by Invesco Tax & Estate team, Invesco Canada

ETF investors should be aware of year end phantom distributions and adjust their cost base (ACB) to avoid double taxation on future dispositions.

Normally, an exchange-traded fund (ETF) will pay most of its income distributions in cash. In some instances, the ETF will choose to reinvest all or a component of its distributions within the ETF. These reinvested distributions are commonly referred to as “phantom distributions” because the investor doesn’t actually receive the cash.

Whether distributions are paid in cash or automatically reinvested, they are taxable in the year they are received if the ETF units are held within a non-registered account.

All distributions received are reported on the annual tax slip for the year. For units of an ETF that are mutual fund trusts, distributions are reported on the T3 tax slip. However, it is important to note that there is no distinction between cash distributions and reinvested distributions from an ETF reported on the T3.

Herein lies the double tax issue related to phantom distributions. The phantom distribution is reported on the tax slip, ensuring proper reporting of that income for tax purposes. However, the investor does not receive a tangible cash payment or see an increase in number of units held inside their investment account.

Why do phantom distributions happen?

Generally, a reinvested distribution occurs because ETFs do not keep excess cash on hand to pay distributions. Since the cash isn’t readily available, most ETFs reinvest that income back into the fund and this could happen throughout the year.

Initially, the investor receives a notional distribution of more units of the ETF. The outstanding units are then immediately consolidated so the net asset value per unit and number of units held by the investor are the same as they were before the reinvested distribution. If these distributions were not reinvested in the ETF, it could cause tracking error when comparing the ETF to the index.

Effect on adjusted cost base (ACB) and avoidance of double tax

As with a reinvestment of distribution proceeds (i.e., cash) in any security, the payment of a phantom distribution has the effect of increasing the ACB. For distributions that have been automatically reinvested on the investor’s behalf, it is the investor’s responsibility to understand what part of the total distribution has been received and reinvested to be in a position to adjust their ACB accordingly.

A proper adjustment of the ACB ensures that a future disposition of the ETF units accounts for distributions for which tax was already paid (for both distributions of cash and reinvested units). It will ensure the investor’s ACB reflects amounts that have already been subject to tax and avoids the double tax issue.

Importantly, distribution of units that have been reinvested most frequently consist of capital gains and Return of Capital (ROC) but, in reality, can be any form of investment income (e.g., Canadian eligible dividends, interest income, foreign non-business income). The ACB should be adjusted upward to account for the component of the phantom distributions that reflects the reinvestment of that income.

Annual due diligence for investors

Investors should check the website of the ETF provider for information for distributions of reinvested units (“phantom distributions”) and adjust their ACB accordingly.

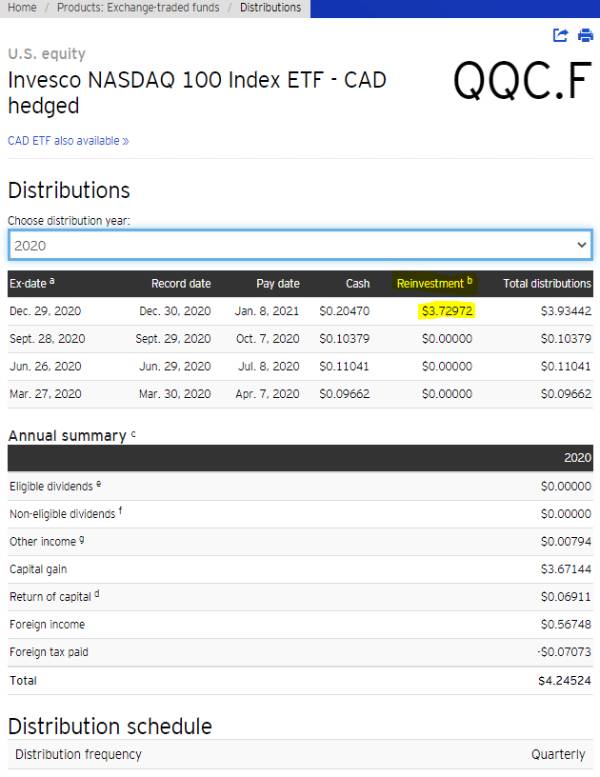

As an example, here is historical information on some distributions for Invesco NASDAQ 100 Index ETF – Canadian Hedged for the 2020 tax year (QQC.F)1.

Notice that for the highlighted distribution paid on December 29, 2020, a unit factor of $3.72972 was automatically reinvested in additional units of the ETF on behalf of investors. The investor will need to ensure they first reduce their fund’s ACB by the total amount of the ROC received and then increase the fund’s ACB by the total phantom distribution.

Example

Let’s assume an investor originally purchases 1,000 units of QQC.F at $100/unit. The investor has a total ACB of $100,000 on 1,000 units, which equates to an average cost per unit (ACB/unit) of $100. An investor can check our website to confirm the fund’s income distribution factors for the calendar year. For instance, based on the website distribution factors for fund QQQ.F, our hypothetical investor would have had the following taxable income amounts reported on their T3 Trust income tax slip for 2020.

| Fund | Ticker | Capital gains (T3 Box 21) | Return of capital (T3 Box 42) | Eligible Canadian dividends (T3 Box 49) | Net foreign non-business income (T3 Box 25 – Box 34) | Other income (T3 Box 26) | Total distribution |

|---|---|---|---|---|---|---|---|

| Invesco QQQ Index ETF – CAD Hedged | QQC.F | $3,671.44 | $69.11 | $0 | $496.75 | $7.94 | $4,245.24 |

First, the investor will need to check their account statements to ensure their ACB was reduced by the total amount of ROC that was issued throughout the year. Since the total ROC component was equal to $69.11, the investor’s ACB should have been reduced to $99,930.89.

Second, per the information found on our website, the phantom distribution (“Reinvestment”) of $3.67144/unit requires the investor to ensure that the total ACB has increased by $3,671.44. The ACB then increases to $103,602.33[1]. Per the web screenshot provided for the fund above, you will notice the “Reinvestment” column in the distribution details is footnoted with the letter “b”.

Footnote b is further explained on our website as follows, “Reinvested distributions remain in the fund rather than being paid out in cash. Reinvested distributions do not affect the value of an investor’s holdings but the amount of the distribution should be added to the investor’s adjusted cost base for income tax purposes.”

Assuming the investor later sells all the units at $135/unit, the proceeds from the sale would be $135,000. The total ACB on the ETF would be $103602.33. This creates a capital gain of $31,397.67, of which 50% is a taxable capital gain.

If the investor did not account for the phantom distribution of $3,671.44, the capital gain would instead be $35,000. At a 50% marginal tax rate (MTR), this could cause them to pay $900.58 more in taxes than is actually required. This results in double taxation because the phantom capital gain distribution already appears on the annual T3 tax slip for which taxes will be payable on that amount.

The following chart demonstrates the double tax phenomenon when an investor does not sufficiently adjust their ACB after a reinvested distribution.

| Transactions | Tax Implications With Adjustment for Reinvested Distribution | Tax Implications Without Adjustment for Reinvested Distribution |

|---|---|---|

| Purchase 1,000 QQC.F units @ $100/units | Total ACB of $100,000 or $100/unit | Total ACB of $100,000 or $100/unit |

| Reduction in ACB due to ROC phantom distribution ($69.11) | Total ACB reduced to $99,930.89 or $99.93/unit | Total ACB of $100,000 or $100/unit |

| Reinvested phantom distribution of $3.67144/unit ($3,671.44) | Total ACB of $103,602.33 or $103.60/unit | Total ACB of $100,000 or $100/unit |

| Proceeds from Sale of 1,000 Units @ $135/unit | $135,000 | $135,000 |

| ACB of 1,000 Units Sold | $103,602.33 | $100,000 |

| Realized Capital Gain | $31,397.67 | $35,000 |

| Taxable Capital Gain | $15,698.84 | $17,500 |

| Marginal Tax Rate (MTR) | 50% | 50% |

| Taxes Payable | $7,849.42 | $8,750 |

| Double Tax Paid | $0 | $900.58 |

The bottom line is that investors should be cognizant of phantom distributions from ETF investments and make the necessary adjustments to their ACB to avoid double taxation.

On May 14, 2021, Invesco QQQ Index ETF was renamed Invesco NASDAQ 100 Index ETF.

We have assumed that all other cash distributions (i.e., non-phantom distributions) were paid to the investor and not reinvested into additional units of the fund.

This post was first published at the official blog of Invesco Canada.