by Don Vialoux, EquityClock.com

Pre-opening Comments for Tuesday February 8th

U.S. equity index futures were lower this morning. S&P 500 futures were down 4 points in pre-opening trade.

Index futures were virtually unchanged following release of the January U.S. Trade Deficit report at 8:30 AM EST. Consensus was an increase to $82.90 billion versus $80.20 billion in December. Actual was a deficit of $80.7 billion

The Canadian Dollar was virtually unchanged at US78.65 cents following release of Canada’s January Merchandise Trade Balance at 8:30 AM EST. Consensus was a surplus of $2.03 billion versus a surplus of $3.13 billion in December. Actual was a deficit of $137 million.

Rio Tinto, the world’s largest base metal producer added $0.63 to $77.27 after the Chinese government postponed plans to increase carbon dioxide emission restrictions for another five years.

Harley Davidson added $2.47 to $38.59 after reporting higher than consensus fourth quarter earnings.

Pfizer dropped $1.91 to $51.30 after reporting lower than consensus fourth quarter revenues.

EquityClock’s Daily Comment

Following is a link:

http://www.equityclock.com/2022/02/07/stock-market-outlook-for-february-8-2022/

Technical Notes released yesterday at

Encouraging signs that Chinese equities will open strongly higher after the Chinese New Year holiday!. Hong Kong iShares advanced 3.24% on Friday. Seasonal influences for the Shanghai Composite Index turn strongly positive just after the Chinese New Year for a seasonal trade lasting until mid-April. If a subscriber to EqutiyClock, see seasonality chart on the Shanghai Composite at https://charts.equityclock.com/sse-composite-index-seasonal-chart

Employment in Canada dropped by 484,900, or 2.5% (NSA), in January, much weaker than the 1.5% decline that has been average of the first month of the year over the past two decades. $STUDY $MACRO #CDNecon #CAD $EWC

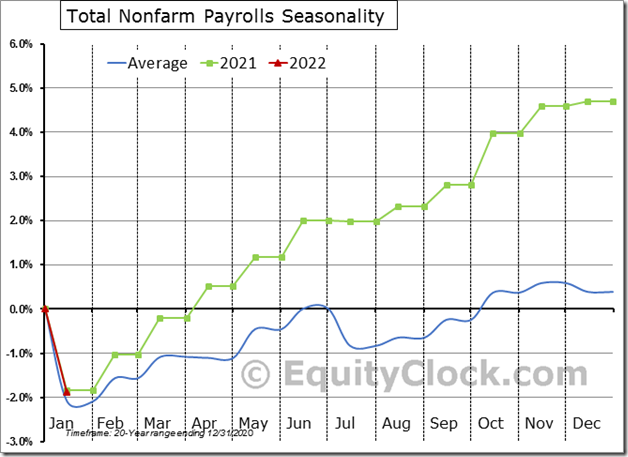

Once again, the seasonal adjustment factor is providing a skewed look at the state of the economy. January nonfarm payrolls actually fell by 2.824 million (NSA), or 1.9%, but this is stronger than the 2.1% decline that is average for the first month of the year. $STUDY $MACRO #Economy #Employment #NFP

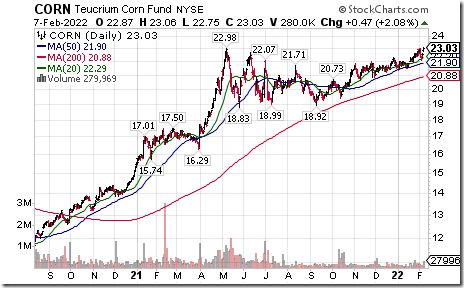

Corn ETN $CORN moved above $22.98 extending an intermediate uptrend. Seasonal influences are favourable until at least early March and frequently to June. If a subscriber to EquityClock., see seasonality chart at https://charts.equityclock.com/corn-futures-c-seasonal-chart

Gilead $GILD a NASDAQ 100 stock moved below $63.41 extending an intermediate downtrend.

Bristol-Myers $BMY an S&P 100 stock moved above $66.85 extending an intermediate uptrend.

Trader’s Corner

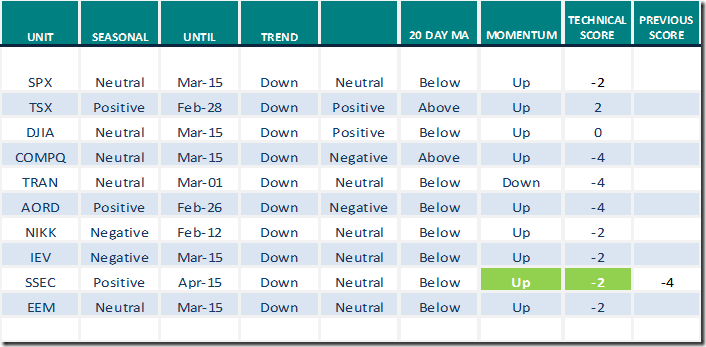

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.7th 2022

Green: Increase from previous day

Red: Decrease from previous day

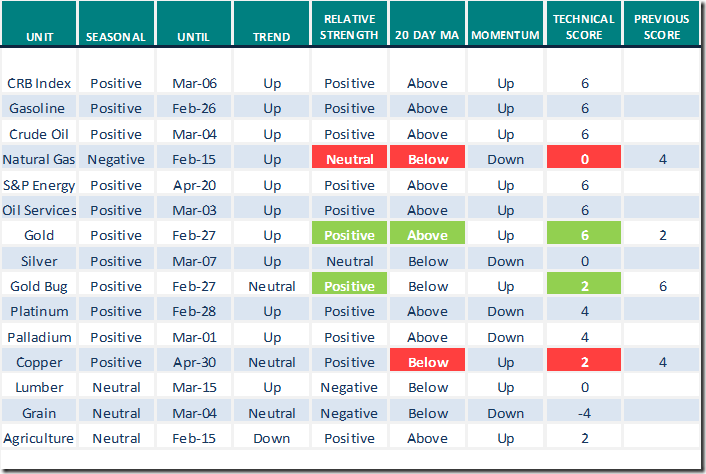

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.7th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

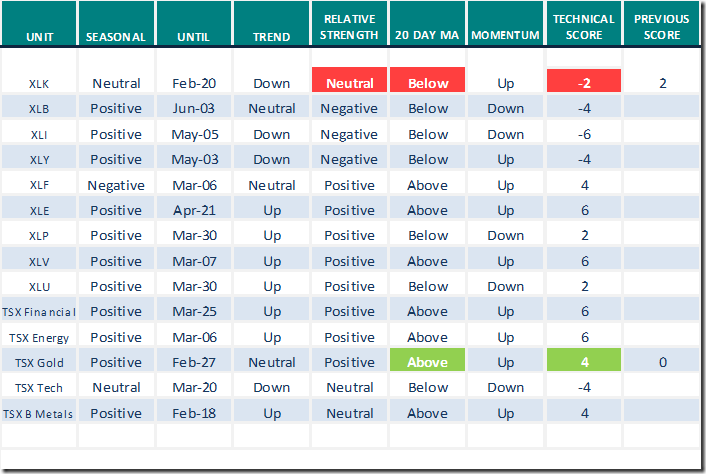

Daily Seasonal/Technical Sector Trends for Feb.7th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

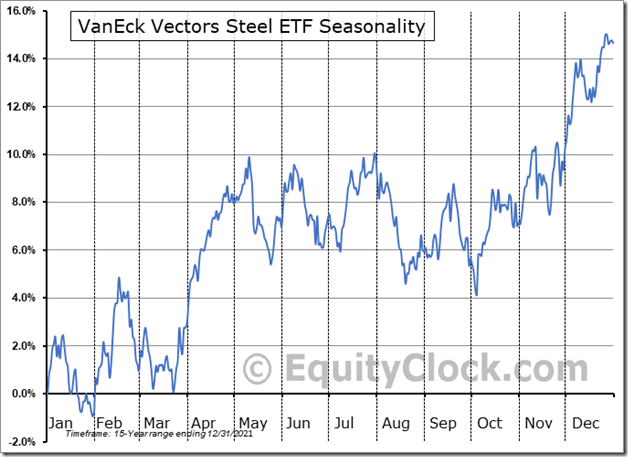

Seasonality Chart of the Day from www.EquityClock.com

The infrastructure sector has started to attract technical attention. Stocks and ETFs notably stronger yesterday included steel (e.g..SLX) and base metals (e.g. PICK, XME)

Seasonality influences are favourable for the sector between now and early May.

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.80 to 42.17 yesterday. It remains Neutral.

The long term Barometer added 0.80 to 51.20 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 3.52 to 51.10 yesterday. It remains Neutral.

The long term Barometer slipped 0.88 to 51.10 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.