by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Both the 10-year treasury yield and the US Dollar Index are reaching towards critical levels of resistance, the reaction to which could have significant implications for the equity market. equityclock.com/2022/04/18/… $STUDY $MACRO $TNX $USDOLLAR

Marriott $MAR a NASDAQ 100 stock moved above $184.99 to an all-time high extending an intermediate uptrend.

Kinder Morgan $KMI an S&P 100 stock moved above $19.67 to a 6 year high extending an intermediate uptrend.

Capital One Financial $COF an S&P 100 stock moved above $141.20 completing a double bottom pattern. Seasonal influences are favourable to July 8th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/capital-one-financial-corp-nysecof-seasonal-chart

Pfizer $PFE a Dow Jones Industrial Average stock moved below intermediate support at $50.37.

Trader’s Corner

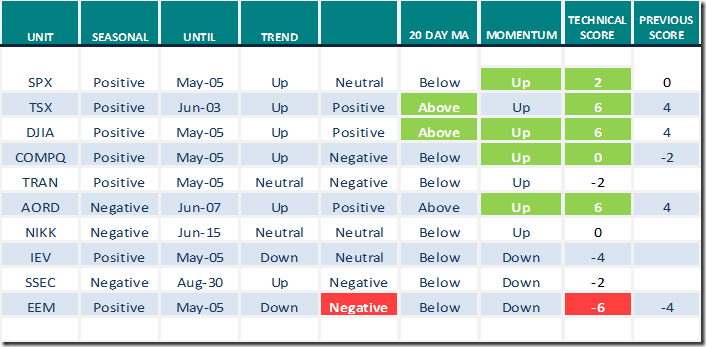

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 19th 2022

Green: Increase from previous day

Red: Decrease from previous day

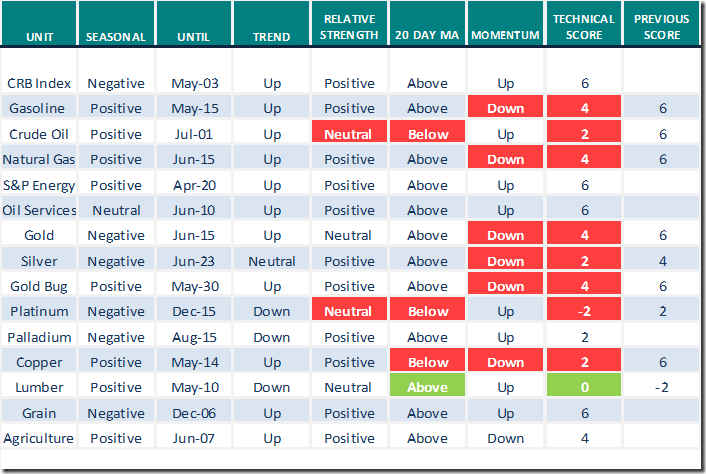

Commodities

Daily Seasonal/Technical Commodities Trends for April 19th 2022

Green: Increase from previous day

Red: Decrease from previous day

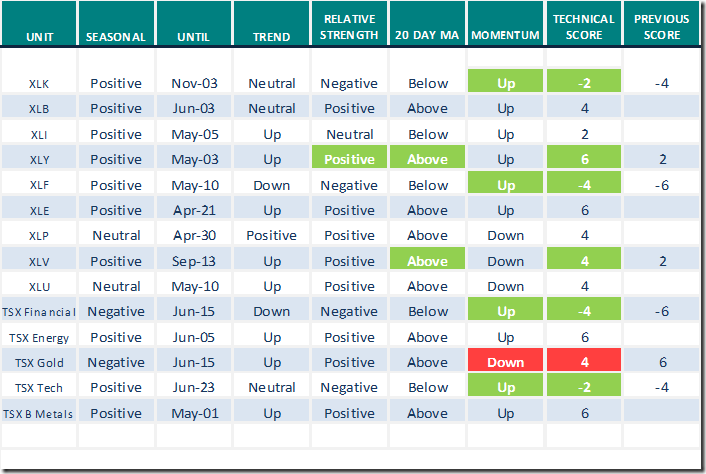

Sectors

Daily Seasonal/Technical Sector Trends for April 19th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Josef Schachter returns as a guest on BNN

Josef will be appearing on BNN Market Call today at 10:00am MDT (Noon EDT) with an update opinion on the energy sector.

S&P 500 Momentum Barometers

The intermediate term Barometer added 9.62 to 61.12 yesterday. It changed from Neutral to Overbought on a recovery above 60.00.

The long term Barometer added 2.61 to 50.50 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 3.45 to 61.82 yesterday. It changed from Neutral to Overbought on a move above 60.00.

The long term Barometer added 2.10 to 65.00 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.