by Don Vialoux, EquityClock.com

Currency Trends

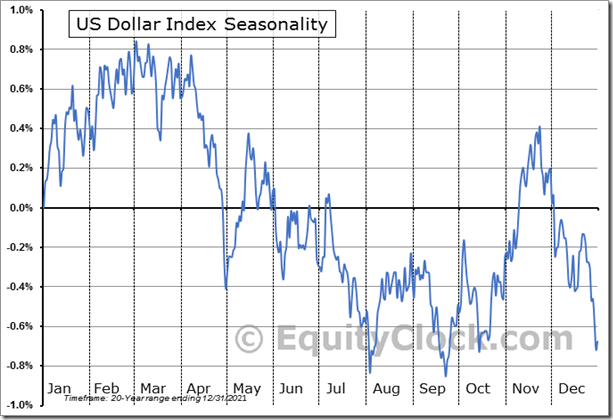

Seasonal influences by the U.S. Dollar Index have a history of peaking in the first week of April.

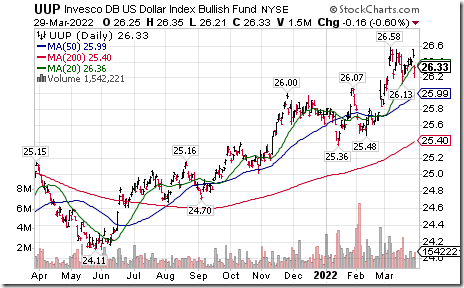

Technical weakness yesterday by the U.S. Dollar and its related ETF: UUP suggests that an intermediate peak in line with seasonal patterns is developing on schedule this year.

Conversely, seasonal pattern by the Canadian Dollar relative to the U.S. Dollar Index is favourable from the middle of March to at least mid-July and frequently to mid-October. See seasonality chart on the Canadian Dollar at http://charts.equityclock.com/seasonal_charts/futures/FUTURE_CD1.PNG .Recovery by the Canadian Dollar during the past two weeks suggests that the Canadian Dollar is closely following its seasonal pattern this year.

Technical Notes released yesterday at

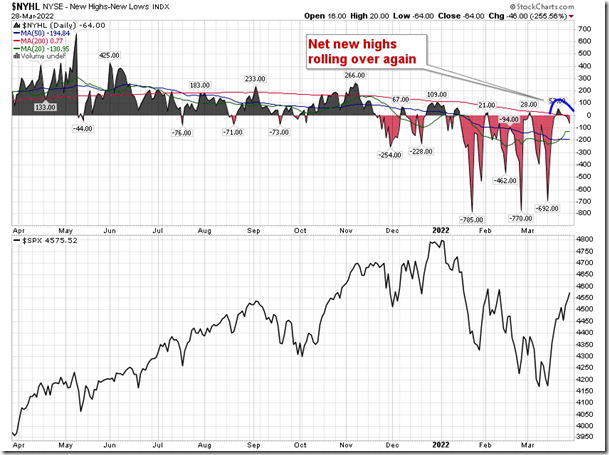

Is the rollover in the net new highs in this market and the stalling of the near-term trend of the advance-decline line signal that the mean-reversion rally is fading? equityclock.com/2022/03/28/… $NYA $STUDY $SPX

S&P 500 SPDRs $SPY moved above intermediate resistance at $456.70

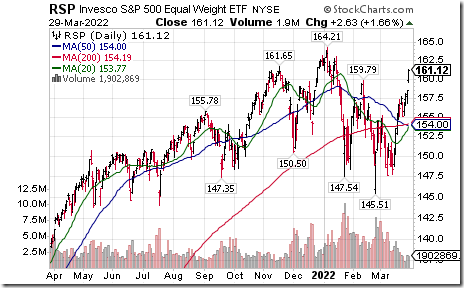

S&P 500 Equal Weight ETF $RSP moved above intermediate resistance at 159.79

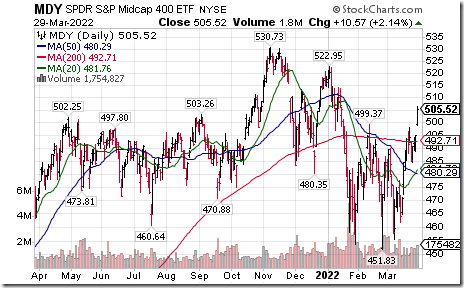

MidCap SPDRs $MDY moved above $499.37 completing a double bottom pattern.

Russell 2000 iShares $IWM moved above $208.64 completing a double bottom pattern.

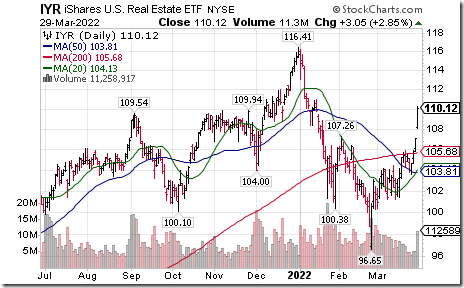

U.S. Real Estate iShares $IYR moved above intermediate resistance at $107.26

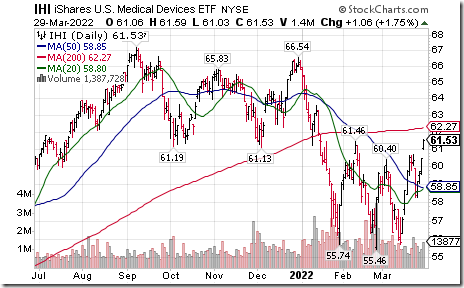

Medical Devices iShares $IHI moved above $60.40 completing a reverse Head & Shoulders pattern.

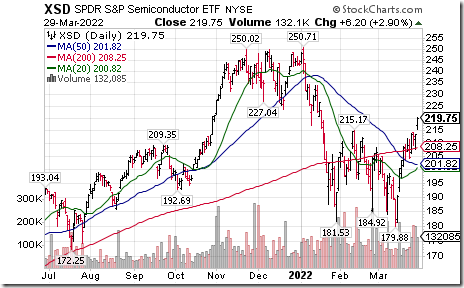

S&P Semiconductor SPDRs $XSD moved above $215.17 resuming an intermediate uptrend.

A wide variety of S&P 100 and NASDAQ 100 stocks moved above intermediate resistance this morning including $CMCSA $MDT $AAPL $ADI $MCHP $ORCL

Microsoft $MSFT a Dow Jones Industrial Average stock moved above $314.47 resuming an intermediate uptrend

Costco $COST a NASDAQ 100 stock moved above $570.62 to an all-time high extending an intermediate uptrend.

Gold and silver ETNs $GLD $SLV moved below support levels setting short term double top patterns. Related equities including $AEM.CA $FNV.CA and $HL also completed double top patterns.

TSX Gold iShares $XGD.CA moved below $20.91 completing a double top pattern.

Grain prices also under technical pressure. $WEAT moved below $9.75 completing a double top pattern.

Trader’s Corner

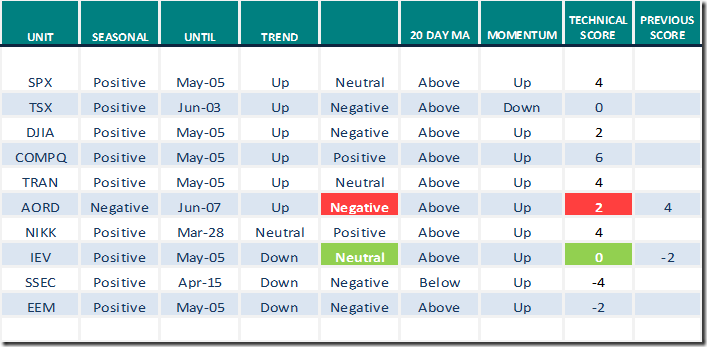

Equity Indices and Related ETFs

Green: Increase from previous day

Red: Decrease from previous day

Commodities

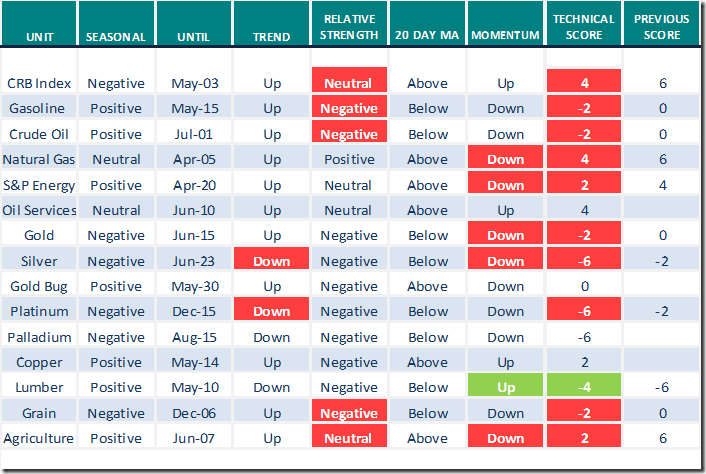

Daily Seasonal/Technical Commodities Trends for March 29th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

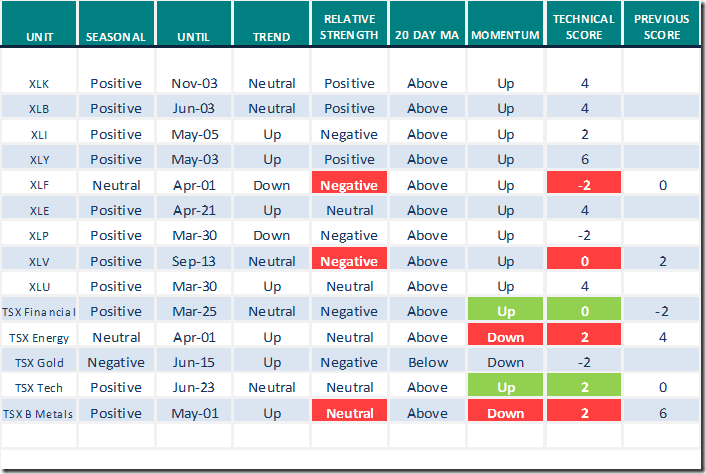

Daily Seasonal/Technical Sector Trends for March 29th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer gained another 11.42 to 75.75 yesterday. It remains Overbought. Trend remains up.

The long term Barometer gained another 6.21 to 60.52 yesterday. It changed from Neutral to Overbought on a move above 60.00. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 5.63 to 73.59 yesterday. It remains Overbought.

The long term Barometer added 1.73 to 65.37 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.