by Don Vialoux, EquityClock.com

After the close technical action by GOOGL and MSFT

Microsoft reported slightly higher than consensus quarterly results and Alphabet reported slightly lower than consensus quarterly results. Both stocks dropped sharply. GOOGL plunged $156.49 to $2226.51 and MSFT fell $4.20 to $266.03.

Technical Notes released yesterday at

The atypical rise in the US Dollar is forcing a rotation in the market away from this year’s winners in resource dominated sectors. equityclock.com/2022/04/25/… $USD.X $EURUSD $UUP $USDOLLAR

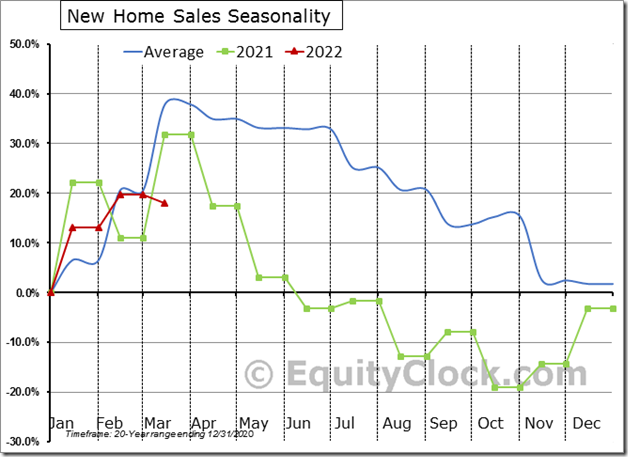

New Home Sales in the US showed a very rare decline in activity for March, falling by 1.4%. The only other time that new home sales have fallen for March was in 2020 amidst pandemic lockdowns. $STUDY $MACRO #Economy #Housing $ITB $XHB

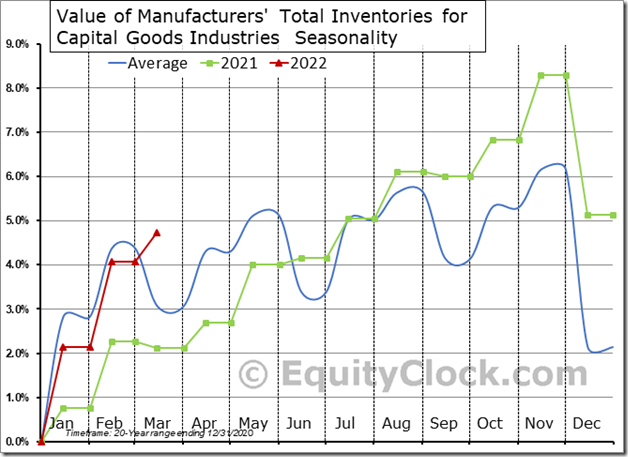

A rare March increase in manufacturer inventories raises concerns that businesses may not be selling as much product as expected. Manufacturer Inventories increased by 0.6% in March versus the 1.1% decline that is average for the month. $STUDY $MACRO #Economy #Manufacturing

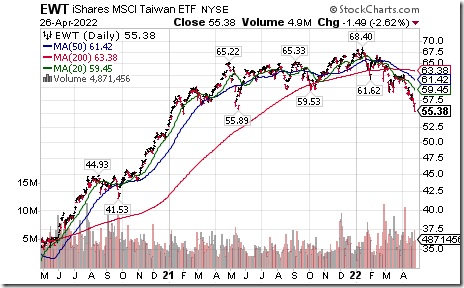

Taiwan iShares $EWT moved below $55.89 extending a long term topping pattern. Responding to spreading COVID 19 infections in nearby China

Auto ETF $CARZ moved below $50.03 extending an intermediate downtrend.

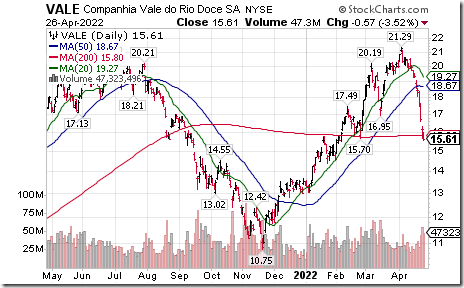

Base metals equities and related ETFs remain under technical pressure. $VALE moved below $16.95 and $15.70 extending an intermediate downtrend.

Technology SPDRs $XLK moved below $140.72 extending an intermediate downtrend.

IDEXX Labs $IDEX a NASDAQ 100 stock moved below $460.36 extending an intermediate downtrend.

Illumina $ILMN a NASDAQ 100 stock moved below $302.79 extending an intermediate downtrend.

Intuit $INTU a NASDAQ 100 stock moved below $422.45 extending an intermediate downtrend.

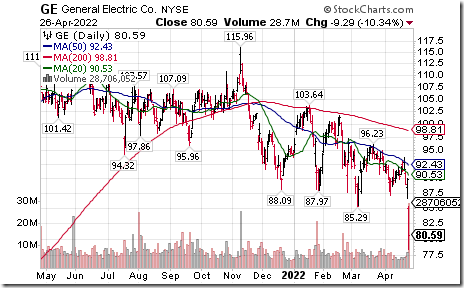

General Electric $GE an S&P 100 company moved below $85.29 extending an intermediate downtrend. First quarter results were less than consensus

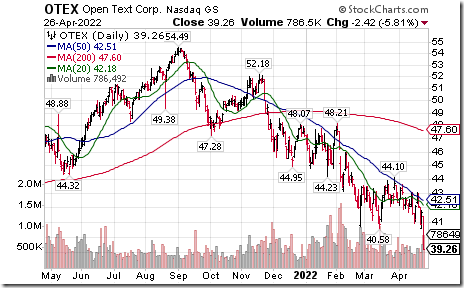

Open Text $OTEX a TSX 60 stock moved below US$40.58 and Cdn.$51.87 extending an intermediate downtrend.

Brookfield Asset Management $BAM.A.CA a TSX 60 stock moved below Cdn$64.26 extending an intermediate downtrend.

Canadian Pacific $CP.CA a TSX 60 stock moved below Cdn$93.10 extending an intermediate downtrend.

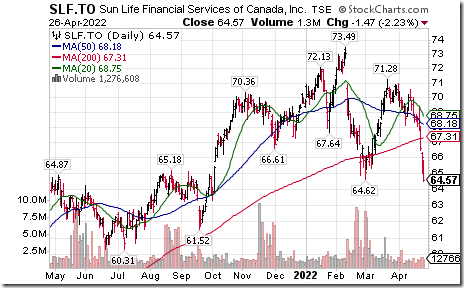

Sun Life $SLF.CA a TSX 60 stock moved below Cdn$64.62 completing a Head & Shoulders pattern.

Trader’s Corner

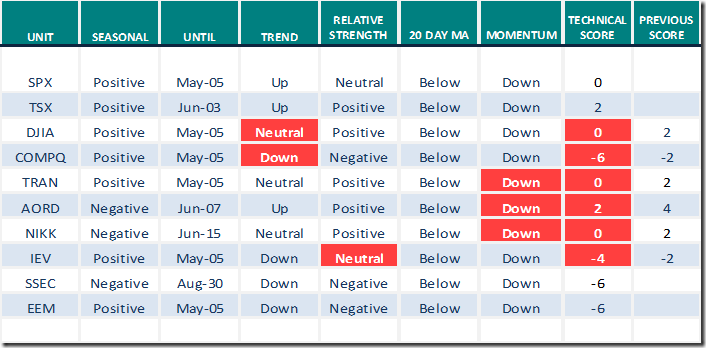

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 26th 2022

Green: Increase from previous day

Red: Decrease from previous day

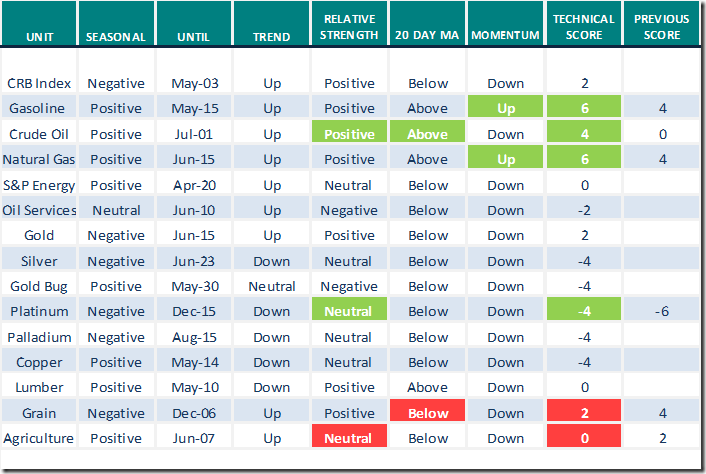

Commodities

Daily Seasonal/Technical Commodities Trends for April 26th 2022

Green: Increase from previous day

Red: Decrease from previous day

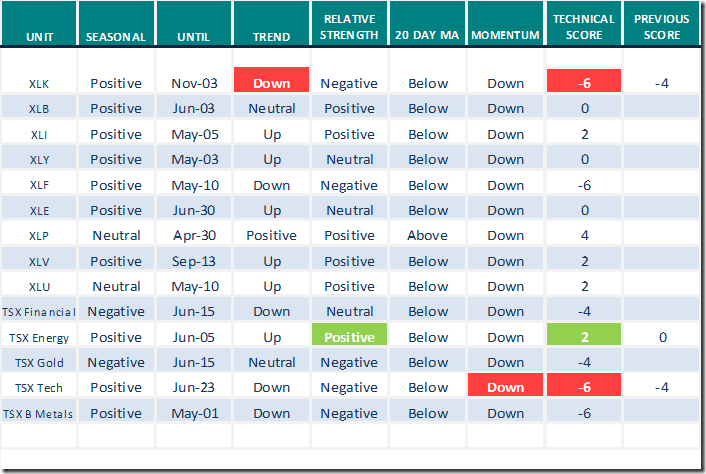

Sectors

Daily Seasonal/Technical Sector Trends for April 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometer

The intermediate term Barometer plunged 9.62 to 33.87 yesterday. It changed from Neutral to Oversold on a move below 40.00. Trend is down.

The long term Barometer dropped 3.81 to 41.88 yesterday. It remains Neutral. Trend is down.

TSX Momentum Barometer

The intermediate term Barometer dropped 2.29 to 28.90 yesterday. It remains Oversold. Trend is down.

The long term Barometer dropped 5.50 to 51.83 yesterday. It remains Neutral. Trend is down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.