by Tony DeSpirito, Managing Director, Fundamental Active Equity Investment Team, Blackrock

Market volatility is a given, but that doesn’t make its inevitable appearance any less stressful. Active equity investor Tony DeSpirito offers market insight and portfolio action items to consider amid the most recent bout.

The more markets move up and down, the harder it can be to hold firm in your investment strategy. But there are good reasons to do just that. Below are three thoughts on recent volatility, along with three action items for investor portfolios.

Market insight amid volatility

1. Corrections are common

They can even be healthy, restoring a level of value (and opportunity) to frothy markets. The S&P 500 in January skirted an official correction (defined as a drawdown of 10%) but recorded its worst month since the start of the COVID-19 pandemic in March 2020. Our research finds that drawdowns of 5% or more are not uncommon: Since 2000, we’ve had 15, with nine of them greater than the January 2022 episode. BlackRock Fundamental Equities investors are culling through their wish lists of favored stocks to identify opportunities to add to those they believe have been unduly punished.

2. Fundamentals are strong

The volatility of late has little to nothing to do with underlying stock market fundamentals, in our view. Individual and corporate finances are in solid shape, as we discuss in our recent market outlook. Fourth-quarter earnings are coming in strong. Through January, 78% of the 172 S&P 500 firms reporting had delivered a positive earnings-per-share surprise. Recent market angst is all about rates and inflation. This suggests volatility is likely to persist as the Fed takes the necessary steps to pull back the “easy money” policies put in place early in the pandemic. But strong market underpinnings mean a solid foundation to fall back on once the dust settles.

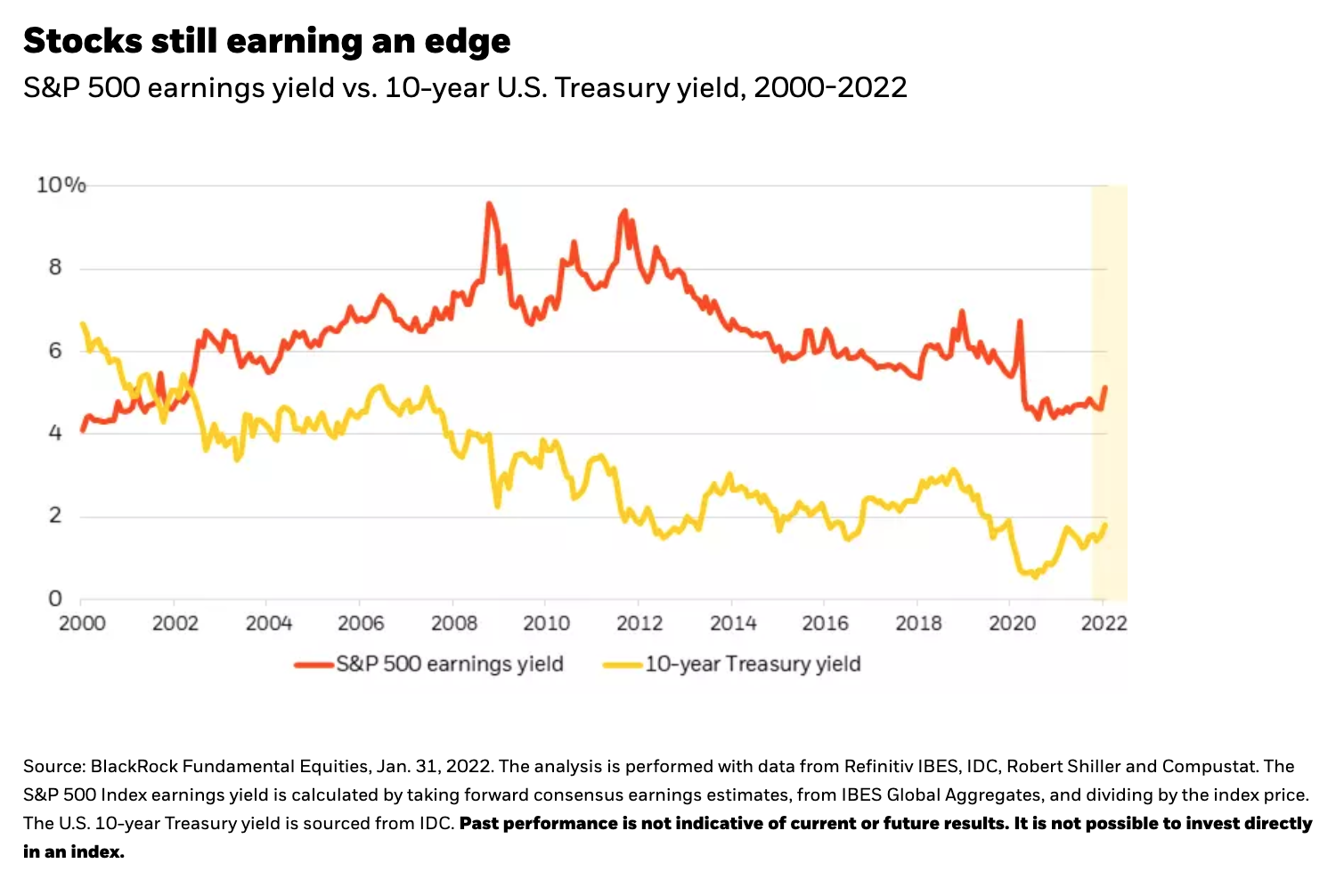

3. Stocks look even better now versus bonds

The equity risk premium (ERP), which calculates the relative risk/reward in stocks versus bonds, has been attractive for the better part of the past two decades as bond yields hovered around historic lows. In the recent market decline, the equity earnings yield rose more than the 10-year Treasury yield, enhancing the equation. (See chart below.) By our calculations, the 10-year Treasury yield would have to rise to slightly over 3% before stocks lose their luster versus bonds. In a low-rate, high-inflation environment where real (after-inflation) yields on government bonds are negative, equities still shine.

Portfolio action items to consider

1. Balance growth and value

Many investors have been underweight value in their portfolios while favoring the long-run winner: growth. We’d evaluate current allocations to ensure better balance between the two. The year started with a large rotation into value as the intrinsically longer-duration cash flows of growth companies were threatened by rising interest rates. Looking out, we see a new world order of higher rates and inflation ― at least relative to the low levels that reigned since the 2008 global financial crisis. This new paradigm should bode well for value and open up an opportunity for underallocations to be addressed. That said, this is not the moment to make heavy bets in one direction as the economy transitions to its next phase. The prudent course is to do the research to capitalize on the best that each style has to offer.

2. Prioritize quality

Quality stocks have been priced at a discount throughout the economic restart, particularly as investors favored riskier bets that paid off in the early phases of last year’s market upswing. We believe they are poised to rerate higher in the next stage of the cycle. In addition to attractive valuations, our research shows quality stocks have historically outperformed the broader market over the long term while enhancing portfolio resilience.

3. Employ a barbell

As discussed in Choosing stocks in a choosier market, we like pairing long-term structural growth stocks with cyclical value exposures. On the durable growth side, we favor technology and healthcare, where we continue to find many high-quality, innovative companies. Notably, the healthcare sector is offering these characteristics while priced below the broader market. On the cyclical value side, we like energy, which typically benefits from reinflation, and financials. Banks, in particular, are poised to see their net interest margins expand as interest rates rise.

Final thoughts

After an exceptional 2021, investors are wise to brace for something more “normal” in 2022 ― and normal market function does entail volatility. The gyrations could be heightened as the Fed does the delicate work of removing emergency accommodation without stoking runaway inflation or impeding economic growth.

Individual companies will navigate higher rates and inflation differently, and this makes selectivity more important this year. We believe fundamental research and active portfolio construction offer an advantage in this environment.