by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

Portfolio Manager and Managing Director, Russ Koesterich examines why investors should look to the most boring and basic of equity hedges: cash.

Outside of commodities and energy stocks, most asset classes this year have posted negative returns. This change of fortune marks a big shift after years of mostly double-digit gains. Unfortunately, investors are challenged by more than just poor returns; finding ways to manage risk has also become more difficult. Given a scarcity of alternatives, investors should consider a higher allocation to the most basic of hedges: cash.

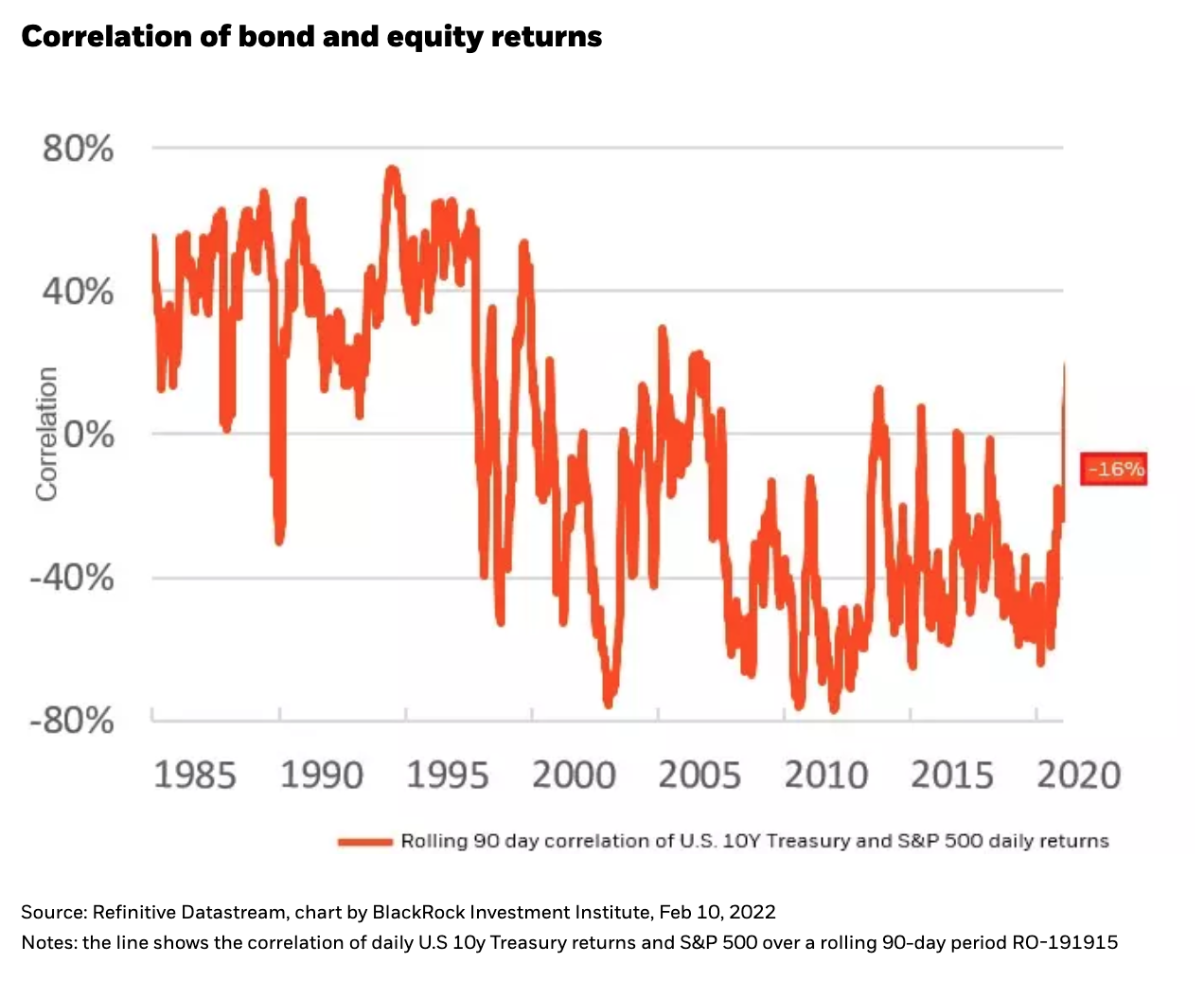

During the past year I have discussed a new challenge for multi-asset investors. As investor angst has shifted from the pandemic and weak growth to inflation, the relationship between stocks and bonds has shifted in meaningful ways. Stock/bond correlations have become significantly less negative, making bonds a less reliable hedge (see Chart 1). This dynamic has been on display in recent months. As inflation has surged to multi-decade highs, rather than mitigate risk, the bond market has shown weakness that coincides with stock market volatility.

Given this dynamic, rather than bonds, investors have needed to look elsewhere to hedge equity risk. For much of the past year an overweight to the dollar has played a role. I should note that it is important to distinguish between investing in a currency like the dollar as a hedge, which can be accomplished via a variety of instruments, and simply holding cash, presumably in dollars for U.S. investors. Nevertheless, in recent months that dollar hedge is also proving less reliable.

Looking at weekly data, in the 18 months from the start of the pandemic to last summer the Dollar Index (DXY) had a -0.6 correlation with U.S. equities. During the past six months that correlation has shifted to -0.35. While still meaningful, the relationship has become less significant and less reliable. And if you shift the horizon from a week to a trading day, the correlation is effectively zero.

Why the shift? One explanation is that over the long term inflation erodes the value of the dollar. Near term, it is also true that the Federal Reserve is no longer the only central bank struggling to keep up with inflation. Part of what drove the dollar higher was the fear that higher U.S. inflation would increase the spread between U.S. interest rates and those of other developed countries. Today, it is becoming increasingly clear that inflation is not just a domestic concern. Other central banks are also scrambling to remove monetary accommodation. As a result, the difference between U.S. interest rates and other countries will be smaller, removing a tailwind for the dollar.

Manage risk with cash

In truth, the dollar was never as effective a hedge as Treasuries. The reason is that currency moves are rarely large enough to offset more volatile equity markets. But while the dollar was never ideal, it will be missed in a regime with fewer and fewer alternatives.

For asset allocators the message is not to abandon stocks. Equities are likely to hold up better in a high inflationary regime than other asset classes, save volatile commodities. That said, a more volatile equity market and a lack of hedging alternatives suggests managing risk will be more challenging. To the extent investors are looking to manage overall portfolio volatility, it is time to revisit the most boring but reliable of risk mitigants: cash.

Copyright © Blackrock