by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

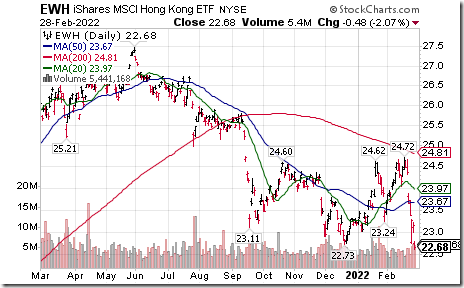

Hong Kong iShares $EWH moved below $22.73 extending an intermediate downtrend.

Solar Energy ETF $TAN moved above intermediate resistance at $68.31

Aerospace & Defense ETF $PPA moved above $74.95 resuming an intermediate uptrend.

Editor’s Note: Units subsequently moved above $77.25 to an all-time high.

Another Aerospace & Defense ETF breakout in response to geopolitical tensions! $ITA moved above $109.33 extending an intermediate uptrend.

Star performers today in the Aerospace & Defense sector include $NOC and $LMT. Nice breakout by Northrop Grumman above $407.35

Cameco $CCO.CA , a TSX 60 stock moved above $30.10 resuming an intermediate uptrend. The uranium ETF $URA, heavily weighted in Cameco completed a similar technical pattern.

ConocoPhillips $COP an S&P 100 stock moved above $94.45 extending an intermediate uptrend.

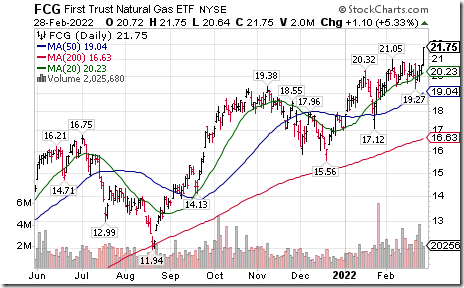

First Trust Natural Gas ETF $FCG moved above $21.05 extending an intermediate uptrend.

TSX energy equities and ETFs are responding to higher natural gas and crude oil prices. TSX Energy iShares $XEG.CA moved above $13.28 to a seven year high extending an intermediate uptrend. Seasonal influences are favourable to early June. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/ishares-sptsx-capped-energy-index-etf-tsexeg-seasonal-chart

Notably stronger among Canadian energy stocks are "gassy" stocks such as ARC Resources. Nice breakout by ARX.CA above Cdn$15.64 extending an intermediate uptrend!

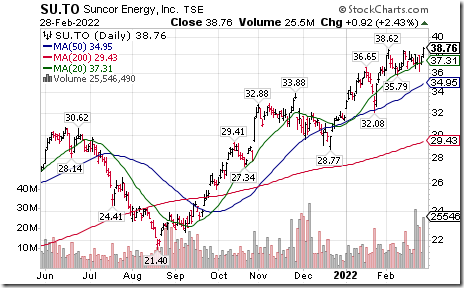

Suncor $SU.CA a TSX 60 stock moved above $38.62 extending an intermediate uptrend.

Agribusiness ETF $COW.CA moved above Cdn$67.00 to an all-time high extending an intermediate uptrend. Responding to higher grain prices.

Base metals iShares $PICK moved above $59.63 extending an intermediate uptrend.

Freeport McMoran $FCX moved above $46.20 extending an intermediate uptrend. Seasonal influences for the stock and related ETFs (e.g. $PICK $COPX XBM.CA are favourable until at least mid-April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/freeport-mcmoran-copper-gold-inc-nysefcx-seasonal-chart

Steel ETF $SLX moved above $59.63 extending an intermediate uptrend.

Trader’s Corner

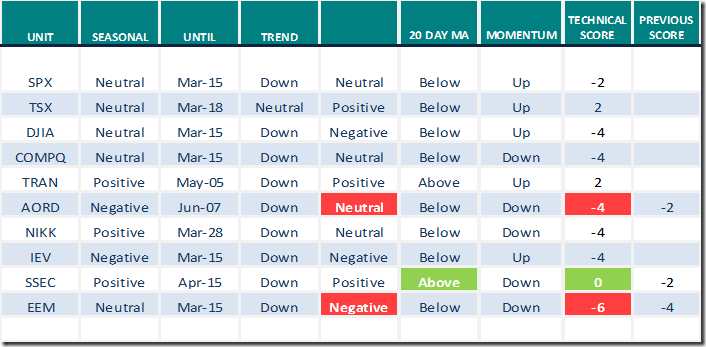

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.28th 2022

Green: Increase from previous day

Red: Decrease from previous day

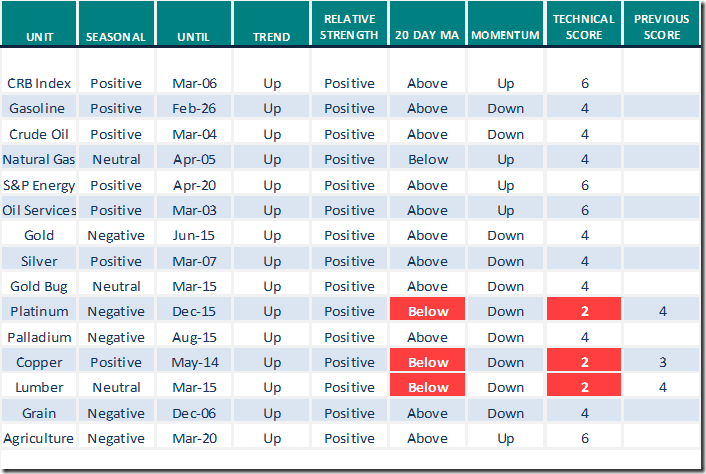

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.28th 2022

Green: Increase from previous day

Red: Decrease from previous day

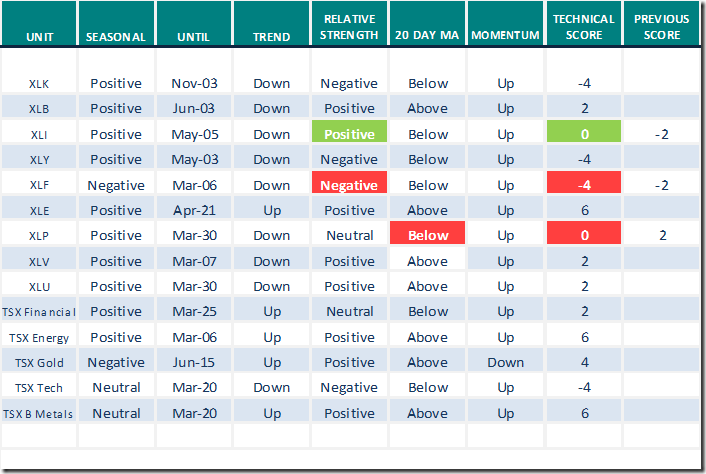

Sectors

Daily Seasonal/Technical Sector Trends for Feb.28th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.01 to 35.07 yesterday. It returned to Oversold on a drop below 40.00.

The long term Barometer slipped 2.40 to 46.89 yesterday. It remains Neutral.

TSX Momentum Barometers

The long term Barometer added 0.94 to 56.89 yesterday. It remains Neutral.

The long term Barometer added 1.83 to 57.78 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.