock valuations that appeared appropriate to us. At the same time, the US Federal Reserve’s (Fed’s) accommodative environment—put in place during the pandemic—impacted fixed income markets.

So far this year, market performance has been challenging across a broad range of asset classes. US equities, as measured by the S&P 500 Index, are down 14.04% through 6 May 2022.1 Growth-oriented stocks, as measured by the NASDAQ Composite, declined even more than the S&P 500. The broader bond markets, as measured by the Bloomberg U.S. Aggregate Bond Index, have also declined this year. Investment-grade and noninvestment-grade bonds within the aggregate index have also fallen, reflecting the broader rise in yields and some weakness in corporate credit spreads.

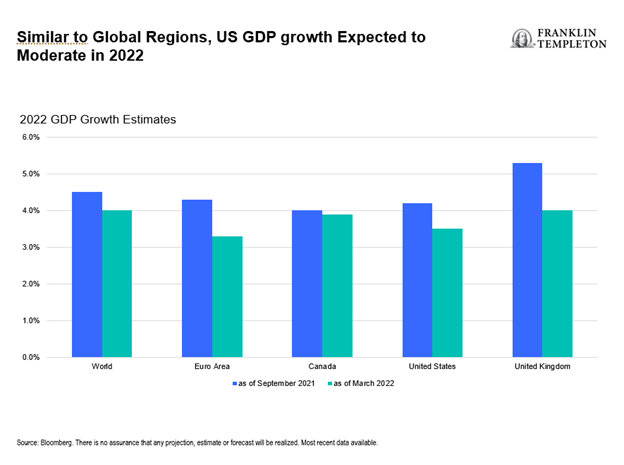

Entering 2022 Investors expected that US gross domestic product growth would decelerate, but we still believe growth is likely to be above long-term trends. In our opinion, it was inevitable that US year-over-year growth would slow following robust growth in 2021 as economies reopened. Also, the fading monetary and fiscal stimulus contributed to the US economy slowing. Economies worldwide are also moderating, with Canada doing better than other places due to the commodity-oriented nature of its economy.2

Inflation Concerns Have Become Top Priority

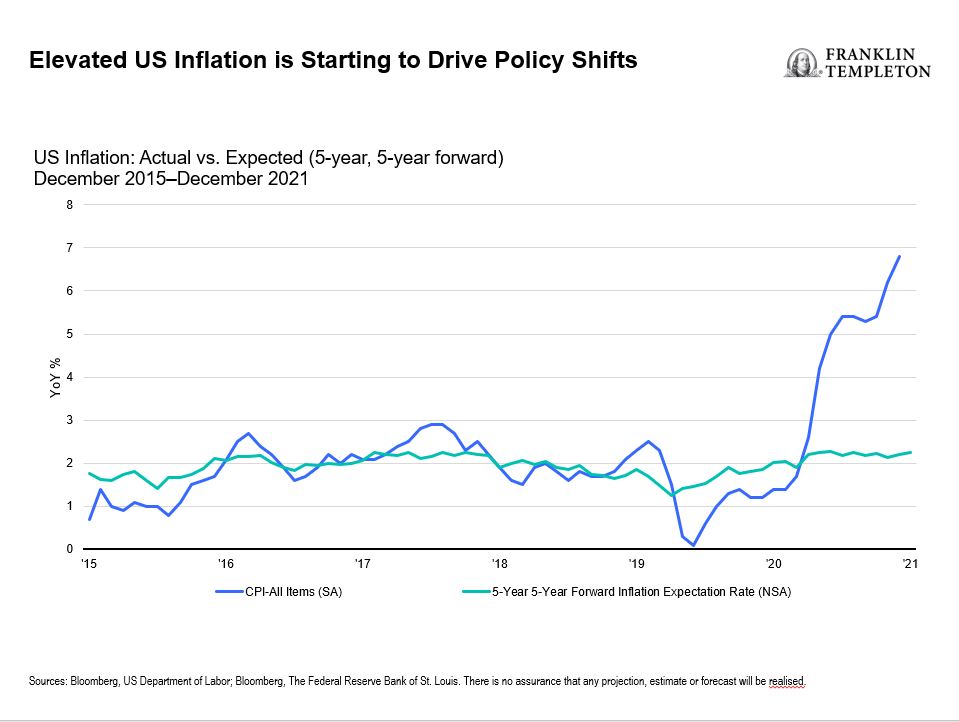

While economic activity in the United States has been normalising as it gets past the pandemic, a lot of inflationary pressures have been more pronounced and are rotating through different parts of the economy. This scenario is what is leading the Fed to raise the federal funds rate, and the market has baked in more frequent rate hikes for this year. These likely increases have rippled across the Treasury yield curve in general, which is what we believe is driving the challenging performance in fixed income markets. Thus, the backdrop remains highly uncertain in terms of the kind of tightening that is possible as the economy decelerates. In addition, there are other risks for investors—mainly geopolitical risks. These include of course the Russian-Ukraine war, which could further dampen economic activity in certain regions, particularly in the eurozone.

Consequently, rising inflation and its impact on the economy has become the primary focus. One of the bigger questions the market has right now is whether or not the Fed can successfully engineer a soft landing, or if a hard landing is more likely, given the pace of rate hikes and quantitative tightening starting up in June. With the Fed starting to make aggressive rate hikes and reducing its balance sheet, it is a dynamic time for the markets. Challenges are likely to stick around for quite some time. Thus, we believe that being nimble in finding opportunities will be critical.

Previous US rate hike cycles, specifically the last time the Fed raised rates in 2015–2018, played out over a long period of time as the economy generally slowed without elevating inflation. This time, it is radically different, with inflation at a very high level at the same time economic growth is decelerating. The United States has not experienced this type of inflation outlook in more than four decades, leading to newer challenges and uncertainties impacting current market performance.

Corporations Starting 2022 on a Positive Note

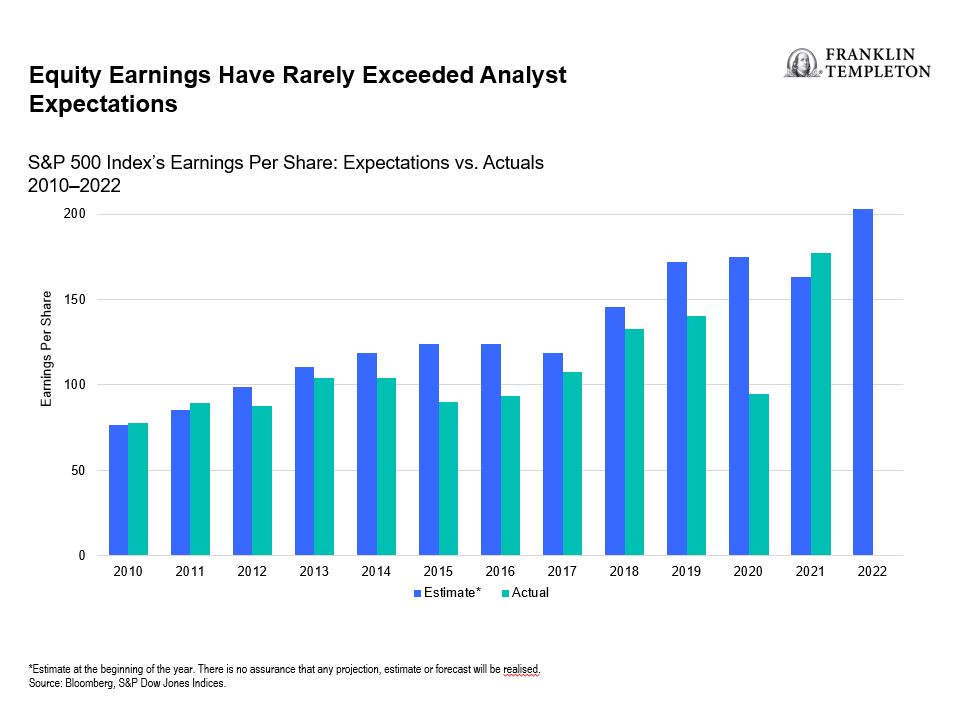

Historically, earnings expectations for companies tend to start the year on an optimistic note, and then decline over the course of the year.3 An exception was 2021, which started with a high degree of uncertainty around the level of earnings coming out of corporate America, but then surprised on the upside as companies managed supply challenges and other logistical issues.

As for the outlook for 2022, companies are generally performing well in terms of meeting first-quarter expectations.4 For the remainder of 2022, expectations are starting to come down as companies will likely vary in how they navigate the changing macroeconomic environment. Demand is still very strong, and challenges with logistics still exist; COVID-19 lockdowns are still occurring in China and may ripple through the United States and the world.

Meanwhile, the US labour market is nearing record low levels of unemployment, with elevated numbers of job openings. Employee sentiment is still high, and while tempered by market declines and higher inflation, household wealth and wages remain robust. The challenge for consumers is how to maintain purchasing power. In our analysis, the resilience of the US labour market—as well as how monetary policy transitions impact the economic outlook—could delay or prevent a US recession.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Investments in lower-rated bonds include higher risk of default and loss of principal. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. High yields reflect the higher credit risk associated with these lower-rated securities and, in some cases, the lower market prices for these instruments.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Year-to-date through 6 May 2022. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator of future results. See www.franklintempletondatasources.com for additional data provider information.

2. Source: Bloomberg, as at 31 March 2022.

3. Source: Bloomberg, S&P Dow Jones Indices, as at 31 December 2021 and 31 March 2022.

4. Source: Bloomberg, as at 21 April 2022.

This post was first published at the official blog of Franklin Templeton Investments.