by Don Vialoux, EquityClock.com

Responses to the FOMC announcement

At 2:00 PM EDT, the FOMC announced a 0.50% increase in the Fed Fund Rate to 1.00% (as expected) and reduction in the Balance Sheet by $95 billion per month starting on June 1st (as expected. Market responses after 2:00 PM EDT were as follows:

The S&P 500 soared repeating a pattern set by the previous three announcements.

Long term government bond yields dropped.

The U.S. Dollar Index plunged

The Canadian Dollar soared.

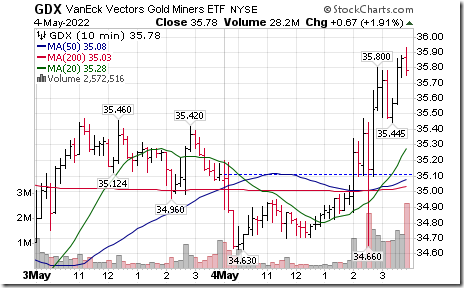

Gold bullion prices and related ETFs moved higher

Gold equity prices and related ETFs moved higher

Technical Notes released yesterday at

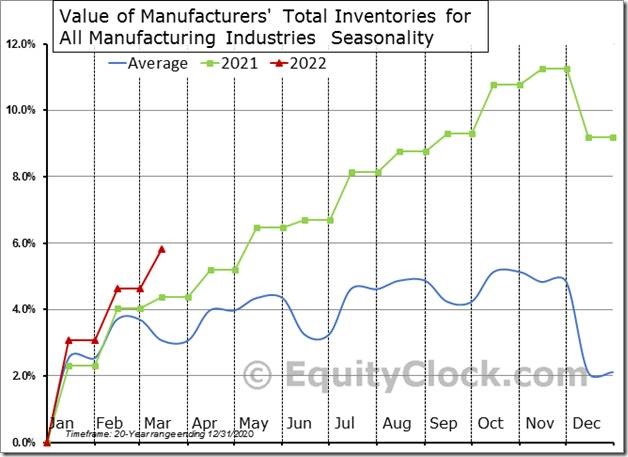

The rise in factory inventories through the first quarter of this year has been the strongest in a decade, suggesting that, as consumer momentum slows, there is simply too much “stuff.” equityclock.com/2022/05/03/… $STUDY $MACRO #Economy #Manufacturing

Natural Gas ETN $UNG moved above $28.15 extending an intermediate uptrend.

Homebuilders SPDRs $XHB moved above $65.02 completing a double bottom pattern.

MMM $MMM a Dow Jones Industrial Average stock moved above $153.26 completing a double bottom pattern.

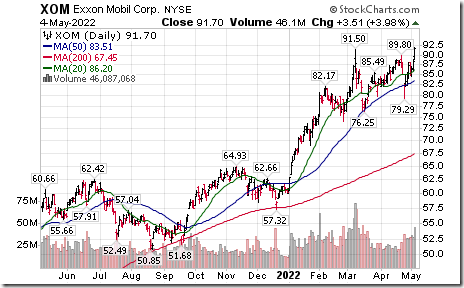

Exxon Mobil $XOM a Dow Jones Industrial Average stock moved above $91.50 extending an intermediate uptrend.

Emerson Electric $EMR an S&P 100 stock moved below $86.27 extending an intermediate downtrend.

Restaurant Brands International $QSR.CA a TSX 60 stock moved below Cdn$67.67 extending an intermediate downtrend.

Thomson Reuters $TRI.CA a TSX 60 stock moved below Cdn$123.08 extending an intermediate downtrend

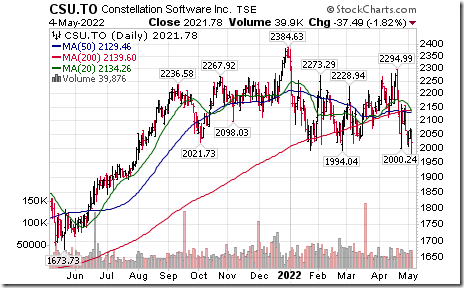

Constellation Software $CSU.CA a TSX 60 stock moved below Cdn$1,994.04 extending an intermediate downtrend.

IAMGold $IMG.CA broke below Cdn$3.06 extending an intermediate downtrend following company guidance.

Trader’s Corner

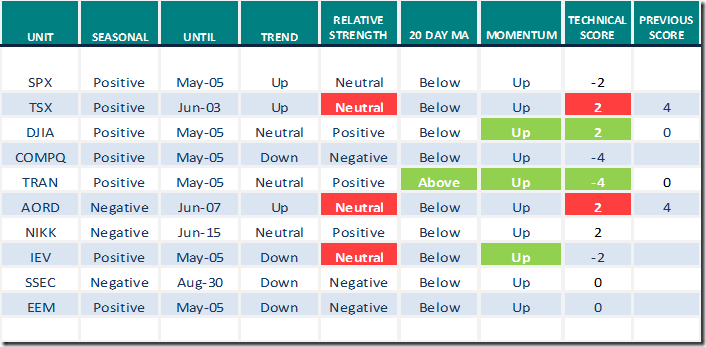

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 4th 2022

Green: Increase from previous day

Red: Decrease from previous day

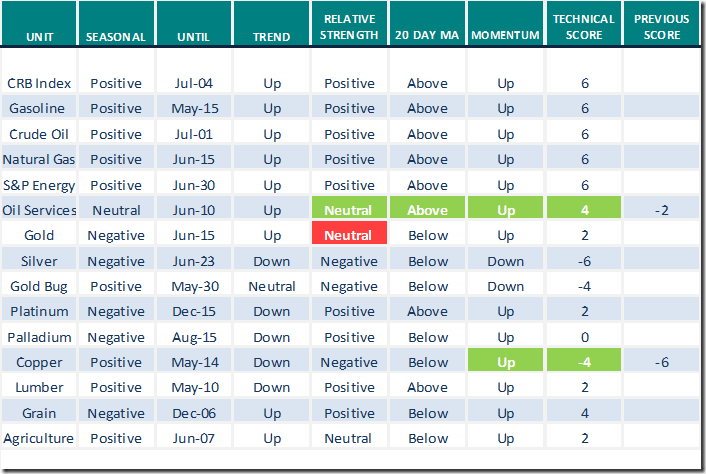

Commodities

Daily Seasonal/Technical Commodities Trends for May 4th 2022

Green: Increase from previous day

Red: Decrease from previous day

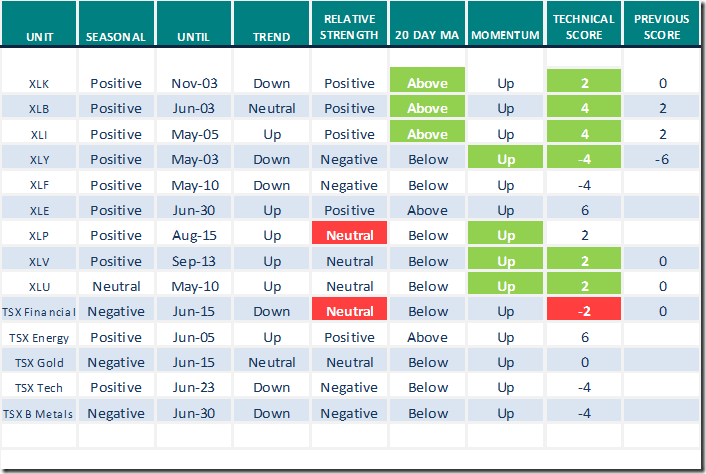

Sectors

Daily Seasonal/Technical Sector Trends for May 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by Valued Providers

Comments from Mark Bunting and www.uncommonsenseinvestor.com

"The Vacuum Effect" of the U.S. Dollar – Uncommon Sense Investor

The Trouble for Big Tech Stocks in Two Charts – Uncommon Sense Investor

Greg Schnell asks “Is a market rally starting”?

Is A Rally Starting? | Greg Schnell, CMT | Market Buzz (02.16.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer surged 19.84 to 48.90 yesterday. It changed from Oversold to Neutral on a move above 40.00.

The long term Barometer added 5.01 to 43.09 yesterday. It changed from Oversold to Neutral on a move above 40.00.

TSX Momentum Barometers

The intermediate term Barometer advanced 8.64 to 32.73 yesterday. It remains Oversold.

The long term Barometer added 3.18 to 50.91 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.