by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

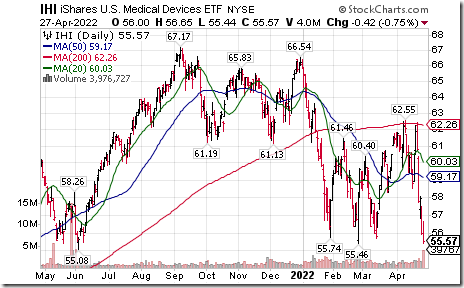

U.S. Medical Devices iShares $IHI moved below $55.46 extending an intermediate downtrend.

Capital One Financial $COF an S&P 100 stock moved below $122.43 extending an intermediate downtrend.

Utilities sector benchmark showing similar action to what was observed prior to the pandemic plunge in stocks in March of 2020. equityclock.com/2022/04/26/… $XLU $VPU $IDU #Utilities

Verizon $VZ a Dow Jones Industrial Average stock moved below $48.50 extending an intermediate downtrend.

Cisco $CSCO a Dow Jones Industrial Average stock moved below $50.44 extending an intermediate downtrend.

ASML Holding $ASML a NASDAQ 100 stock moved below $558.77 extending an intermediate downtrend.

Check Point $CHKP a NASDAQ 100 stock moved below $132.38 extending an intermediate downtrend.

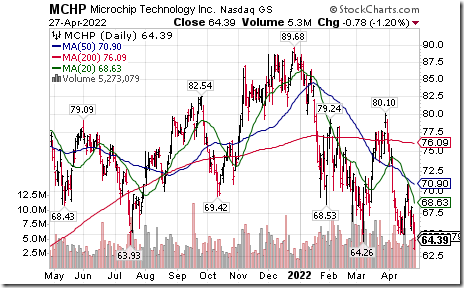

Microchip Technologies $MCHP a NASDAQ 100 stock moved below $64.26 extending an intermediate downtrend.

CDW Corp $CDW a NASDAQ 100 stock moved below $162.91 extending an intermediate downtrend.

Canadian National Railway $CNR.CA a TSX 60 stock moved below $149.05 completing a double top pattern.

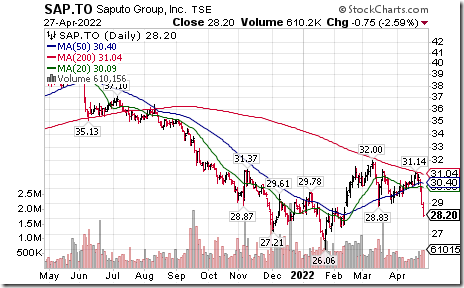

Saputo $SAP.CA a TSX 60 stock moved below $28.83 completing a double top pattern.

Cdn. REIT iShares $XRE.CA moved below $19.78 extending an intermediate downtrend.

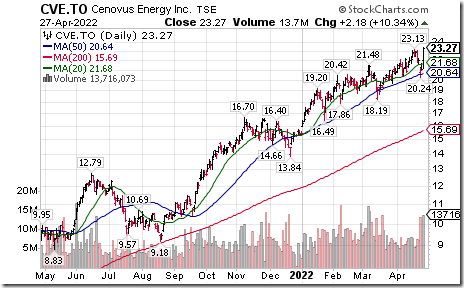

Cdn. Energy iShares $XEG.CA gained 3.29% following release of better than consensus quarterly results from Cenovus Energy. $CVE.CA broke to a seven year high.

Trader’s Corner

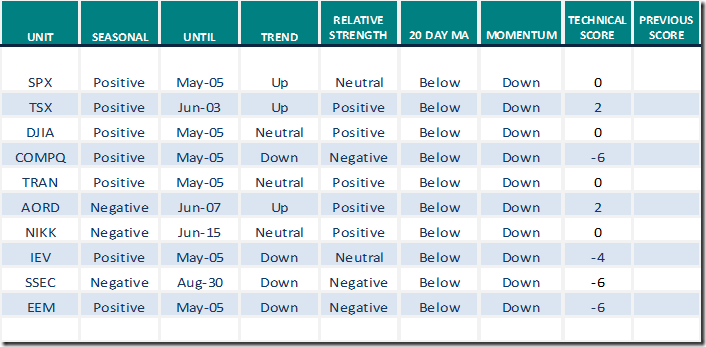

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

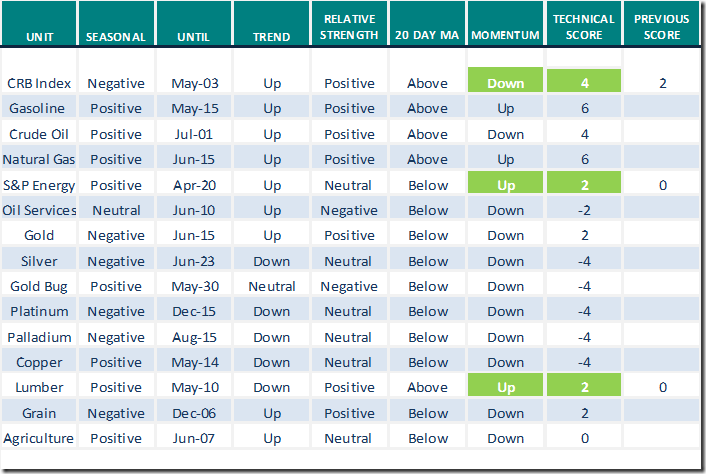

Commodities

Daily Seasonal/Technical Commodities Trends for April 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

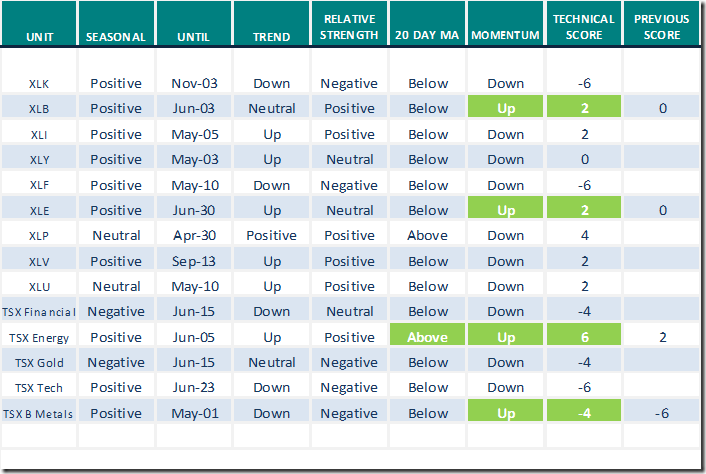

Sectors

Daily Seasonal/Technical Sector Trends for April 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by Valued Providers

Links from Mark Bunting and www.uncommonsenseinvestor.com

25 High Cash Flow Stocks from Analyst Saying "Buy New Regime Canada" – Uncommon Sense Investor

Two Stock Ideas to Profit from Electric Vehicle Growth – Uncommon Sense Investor

Stocks Heading for "Goldilocks" Environment & "Last Hurrah" – Uncommon Sense Investor

Greg Schnell discusses “The benefits of Relative Strength”. Greg states at the end of the video that “Yes, you can time the market” Needless to say, Tech Talk agrees with that statement.

The Benefits of Relative Strength | Greg Schnell, CMT | Market Buzz (04.27.22) – YouTube

Editor’s Note: Note that strength relative to the S&P 500 Index is an important part of this daily report.

S&P 500 Momentum Barometer

The intermediate term Barometer added 0.40 to 34.27 yesterday. It remains Oversold.

The long term Barometer added 0.80 to 42.69 yesterday. It remains Neutral.

TSX Momentum Barometer

The intermediate term Barometer slipped another 1.38 to27.52 yesterday. It remains Oversold. Trend remains down.

The long term Barometer slipped another 1.83 to 50.00 yesterday. It remains Neutral. Trend remains down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.