by Jeremy Taylor and Luke Pryor, AllianceBernstein

Russia’s power on the world stage is supported by its vast reserves of oil and gas. Since the invasion of Ukraine, Western countries have stepped up sanctions, including initial efforts to ban some of Russia’s oil exports. But expanding and enforcing an oil embargo will have wide-ranging consequences—on all sides.

The Western world stands aghast at the suffering of the Ukrainian people. The global economic consequences of the conflict could also be severe, because Russia and Ukraine are major exporters of vital commodities. For Western democracies, applying pressure to halt the conflict will likely come at a cost, because Russia is the world’s third largest oil producer—accounting for 12% of global oil output. While a ban on Russian oil will hurt the invader’s biggest source of revenue, its effectiveness depends on solidarity from Western countries in the face of economic hardship and risks of escalating the conflict.

Russia’s Invasion Highlights Western Vulnerability

Oil markets were already undersupplied before the outbreak of war; now they are heading further into deficit. In Western European countries, environmental legislation and regulation has discouraged supply growth of oil and gas in the private sector, while in the US a higher cost of capital and a focus on higher returns has also constrained new supply. The result? Tighter and more volatile markets. Given these constraints, if Russian oil disappears from the market, it will be very hard to find enough new sources of supply in the near term to plug the gap and prevent oil prices from rising sharply.

Oil Embargo Begins to Take Effect

The US and UK have announced oil embargos, with the US ban immediately effective on March 8 and the UK planning to phase out Russian oil imports by the end of this year. Both countries import relatively little Russian oil as a percentage of their total energy mix, so their actions appear largely symbolic. To be fully effective, many more countries would need to join the embargo, particularly Europeans, who rely much more on Russian supply.

But meanwhile, big global corporate oil buyers such as BP and ENI are wary of violating an embargo, so they have started to self-sanction. While they continue to buy the Russian oil they have already contracted for, they are not renewing contracts for future delivery. Seaborne exports from Russia to the OECD have already been cut in half, while Urals crude is trading at around a US$25 per barrel discount to Brent, compared with just US$4 in February. And the price of diesel—which is vital for commercial transportation and machinery—is reflecting actual shortage. Can European governments bring clarity to a confused and deteriorating situation?

Embargo Puts Europe in a Tough Spot

Europe faces a tougher decision than the US and UK. European countries, notably Germany and Italy, are relatively much bigger customers for Russian oil—and, crucially, depend on Russia for over 40% of their natural gas as well as 30% of their oil. This dependence gives Russia leverage, because any action to halt Russian oil imports could escalate to interruption of Russian gas supplies too. The EU recently published an outline plan to become independent of Russian energy supplies well before 2030 and to reduce EU demand for Russian gas by two-thirds by the end of this year. But these measures will take time to implement.

In the interim, Europe could face a brutal winter if it nixes Russian oil—and/or if Russia pre-emptively cuts off energy supplies. According to estimates by European think-tank EconPol, the short-term cost to Germany of fully stopping Russian energy imports would be 3% of GDP. But EconPol could not rule out larger economic slumps and upheavals. RWE, Germany’s largest power producer, has even warned of “unimaginable consequences” for the heating supply of households. Those outcomes may seem dire, but the consequences could be even worse if Europe doesn’t take action to deter Russian aggression. Against that background, it’s impossible to predict the chances of a concerted European ban on Russian oil. Geopolitical forecasters currently estimate a probability range of 30%–50%, but in this volatile situation the outlook could change from day to day.

Embargo’s Impact on World Markets

Replacing Russia’s share of world supply would be challenging even in a best-case scenario. An optimistic scenario would include higher output from US shale, OPEC nations and countries currently subject to US sanctions such as Venezuela and Iran. But much of that increased output would require further investment and much more time.

As a result, a total loss of Russian oil exports would be very damaging for global GDP in the short/medium term. Much higher prices would drive demand destruction (less economic activity) to rebalance the market. Consumers and businesses would need to economize, and demand would contract, until adequate supply ultimately came back onstream and allowed prices to fall. Oil is not only 5% of world GDP but also a key driver of most types of economic activity. The impact of a shortage of oil will be felt across Asia and Latin America as well as the US and Europe because oil prices reflect global market conditions.

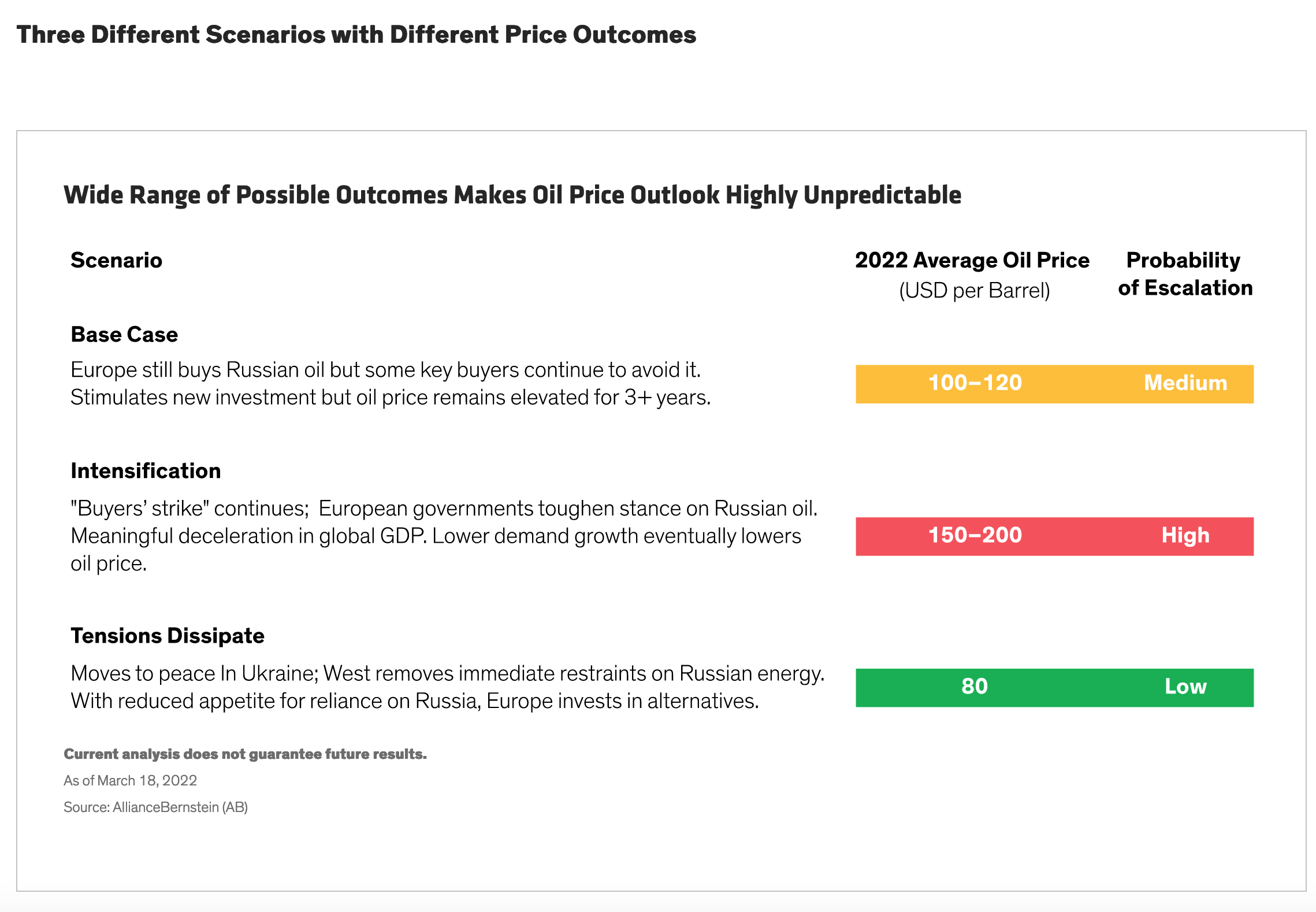

Our scenario analysis suggests that in a demand destruction case (“Intensification”—Display, below) oil prices could reach US$200 per barrel. This worst-case scenario also increases the chances of Russian retaliation against the West, potentially leading to further escalation and human suffering and economic damage.

Embargo’s Dangers for Russia

Embargo’s Dangers for Russia

An embargo would pose multiple dangers to Russia. Energy represents over 30% of Russian GDP (split 75% oil / 25% gas) and exports account for 75%–80% of hydrocarbon output. It is unlikely Russia would be able to redirect all of its oil exports to more-friendly countries (primarily China and India), particularly in the short term, leaving a large portion of its oil surplus undeliverable. As Russia lacks enough storage capacity for a long-term embargo, this surplus oil would ultimately need to be shut in, potentially leading to permanent loss of revenues (and global capacity) because the costs of restarting fields in hostile northern environments are so high.

Best Case and Alternative Scenarios

Of course, it’s perfectly possible that none of these dire outcomes materializes. The conflict could be resolved, with oil prices reverting to pre-war levels. And there’s a wide margin of error for any forecasts: unpredictable events—such as a resurgence of COVID—can trigger big changes in the supply/demand balance with a commensurate impact on prices.

The conflict is tragic for the people of Ukraine and the world. It also serves as a huge wake-up call for Western governments. We expect there will be a reappraisal of the importance of energy security and a push to develop new energy supply of all sorts—both renewable and oil and gas-based. The shift to renewable energy should accelerate alongside intensified investments in energy efficiency, this time with more pragmatic transition planning across Western countries that considers both the security of supply and industrial competitiveness.

That more hard-headed approach will include a continuing medium-term role for oil—and for gas too, as a lower-emission replacement for coal, the single most polluting fuel. But European energy companies will want a clear signal from governments that new projects represent a necessary contribution to supply security consistent with the long-term energy transition to net zero.