by Don Vialoux, EquityClock.com

Pre-opening Comments for Friday February 18th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points in pre-opening trade.

The Canadian Dollar was virtually unchanged at US78.71 cents following release of Canada’s December Retail Sales Report at 8:30 AM EST. Consensus was a decline of 2.1% versus a gain of 1.1% in November. Actual was a decline of 1.8%.

Shake Shack dropped $6.83 to $68.35 after reporting a larger than consensus fourth quarter loss. The company also lowered first quarter guidance.

Roku fell $13.16 to $131.55 after lower first quarter guidance.

Deere added $3.47 to $384.00 after reporting higher than consensus fiscal first quarter revenues and earnings.

Dupont gained $2.39 to 82.12 after announcing sale of its Materials division for $11 billion.

EquityClock’s Daily Comment

Following is a link:

http://www.equityclock.com/2022/02/17/stock-market-outlook-for-february-18-2022/

Technical Notes released yesterday at

The 20-day moving average on the S&P 500 Index is poised to cross below its 200-day in what would be the first bearish crossover event since March of 2020. equityclock.com/2022/02/16/… $SPX $SPY $ES_F

Canadian Tire $CTC.A.CA a TSX 60 stock moved above $186.63 and $187.64 extending an intermediate uptrend following release of higher than consensus fourth quarter results. Seasonal influences are favourable to the end of May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/canadian-tire-corp-ltd-seasonal-chart

Nutrien $NTR.CA a TSX 60 stock moved above Cdn$98.51 to a 10 year high extending an intermediate uptrend. The company reported higher than consensus quarterly earnings, increased its dividend and announced expansion of its share buyback program.

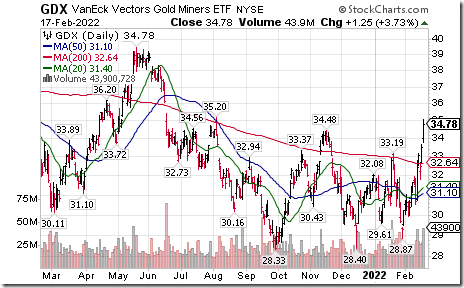

U.S. based Global Gold equity ETF $GDX above $34.48 extending an intermediate uptrend.

Junior Gold Equity ETF $GDXJ moved above intermediate resistance at $43.40 extending an intermediate uptrend.

More gold stock breakouts following strength in gold prices. Agnico-Eagle $AEM.CA moved above intermediate resistance at Cdn$68.34 and First Majestic Silver $AG and $FR.CA moved above intermediate resistance at Cdn$15.12 and US$12.12

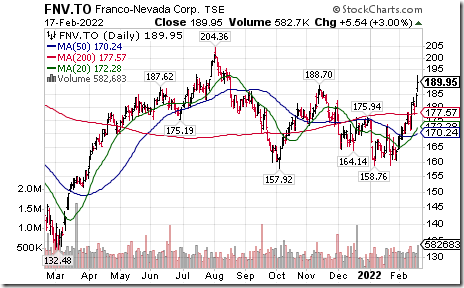

Another gold stock breakout! Franco-Nevada $FNV.CA a TSX 60 stock moved above $180.70 extending an intermediate uptrend.

Altria Group $MO an S&P 100 stock moved above $51.37 extending an intermediate uptrend. Seasonal influences are favourable until at least mid-March and frequently to June. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/altria-group-inc-nysemo-seasonal-chart

Workday $WDAY a NASDAQ 100 stock moved below $223.52 extending an intermediate downtrend.

Zoom $ZM a NASDAQ 100 stock moved below $134.70 extending an intermediate downtrend.

Ilumina $ILMN a NASDAQ 100 stock moved below $318.07 extending an intermediate downtrend.

eBay $EBAY a NASDAQ 100 stock moved below $55.91 extending an intermediate downtrend.

Intuit $INTU a NASDAQ 100 stock moved below $499.75 extending an intermediate downtrend.

Canadian Technology iShares $XIT.CA moved below $40.60 extending an intermediate downtrend.

Trader’s Corner

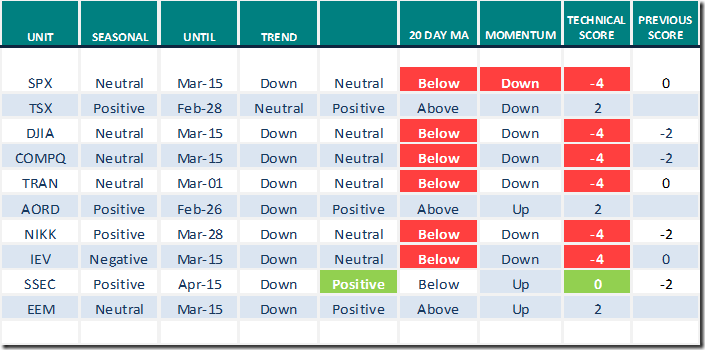

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.17th 2022

Green: Increase from previous day

Red: Decrease from previous day

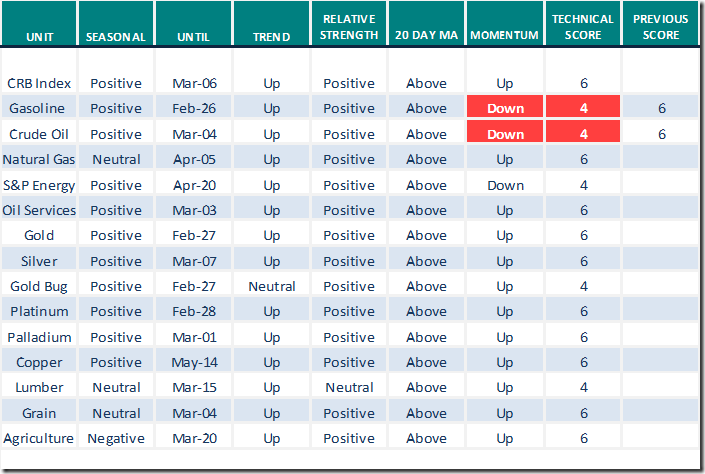

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.17th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

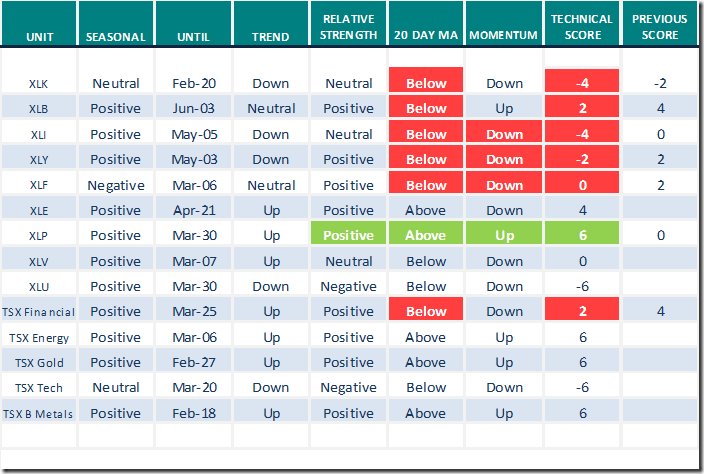

Daily Seasonal/Technical Sector Trends for Feb.17th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.01 to 35.87 yesterday. It changed to Oversold from Neutral on a return below 40.00.

The long term Barometer dropped 6.01 to 46.09 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 5.91 to 58.85 yesterday. It changed from Overbought to Neutral on a drop below 60.00. Trend has turned down.

The long term Barometer added 0.71 to 61.06 yesterday. It remains Overbought. Trend remains up.

Next Tech Talk report is to be released on Tuesday, February 22nd

U.S. and Canadian equity markets are closed on Monday (Presidents’ Day in the U.S. and Family Day in Canada).

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image003[1] clip_image003[1]](https://advisoranalyst.com/wp-content/uploads/2022/02/clip_image0031_thumb-10.png)

![clip_image004[1] clip_image004[1]](https://advisoranalyst.com/wp-content/uploads/2022/02/clip_image0041_thumb-5.png)