by Ryan James Boyle, Senior Economist, Northern Trust

The risk of an imminent recession is low, but next year is anyone's guess.

In their 2020 book Radical Uncertainty, John Kay and Mervyn King attack the practice of assigning probabilities to unknowable outcomes. They cite a banker who called the 2008 global financial crisis (GFC) a “25 sigma” (effectively impossible) event, or the military advisers who, after many revisions, assigned a 70% probability of finding Osama bin Laden when raiding his compound in Abbottabad. These events had no precedents, no past data to study, and could not be predicted with anything approaching mathematical certainty. But even if they are not entirely defensible, probabilities help decision-making and preparation for worst-case scenarios.

Economists are often asked to offer a probability of recession in the year ahead. Given the far-reaching consequences of contractions, we do make a good faith effort to respond.

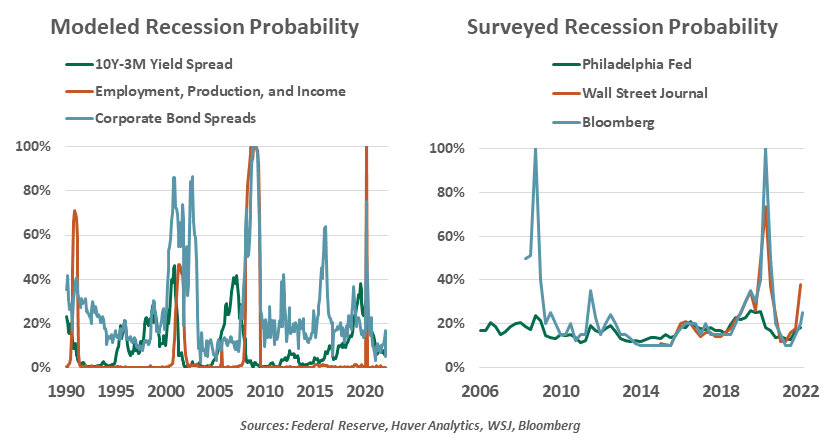

With ample historical data to study, many have attempted to create statistical models of recession risk. Data series abound, from market volatility to industrial production to employment, which may reveal historical correlation with downturns. As an example, yield curve-driven estimates of recession risk are currently low; despite a narrowing of spreads between longer-duration bonds, the full yield curve remains firmly upward-sloping. The limitation of any of these models is that they rely on past relationships, which may not necessarily be repeated in future scenarios.

Estimates are not always well-quantified. Several economic surveys ask their panelists to contribute their estimate of the probability of a pending recession. Respondents provide a number, but they do not need to show their work. Some may have sophisticated models to assign a probability, but others are likely making a simple guess.

In aggregate, surveys of recession risk have started to show a rising trend, likely driven by sentiment and current events. Risks to the outlook are growing. Confronted with headlines about rapid inflation and high oil prices, rising rates, COVID lockdowns and regional wars, it is easy for forecasters to feel bearish and adjust their recession probability upward. These survey-based estimates are rising more quickly than many models are, as most actual data points are do not reflect the uncertainty we feel.

Some of the current discomfort is the unwelcome feeling of slowing down. The U.S. economy grew by 5.7% in 2021, its fastest pace since 1984, a rate more typical of an emerging market. Growth rates were outstanding across most developed markets. As advanced economies return to their more normal trends, it may feel like the onset of a recession. But slowing is not contraction, and slower growth is still growth.

Economic indicators are too strong to expect a recession in the U.S. this year.

Recessions are notoriously unpredictable, in both their likelihood and their causes. With so much economic momentum, from elevated savings to restocking to infrastructure investment, we see low risk of recession in the year ahead. Looking further to 2023, a year poised to feature higher interest rates and lower demand, contraction may become more likely. But the longer the time horizon, the less certainty any forecaster can claim.

Mere mentions of recessions can cause a visceral reaction, but cyclical recessions are usually brief and manageable. The magnitude of the COVID-19 shock and the prolonged correction of the GFC were outliers. A minor contraction that helps to tame inflation by curbing demand may be beneficial in the long run. If central bank governors maintain their resolve to fight inflation, they may not see a recession as a cue to reconsider the path of monetary tightening.

While we do not publish a recession probability estimate, we are 100% certain we will continue to get questions on this topic as this unprecedented cycle unfolds.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Ryan James Boyle

Ryan James Boyle

Vice President, Senior Economist

Ryan James Boyle is a Vice President and Senior Economist within the Global Risk Management division of Northern Trust. In this role, Ryan is responsible for briefing clients and partners on the economy and business conditions, supporting internal stress testing and capital allocation processes, and publishing economic commentaries.

Copyright © Northern Trust