by Anna Hawley, Travis Cooke, and Gerald Garvey, Blackrock

Russia’s tragic invasion of Ukraine has layered on existing supply imbalances, causing geopolitical uncertainty and a global energy shock. What do these added complexities mean for the path of the energy transition? BlackRock’s systematic experts discuss how they use sustainable investing and a data-driven framework to align with the future low-carbon economy while identifying opportunities along the way.

Russia’s invasion of Ukraine, a tragic humanitarian crisis in its own right, has clearly exacerbated global geopolitical tensions and economic uncertainty. The market impact has been most severe within the energy sector, driving price spikes and raising questions surrounding the impact on long-term climate goals. This near-term shift in sentiment is taking place alongside the structural transition to a low-carbon economy – adding a layer of complexity for investors to navigate.

As systematic investors, we leverage sustainable insights to better understand how these evolving market dynamics may influence businesses and society on the path to a low-carbon world. We’re faced with a multidimensional challenge that requires deeper analysis to understand the impact of several forces on economic activity and long-term company performance. Better data and forward-looking analysis help us to uncover tomorrow’s investment opportunities amid today’s increasingly challenging environment.

Steps to align with a lower carbon footprint

The transition to a low-carbon economy (while undoubtedly complex) is well underway, with a common understanding: tomorrow’s economy will look different than it does today. Traditional approaches to ESG investing often focus on achieving a lower carbon footprint relative to broad indices that mirror today’s economy, not tomorrow’s. This can lead to excluding entire sectors like energy based on a narrow view of current emissions without considering the role that they play in the broader economy.

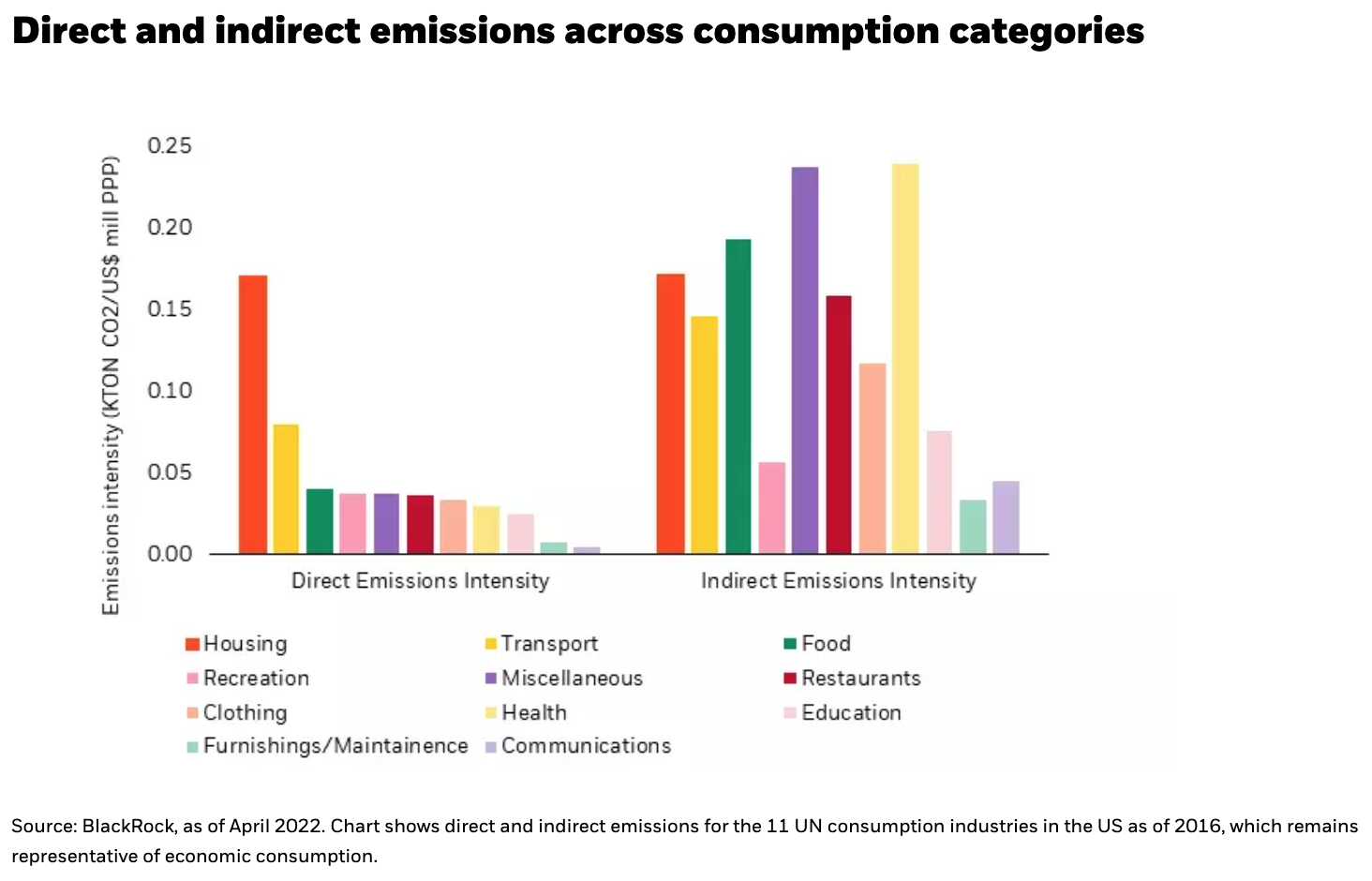

Our framework for aligning with the future economy begins with analyzing the full scope of emissions1 associated with end-use consumption categories. Focusing our analysis on final consumption allows us to capture the carbon footprint of the entire value chain. This includes both direct emissions owned and controlled by companies (i.e., emissions from company facilities) and the remaining indirect emissions that a company emits across its value chain (i.e., processing of goods; transportation and distribution). We then factor in expected future climate policy directives to understand which sectors and businesses are positioned to succeed in a low-carbon world. This process provides a forward-looking, non-exclusionary sustainability framework that helps us capture opportunities by reorienting with the changing economy.

Decarbonization, not divestment

Aligning with the increasingly complex path of decarbonization requires a granular, complete view of current emissions. The left side of the chart below shows direct emissions which are concentrated in a few select end-use consumption categories. Divesting the sectors that support those consumption categories would seemingly lower a portfolio’s carbon footprint – without addressing the bigger picture shown on the right.

The indirect emissions on the right side of the graph are significantly higher and more evenly distributed across categories, revealing that there’s much more to consider than direct emissions alone. Within healthcare, for example, a large portion of the carbon footprint comes from medical devices, pharmaceuticals, transportation, and hospital buildings which are only captured by analyzing indirect emissions. Including both direct and indirect emissions in our analysis provides a comprehensive view that leads to a focus on decarbonization, not divestment.

Zeroing in on a net-zero world

Our emissions analysis provides the full carbon footprint of current economic activity. We then factor in expected global emissions constraints to determine how the mix of industries supporting activity is likely to change in the future low-carbon economy. For example, we’ve found sectors with high direct emissions may remain important if they service other low-emitting industries or are crucial in maintaining consumption patterns. We see this dynamic today as energy producers ease inflationary pressures and consumer pain through an increased supply of fossil fuels – even as governments, businesses, and investors work towards reducing global emissions. Simply excluding those companies based on high direct emissions fails to acknowledge their position in both the current and future economy.

The energy crisis also has the potential to act as a catalyst for green innovation and the development of more secure and affordable sources of energy. Our analysis reveals areas of the economy that may benefit the most from green innovation, guiding our pursuit of firms developing new technologies. In a recent insight, we discussed investing in energy transition and how we identify energy companies evolving ahead of peers by analyzing green patent filings and capital expenditure growth. These data-driven insights help us uncover investment opportunities tied to green innovation as they increasingly emerge.

Today’s framework for tomorrow’s economy

The humanitarian crisis in Ukraine has sent shockwaves through markets, layering on existing supply imbalances while potentially making the energy transition more complex. Today’s multidimensional challenges expose a key shortcoming in sustainable strategies focused on reducing direct emissions relative to market indices through an exclusionary approach. In our view, a broad and forward-looking perspective is essential to capturing opportunities as the economy evolves while managing near-term sentiment swings and disruptions along the way.

Within the Sustainable Advantage Large Cap Core Fund (BIRIX), we focus on a sector-neutral approach to sustainability that aligns with the future economy across all industries – inclusive of energy leaders innovating and bridging the gap to a low-carbon world. Our view of tomorrow’s economy serves as a foundation for a broad range of insights we use to help identify compelling opportunities – investing for the future while navigating today.

Anna Hawley, CFA, Lead ESG Portfolio Manager for Systematic Active Equity,