by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

S&P 500 Index testing the neckline to a massive head-and-shoulders topping pattern. equityclock.com/2022/02/22/… $SPX $SPY $ES_F

S&P 500 Index $SPX touched below 4,222.62 extending an intermediate downtrend.

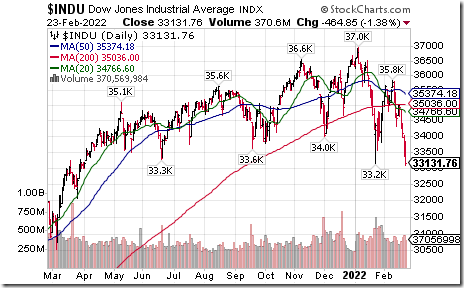

Dow Jones Industrial Average $DJIA moved below 33,150.33 extending an intermediate downtrend.

NASDAQ Composite Index $COMPQ moved below $13,94.65 extending an intermediate downtrend.

U.S. Telecommunications iShares $IYZ moved below $29.55 extending an intermediate downtrend.

AT&T $T an S&P 100 stock moved below $23.56 setting an intermediate downtrend.

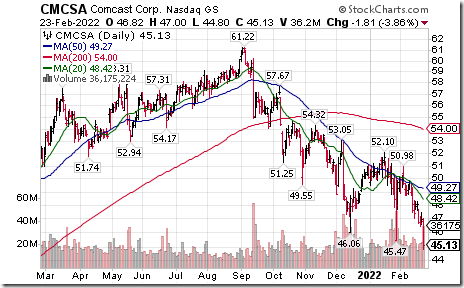

Comcast $CMCSA an S&P 100 stock moved below $45.47 extending an intermediate downtrend.

Palladium ETN $PALL moved above $227.53 extending an intermediate uptrend.

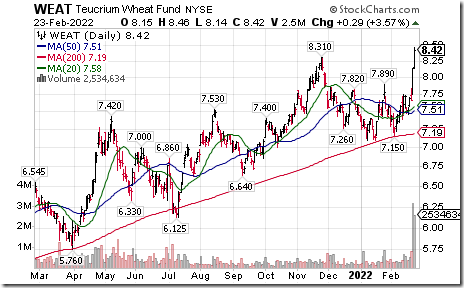

Wheat ETN $WEAT moved above $8.31 to a 4.5 year high extending an intermediate uptrend.

Consumer Discretionary SPDRs $XLY moved below $171.48 extending an intermediate downtrend.

Biotech NASDAQ iShares $IBB moved below $122.50 extending an intermediate downtrend.

Silver stocks and related ETFs continue to advance. Hecla Mining $HL moved above $5.91 completing a double bottom pattern.

Water Resources ETF $PHO moved below $50.33 extending an intermediate downtrend.

Bank of New York Mellon $BK an S&P 100 stock moved below $54.85 and $53.78 completing an intermediate topping pattern.

Moderna $MRNA a NASDAQ 100 stock moved below $138.17 and $138.13 extending an intermediate downtrend.

Caterpillar $CAT a Dow Jones Industrial Average stock moved below $190.44 extending an intermediate downtrend.

Ford $F an S&P 100 stock moved below $17.02 extending an intermediate downtrend.

Match Group $MTCH a NASDAQ 100 stock moved below $105.15 extending an intermediate downtrend.

Tesla $TSLA a NASDAQ 100 stock moved below $792.01 extending an intermediate downtrend.

VeriSign $VRSN a NASDAQ 100 stock moved below $204.19 extending an intermediate downtrend.

Fastenal $FAST a NASDAQ 100 stock moved below $50.17 extending an intermediate downtrend.

CDW Corp. $CDW a NASDAQ 100 stock moved below $171.80 extending an intermediate downtrend.

Canadian Pacific $CP.CA a TSX 60 stock moved below Cdn$88.98 setting an intermediate downtrend.

Other Significant Breakdowns

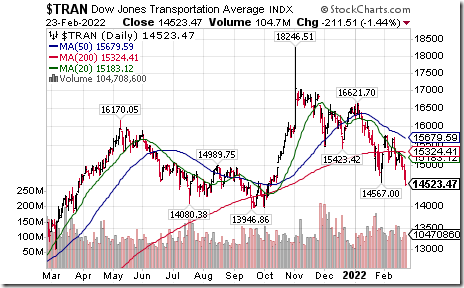

Dow Jones Transportation Average moved below 14,567.00 extending an intermediate downtrend.

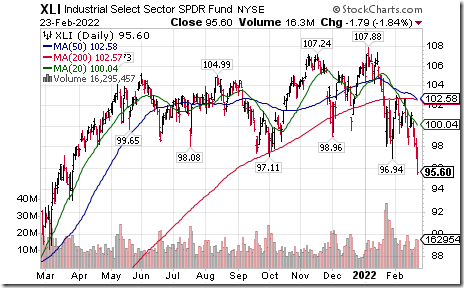

Industrial SPDRs moved below $96.94 setting an intermediate downtrend.

Trader’s Corner

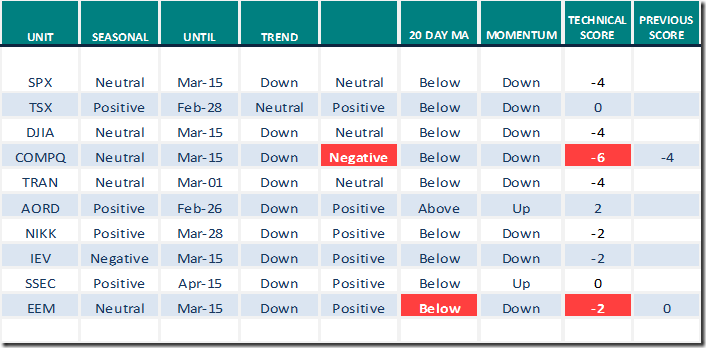

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

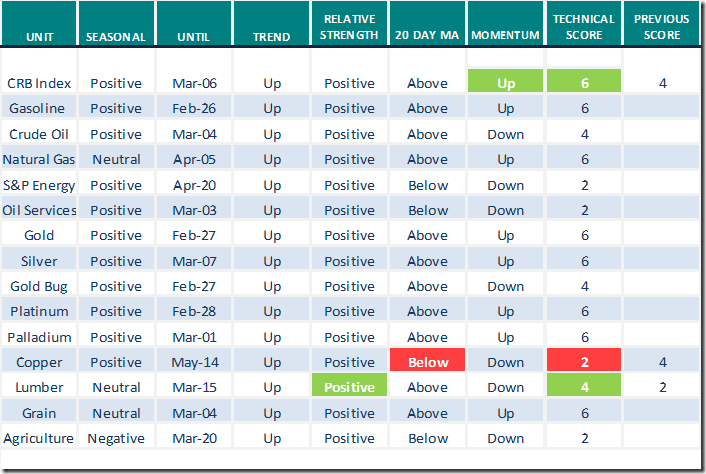

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

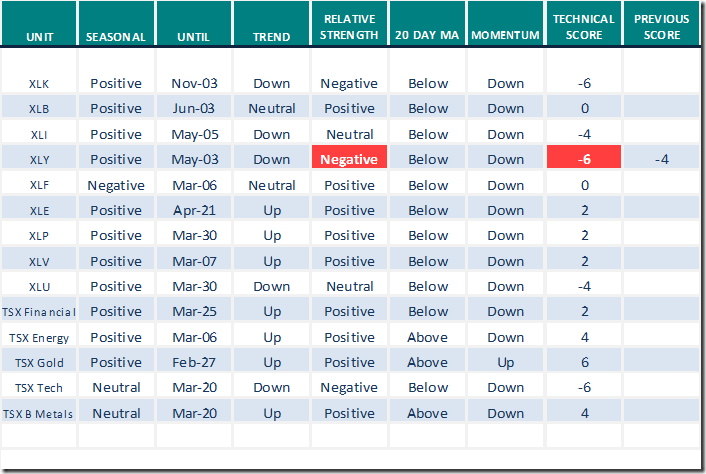

Sectors

Daily Seasonal/Technical Sector Trends for Feb.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Market Buzz

Greg Schnell discusses “Lessons learned: Electric Vehicles one year later”. Following is a link:

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 5.01 to 26.05 yesterday. It remains Oversold, but has yet to show signs of bottoming.

The long term Barometer plunged 5.61 to 37.07 yesterday. It changed from Neutral to Oversold on a drop below 40.00, but has yet to show signs of bottoming.

TSX Momentum Barometers

The intermediate term Barometer slipped 3.33 to 48.21 yesterday. It remains Neutral.

The long term Barometers slipped 0.18 to 53.12 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.