by Don Vialoux, EquityClock.com

Responses to the FOMC announcement and Federal Chairman Powell’s news conference

The 2:00 PM EST comment by the Fed confirmed continuation of its asset tapering program until March as anticipated. Comments by Chairman Powell were interpreted as more “hawkish” than anticipated. Responses in selected markets from 2:00 PM to the close at 4:00 PM EST were as follows:

S&P 500 Index moved lower

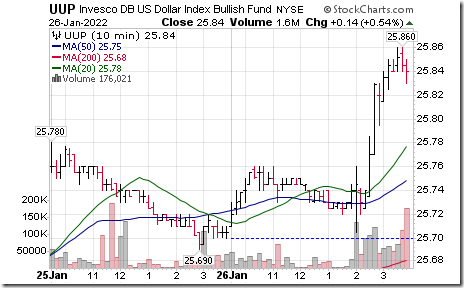

The U.S. Dollar ETN moved higher

Yield on 10 year Treasuries moved higher

Gold ETN moved lower

Commodity prices moved lower with U.S. Dollar strength

Technical Notes released yesterday at

Pepsico $PEP a NASDAQ 100 stock moved below intermediate support at $166.75

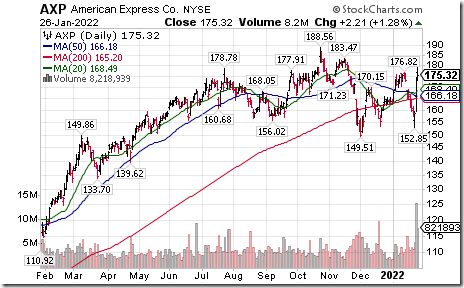

American Express $AXP a Dow Jones Industrial Average stock moved above $176.82 resuming an intermediate uptrend.

Synopsys $SNPS a NASDAQ 100 stock moved below $287.02 extending an intermediate downtrend.

General Electric $GE an S&P 100 stock moved below $88.17 extending an intermediate downtrend.

Trader’s Corner

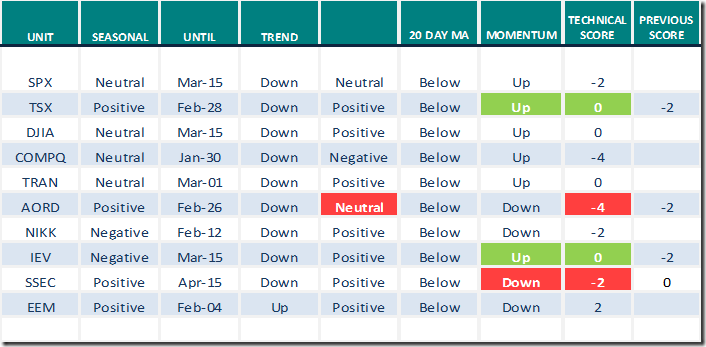

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.26th 2022

Green: Increase from previous day

Red: Decrease from previous day

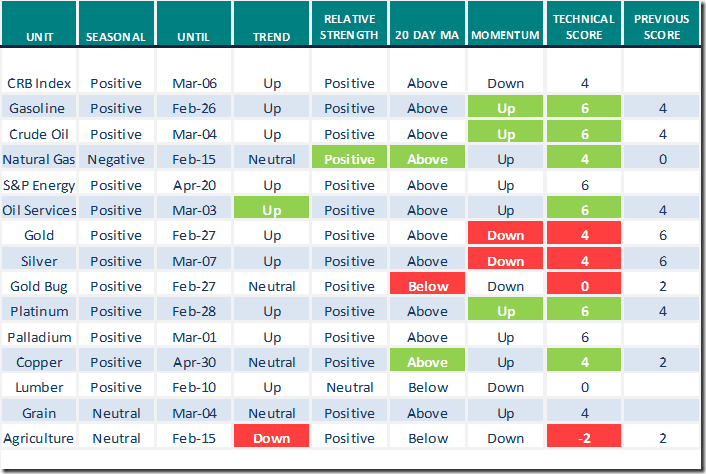

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.26th 2022

Green: Increase from previous day

Red: Decrease from previous day

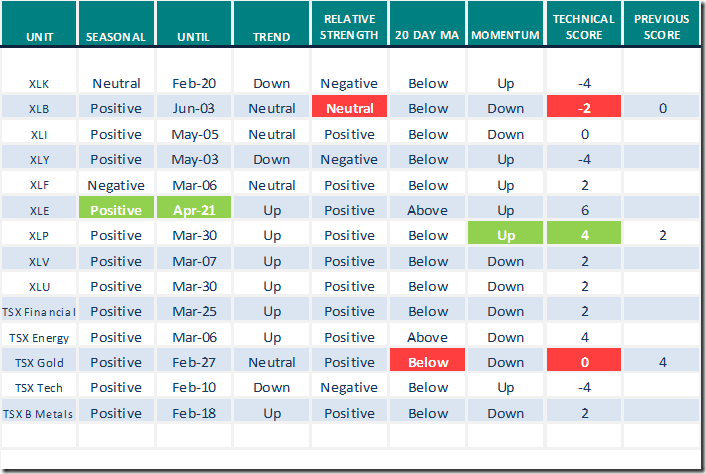

Sectors

Daily Seasonal/Technical Sector Trends for Jan.26th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Market Buzz

Greg Schnell asks ”Gold and Oil: Charts of Strength”? Following is a link:

https://www.youtube.com/watch?v=abpK5e2wDNw

Next Canadian Association for Technical Analysis Meeting

|

Event: |

CATA Meeting Jan 27 with Jake Wujastyk from TrendSpider |

|

Date/Time: |

Thursday, January 27, 2022, 8:00 PM until 10:00 PM |

For membership information, see cata@canadianata.org

S&P 500 Momentum Barometers

The intermediate term Barometer slipped another 1.40 to 30.26 yesterday. It remains Oversold and trending down.

The long term Barometer dropped another 3.81 to 45.69 yesterday. It remains Neutral and trending down.

TSX Momentum Barometers

The intermediate term Barometer eased 0.45 to 36.65 yesterday. It remains Oversold.

The long term Barometer slipped 1.36 to 47.05 yesterday. It remains Neutral and trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.comare for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.