by Don Vialoux, EquityClock.com

Bottom Line

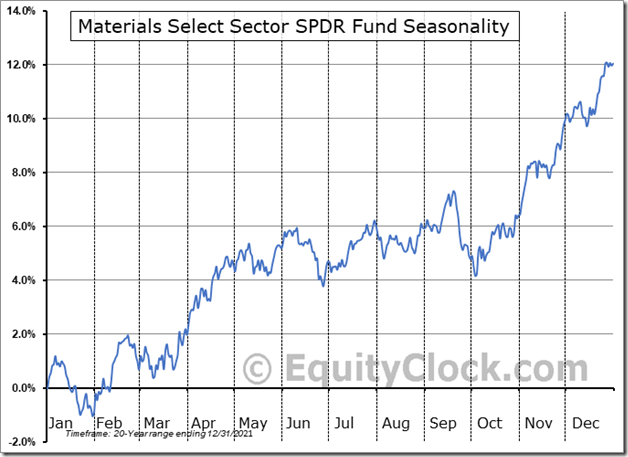

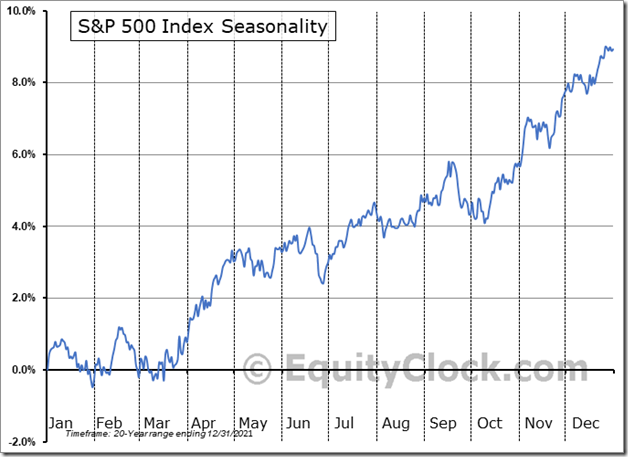

Economic sensitive (i.e. risk on) sectors have a history of outperforming the S&P 500 Index in the month of April, notably Energy, Industrials and Materials sectors.

Observations

Consensus earnings estimates for S&P 500 companies on a year-over-year basis in the first quarter of 2022 were unchanged again last week: 67 companies have issued negative guidance to date and 29 companies have issued positive guidance. According to www.FactSet.com first quarter earnings on a year-over-year basis are expected to increase 4.7% (versus 4.8% last week) and revenues are expected to increase 10.7%.

Consensus estimates for S&P 500 companies beyond the first quarter on a year-over-year basis increased slightly again. According to www.FactSet.com second quarter earnings are expected to increase 5.8% (versus 5.6% last week) and revenues are expected to increase 9.6% (versus 9.7% last week). Earnings in the third quarter are expected to increase 10.3% and revenues are expected to increase 8.7%. Earnings in the fourth quarter are expected to increase 9.6% and revenues are expected to increase 9.3%. Earnings on a year-over-year basis for all of 2022 are expected to increase 9.5% (versus 9.4% last week) and revenues are expected to increase 9.3% (versus 9.0% last week).

Economic News This Week

February Factory Orders to be released at 10:00 AM EDT on Monday are expected to drop 0.6% versus a gain of 1.4% in January.

February U.S. Trade Deficit to be released at 8:30 AM EDT on Monday is expected to narrow to $88.50 billion from $89.70 billion in January.

February Canadian Trade Balance to be reported at 8:30 AM EDT on Tuesday is expected to be a surplus of $1.60 billion versus a surplus of $2.62 billion in January.

FOMC Meeting Minutes from the last meeting are to be released at 2:00 PM EDT on Wednesday

March ISM Non-Manufacturing PMI to be released at 10:00 AM EDT on Thursday is expected to increase to 58.5 from 56.5 in February.

Canada’s Federal Government releases its budget at 4:00 PM EDT on Thursday.

March Canadian Unemployment Rate to be released at 8:30 AM EDT on Friday is expected to increase to 6.2% from 5.5% in February.

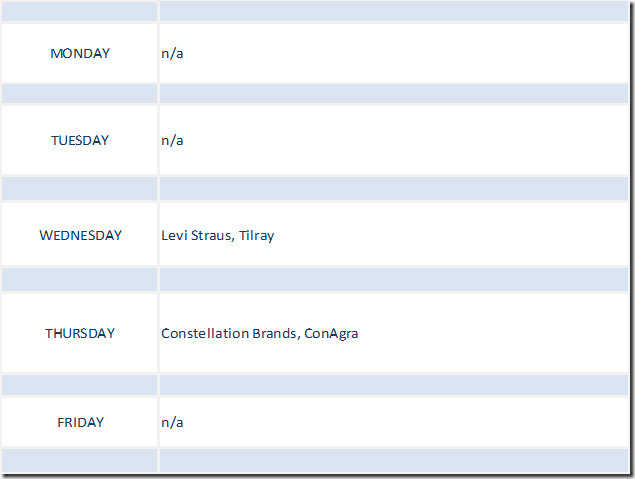

Selected Earnings News This Week

Trader’s Corner

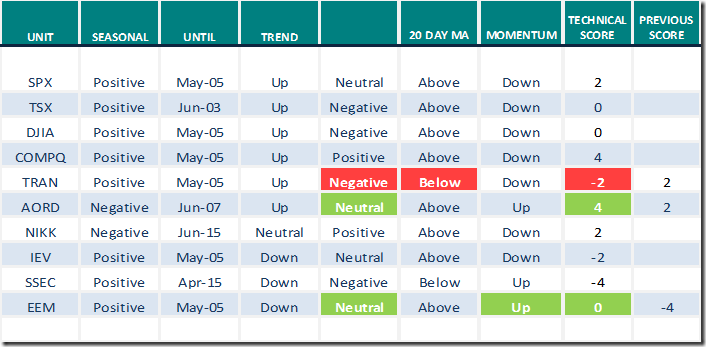

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

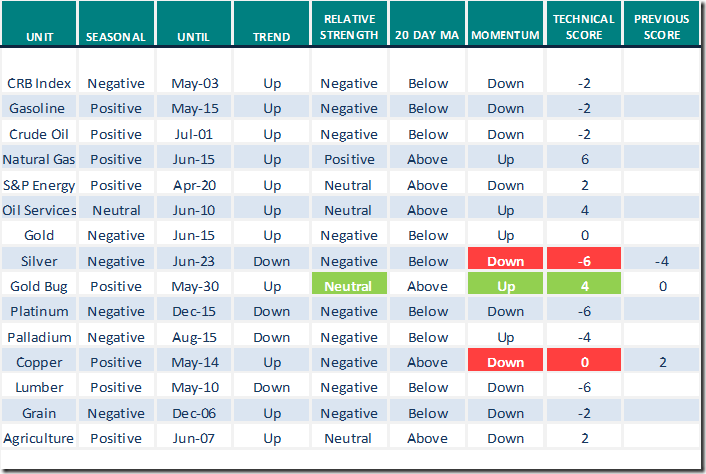

Commodities

Daily Seasonal/Technical Commodities Trends for April 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

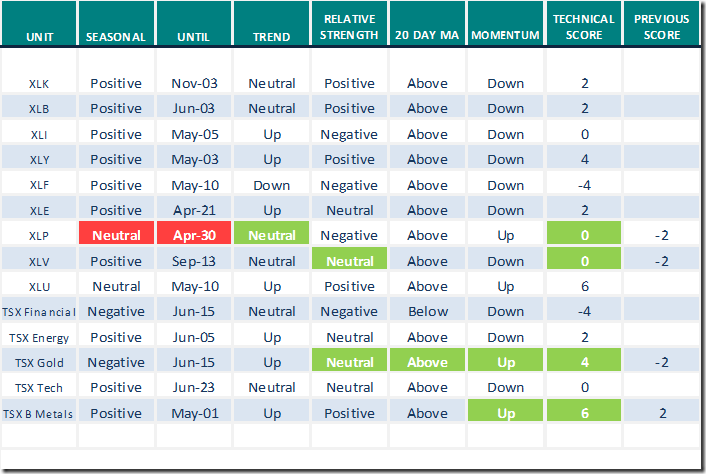

Daily Seasonal/Technical Sector Trends for April 1st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Mark Leibovit discusses Russia, Ukraine, U.S. Dollar and Cryptos

Russia Ukraine, US Dollar, Cryptos – HoweStreet

Michael Campbell’s Money Talks for April 2nd

April 2nd Episode (mikesmoneytalks.ca)

Comments from Mark Bunting and www.uncommonsenseinvestor.com

"Buy the Dip, Sell the Rip." Here’s Why. – Uncommon Sense Investor

Three High Quality, High Volatility Stocks to Consider – Uncommon Sense Investor

Three Reasons Recession Fears Overblown – Uncommon Sense Investor

7 Defense Stocks to Buy as Geopolitical Risks Rise | Kiplinger

Greg Schnell says “Financial charts are crumbling”

Financial Charts are Crumbling | ChartWatchers | StockCharts.com

Technical Scoop from David Chapman and www.EnrichedInvesting.com

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

S&P 500 Index has gained 2.4%, on average, in the month of April with 80% of periods seeing gains in the past two decades. equityclock.com/2022/03/31/… $STUDY $SPX $SPY $ES_F

Chinese equities and related ETFs/closed end funds finally are showing positive technical action following a substantial drop related to recent COVID 19 breakouts. $CAF is a closed end fund holding Chinese "A" shares. Nice breakout above $16.90. $FXI is an ETF holding a basket of big cap Chinese stocks.

Global Base Metals iShares $XBM.CA moved above Cdn$24.94 to an all-time high extending an intermediate uptrend.

Teck Resources $TECK a TSX 60 stock moved above US$41.75 to an 11 year high extending an intermediate uptrend.

T-Mobile $TMUS a NASDAQ 100 stock moved above $129.57 extending an intermediate uptrend. Seasonal influences are strongly favourable to May 30th . If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/tmobile-us-inc-nasdtmus-seasonal-chart

Seattle Genetics $SGEN a NASDAQ 100 stock moved above $145.57 completing a reverse Head & Shoulders pattern.

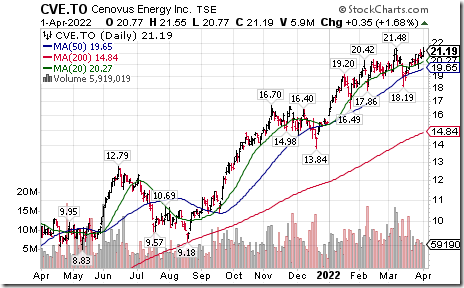

Cenovus $CVE.CA a TSX 60 stock moved above $21.48 to a six year high extending an intermediate uptrend.

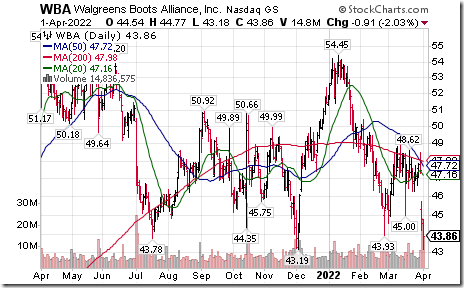

Wallgreens Boots $WBA a Dow Jones Industrial Average stock moved below $43.19 extending an intermediate downtrend.

Gold stocks on both sides of the border are recording upward momentum spurts. Kinross Gold $KGC a TSX 60 stock moved above US$5.97 completing a double bottom pattern. Seasonal influences are favourable for Kinross on a real and relative basis to the end of May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/kinross-gold-corp-nysekgc-seasonal-chart

Canadian forest product stocks including $IFP.CA $CFP.CA and $WFG.CA moved sharply lower on falling lumber prices. Interfor completed a double top pattern on a move below Cdn$34.75

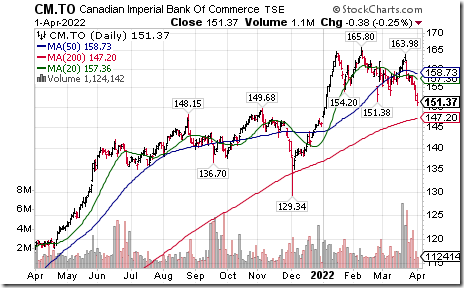

Canadian Imperial Bank of Commerce $CM.CA a TSX 60 stock moved below $151.38 completing a double top pattern.

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.28 on Friday and 1.81 last week to 63.33. It is Overbought and showing early signs of rolling over.

The long term Barometer slipped 1.40 on Friday and 0.60 to 52.51 last week. It remains Neutral and showing early signs of rolling over.

TSX Momentum Barometers

The intermediate term Barometer dropped 4.43 on Friday and 1.73 last week to 65.37. It remains Overbought and showing early signs of trending down.

The long term Barometer dropped 0.87 on Friday and 0.43 last week. It remains Overbought and showing early signs of trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.