by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Expect higher inflation to be the key market driver for some time. Russ Koesterich, Managing Director and Portfolio Manager explains how to prepare.

By Russ Koesterich, CFA, JD

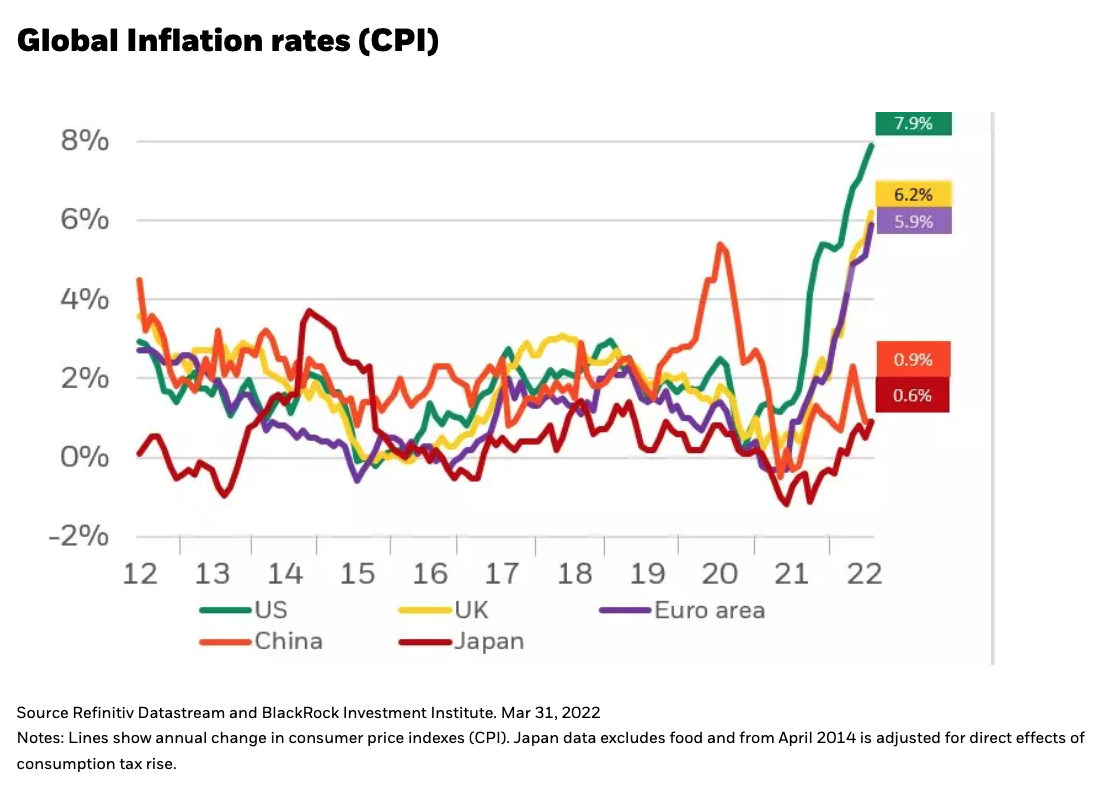

Three months into the year, 2022 has been notable for many economic and financial milestones; several of these have been tied to inflation. Headline inflation has accelerated to nearly 8%, a 40-year high; core inflation has accelerated to nearly 6.5%, also a 40-year high; core personal consumption expenditure, the Federal Reserve’s preferred measure of inflation, has climbed to 5.4%, a 39-year high. Nor is inflation just a U.S. problem. Outside of Japan, consumer prices have skyrocketed in virtually every developed country (see Chart 1).

Inflation is not only higher, but also more volatile. The volatility of core inflation, measured as the trailing three-years standard deviation, is higher than at any point since the early 1980s. Aside from the conflict in the Ukraine, accelerating and unhinged inflation has dominated the investment narrative, in turn driving sector performance and contributing to an unexpectedly tough start to the year. Given that this dynamic is unlikely to change near term, how should investors navigate the landscape?

Back in December, I highlighted that while the link between inflation and equities is more complicated than “prices up, stocks down,” higher and more volatile inflation is a headwind for stock valuations. That has proved true. Year-to-date U.S. valuations are down roughly 10%, with even more pronounced multiple compression in Europe and China. Apart from cheaper stocks, inflation has also been key in navigating industry rotation. As this is likely to continue, investors should continue to focus on industries benefiting from elevated inflation.

Specific cyclicals

In my previous blog I emphasized the importance of cyclical exposure. That said, not all cyclicals benefit equally from inflation. As discussed back in December, industries such as energy, mining and transport have historically been the biggest relative beneficiaries from accelerating inflation.

Year-to-date, this pattern has held. Energy is far and away the best performing sector, up roughly 40% year-to-date. Metals and mining stocks are also up nearly 40%. Gains in transport have been more muted but have generally exceeded the broader market.

This pattern should continue. While base-effects suggest inflation will decelerate later this year, two developments are worth noting. A peak in headline inflation will probably take longer given the spike in energy and other commodities associated with the war in the Ukraine.

Apart from higher energy and commodities, there is also significant evidence that inflation is becoming more ubiquitous. For much of last year, inflation was thought to be mostly a function of idiosyncratic supply bottlenecks. This is no longer the case. The Federal Reserve Bank of Cleveland’s Trimmed Mean Index, which attempts to strip out the more volatile outliers, has accelerated from 2% to 5.75%, another multi-decade high. The point being: Even if headline inflation starts to decelerate, we’re still in a very different world. Select cyclical exposure, geared towards those market segments that benefit from higher prices, is the best insulation.

Russ Koesterich, Portfolio Manager

Russ Koesterich, Portfolio Manager

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Copyright © Blackrock