by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

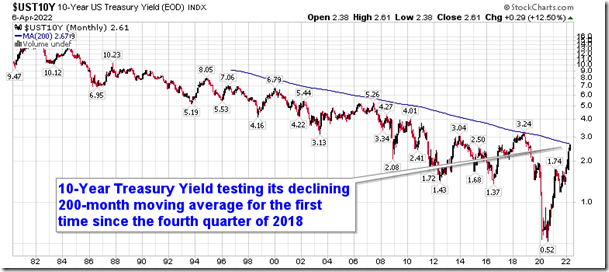

The yield on the 10-Year Treasury Note is now back to its declining 200-month moving average, a hurdle last tested before the dramatic selloff in stocks during the fourth quarter of 2018. equityclock.com/2022/04/06/… $TNX $ZN_F $IEF $STUDY

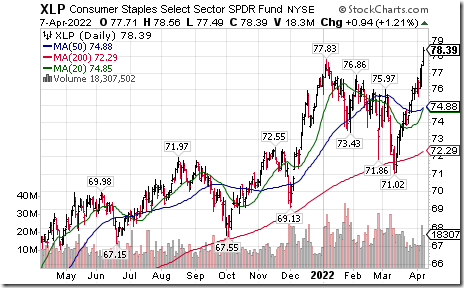

Consumer Staples SPDRs $XLP moved above $77.83 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to May 24th . If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/consumer-staples-select-sector-spdr-fund-nysexlp-seasonal-chart

Healthcare SPDRs $XLV moved above $141.53 to an all-time high extending an intermediate uptrend.

Abbott Labs $ABT an S&P 100 stock moved above $123.10 completing an intermediate reversal pattern.

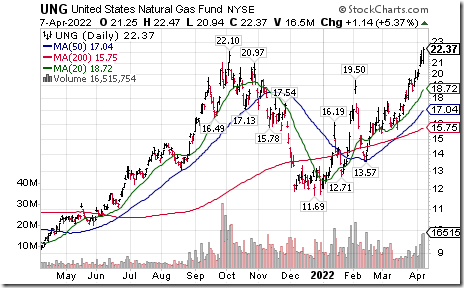

Natural gas ETN $UNG moved above $22.10 extending an intermediate uptrend. Seasonal influences are favourable to June 29th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/united-states-natural-gas-fund-nyseung-seasonal-chart

Morgan Stanley $MS an S&P 100 stock moved below $81.97 extending an intermediate downtrend.

O’Reilly Automotive $ORLY a NASDAQ 100 stock moved above $710.86 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to June 2nd. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/oreilly-automotive-inc-nasdaqorly-seasonal-chart

Charter Communications $CHTR a NASDAQ 100 stock moved below $545.33 extending an intermediate downtrend.

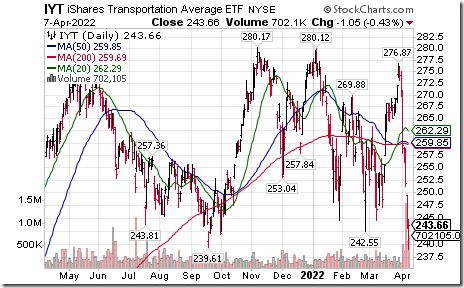

Transportation Average iShares $IYT moved below $242.55 and $239.61 extending an intermediate downtrend

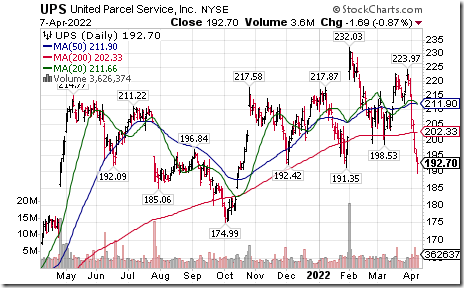

United Parcel Services $UPS moved below $191.35 extending an intermediate downtrend.

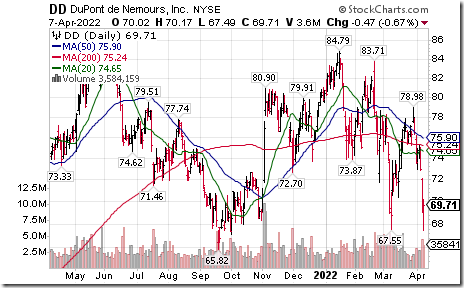

Dupont $DD an S&P 100 stock moved below $67.55 extending an intermediate downtrend.

Cameco $CCO.CA CCJ a TSX 60 stock moved above Cdn$37.58 to a 14 year high extending an intermediate uptrend

National Bank $NA.CA a TSX 60 stock moved below $92.44 completing a Head & Shoulders pattern.

Loblaw Companies $L.CA a TSX 60 stock moved above $116.50 to an all-time high extending an intermediate uptrend.

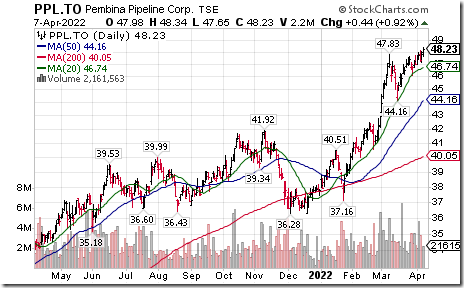

Pembina Pipeline $PPL.CA a TSX 60 stock moved above Cdn$47.83 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to May 21st. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/pembina-pipeline-corp-tseppl-seasonal-chart

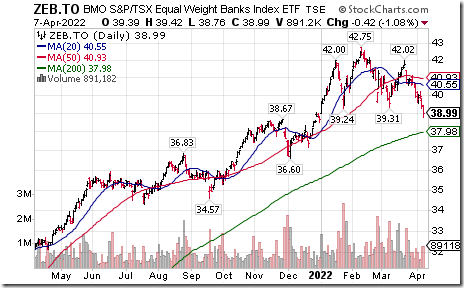

Equal Weight Canadian Bank ETF $ZEB.CA moved below $39.24 and $39.31 completing a classic Head & Shoulders pattern. As pre-announced, Canada’s banks are to be taxed higher in the Federal Government budget

Trader’s Corner

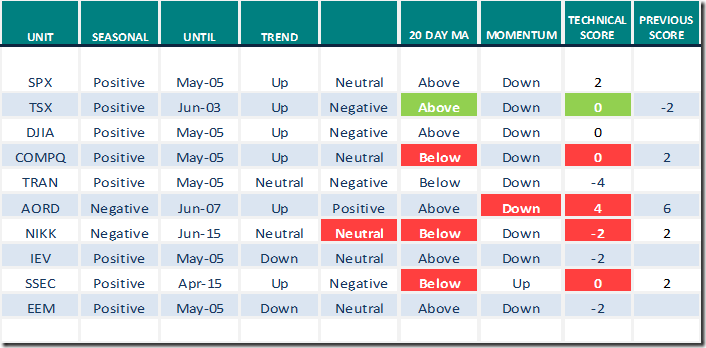

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

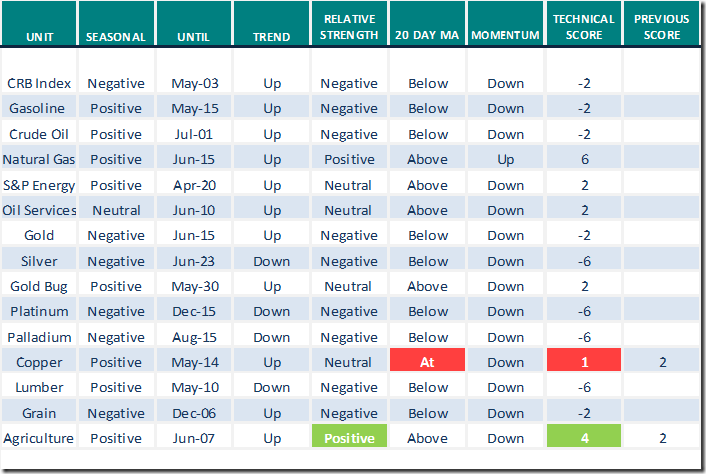

Commodities

Daily Seasonal/Technical Commodities Trends for April 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

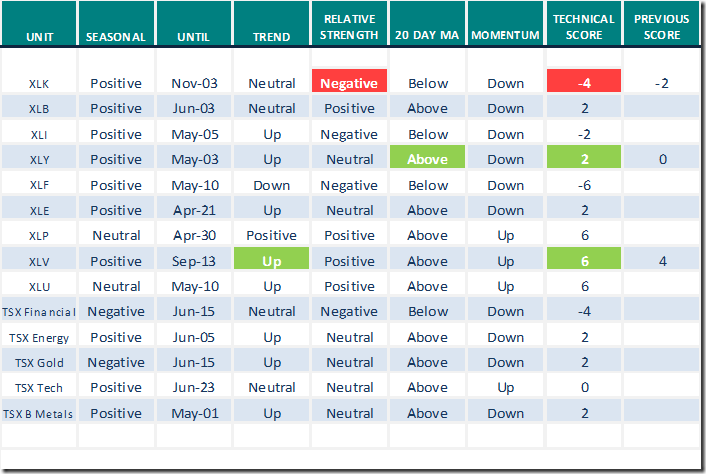

Sectors

Daily Seasonal/Technical Sector Trends for April 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.40 to 57.51 yesterday. It remains Neutral.

The long term Barometer was unchanged yesterday at 49.70. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 3.54 to 59.73 yesterday. It remains Neutral.

The long term Barometer added 0.88 to 61.06 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.