by Talley Léger, Invesco Canada

The Fed’s hawkish pivot is on many investors’ minds, and with good reason. Talley Léger answers these top questions from clients about stock market performance during Fed tightening cycles.

How did U.S. stocks perform in past Fed tightening cycles?

Contrary to popular belief, U.S. stocks generally did better during U.S. Federal Reserve (Fed) tightening cycles than during Fed easing schedules.

That’s because Fed tightening occurred in the second half of U.S. business cycles 67% of the time, and Fed easing overlapped with U.S. economic recessions 67% of the time.

It would be unusual for the stock market advance to end this early in a Fed tightening cycle. In my view, the last hike matters more than the first. Until then, I remain a buyer of stocks on the dips (Figure 1).

Figure 1: Fortunately, the U.S. stock market generally did better during Fed tightening cycles, which occurred in the second half of business cycles 67% of the time.

U.S. equity performance during Fed tightening cycles since 1983

How should global investors position themselves in this Fed tightening cycle?

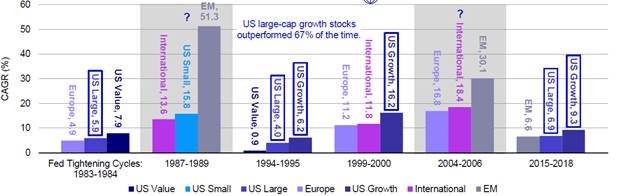

Similar to U.S. stocks, global equities generally did better when the Fed was raising interest rates. Indeed, style, size, U.S., and non-U.S. equities all performed better when U.S. authorities were tightening monetary policy. Unfortunately, investors who are looking for consistent global equity leadership (myself included) during Fed tightening cycles may be disappointed.

Whether it was style, size, U.S., or non-U.S. equities, not a single category ranked in the top three more than 50% of the time in our sample.

As a combined category, however, U.S. large-cap growth stocks did top the leader board in the 2015-2018, 1999-2000, 1994-1995, and 1983-1984 Fed tightening cycles. I could live with those odds.

In my view, the combination of slower economic and earnings growth, exacerbated by tighter fiscal and monetary policy, point to higher quality positioning in large-cap growth stocks, the recent selloff in which I believe presents another attractive entry point (Figure 2).

Figure 2: Change was constant across tightening cycles. But I expect U.S. large-cap growth to resurface, given tighter fiscal and monetary policy coupled with slower activity.

Global equity performance during Fed tightening cycles since 1983

What about sectors?

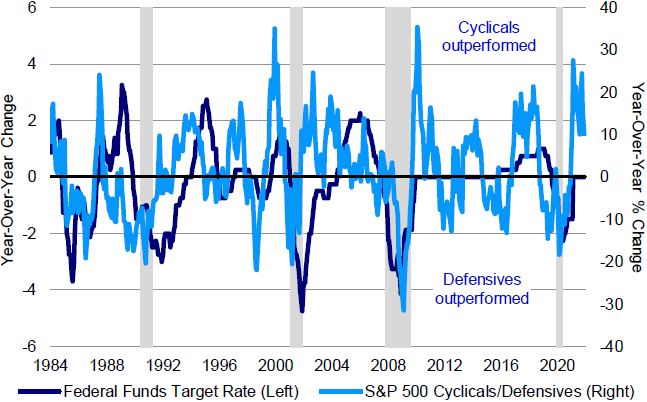

It would be unusual for the cyclical advance to end this early in a Fed tightening cycle. As we’re fond of saying, the last hike matters most. Until that time, I remain a buyer of cyclicals on the dips (Figure 3).

Figure 3: U.S. cyclical sectors outperformed their defensive counterparts in four of the last six Fed tightening cycles.

Federal funds target rate (dark blue) and the performance of U.S. cyclicals relative to defensives (light blue) since 1984

Within cyclicals, what should investors favour?

In Fed tightening cycles, tech (growth) stocks outperformed financials (value) most of the time. Consistent with my expectation for continued U.S. large-cap growth outperformance, I believe that tech stocks will become interesting to investors once again after their recent correction. More often than not, tech outperformed financials during Fed tightening cycles.

The bottom line is that I believe persistent defensive sector outperformance likely awaits an economic downturn. However, I see plenty of runway ahead for this business cycle, barring a Fed policy error. As such, I think it’s too soon to get outright defensive by fully embracing counter-cyclicals. In my view, the economy-sensitive, cyclical sectors of the market remain the place to be for now. Stay tuned.

Click here for more charts and all of the reasons why I think investors should favour stocks in Fed tightening cycles.

This post was first published at the official blog of Invesco Canada.