by Don Vialoux, EquityClock.com

Observation

North American equity indices recorded a strong recovery following a brutal period of weakness from the opening to noon yesterday.

Technical Notes released yesterday at

Dow Jones Industrial Average SPDRs $DIA moved below $339.44 and $334.35 extending an intermediate downtrend.

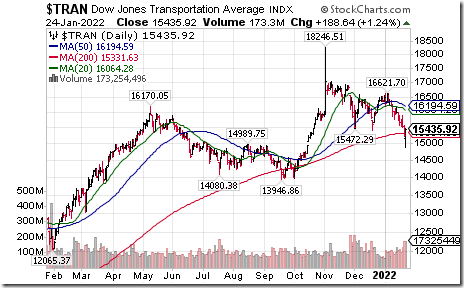

Dow Jones Transportation Average (and its related ETF $DJT) moved below 15,472.29 and 15,423.42 setting/extending an intermediate downtrend.

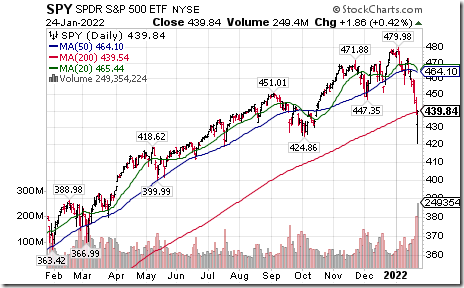

S&P 500 SPDRs $SPY moved below intermediate support at $424.86

Equal weight S&P 500 ETF $RSP moved below intermediate support at $151.13

TSX Composite Index $TSX.CA moved below $20,482.33 completing a double top pattern.

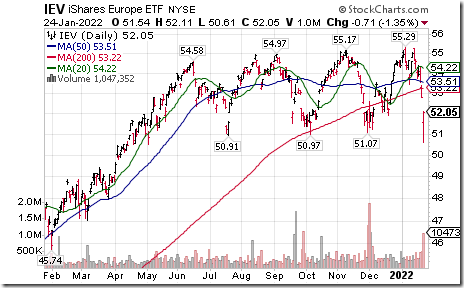

Europe iShares $IEV moved below $90.91, $50.97 and $51.07 setting an intermediate downtrend.

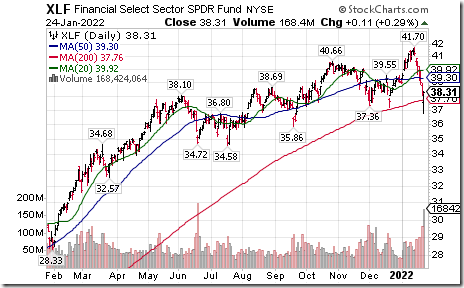

U.S. Sector SPDRs that broke intermediate support/set an intermediate downtrend this morning included $XLB $XLF and $XLI

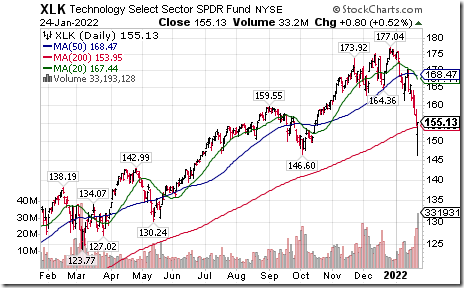

Another sector SPDR breakdown! Technology SPDRs $XLK moved below $146.60 extending an intermediate downtrend.

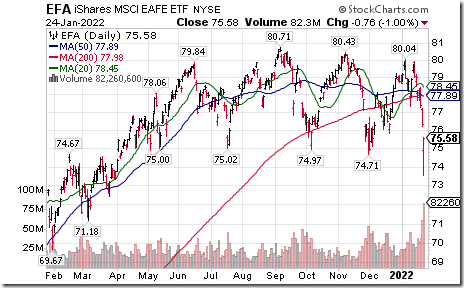

International ETFs that broke intermediate support/set intermediate downtrends this morning included $EWG $EWY $EZU $EWA $EIS $EPP $EFA and $FM

S&P 100 and NASDAQ 100 stocks that broke intermediate support/set intermediate downtrends this morning included $SPG $FB $CDNS $INTU $TSLA and $PAYX

MMM $MMM a Dow Jones Industrial Average company moved below $169.18 extending an intermediate downtrend.

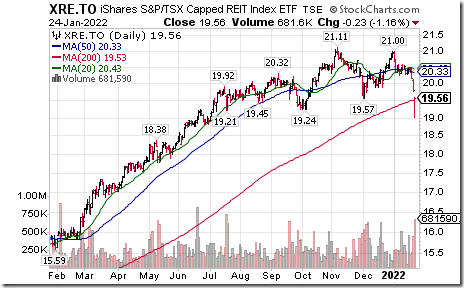

Prominent Canadian sector ETFs that broke intermediate support/ set an intermediate downtrend this morning included $ZEM.CA and XRE.CA

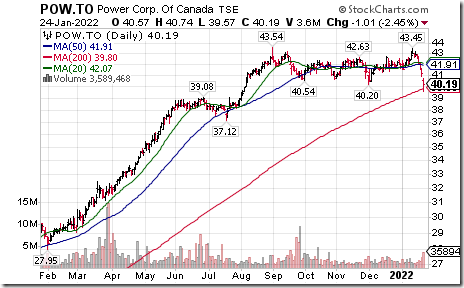

TSX 60 stocks moving below intermediate support/setting intermediate downtrends this morning included $CSU.CA QSR.CA $BAM.A.CA and POW.CA

More TSX 60 stocks breaking intermediate support! Open Text $OTEX moved below US$44.55 and US$44.98, Franco Nevada $FNV moved below US125.20 and CGI Group $GIB moved below US$80.23

Trader’s Corner

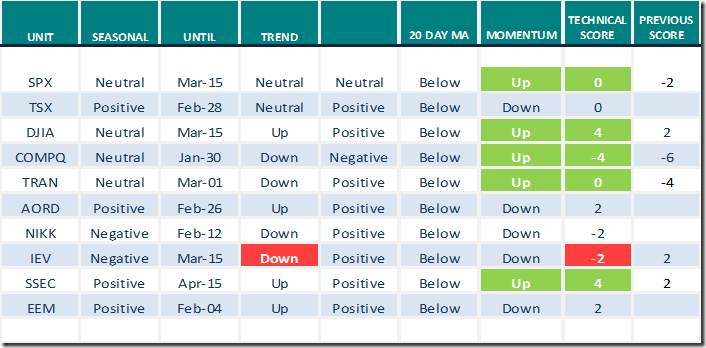

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.24th 2022

Green: Increase from previous day

Red: Decrease from previous day

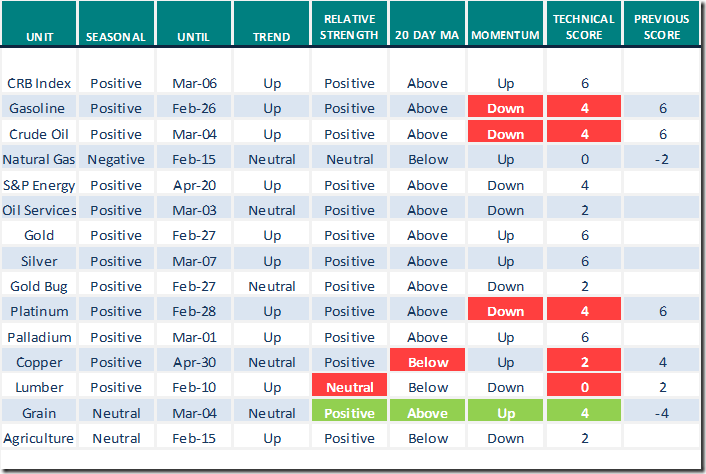

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.24th 2022

Green: Increase from previous day

Red: Decrease from previous day

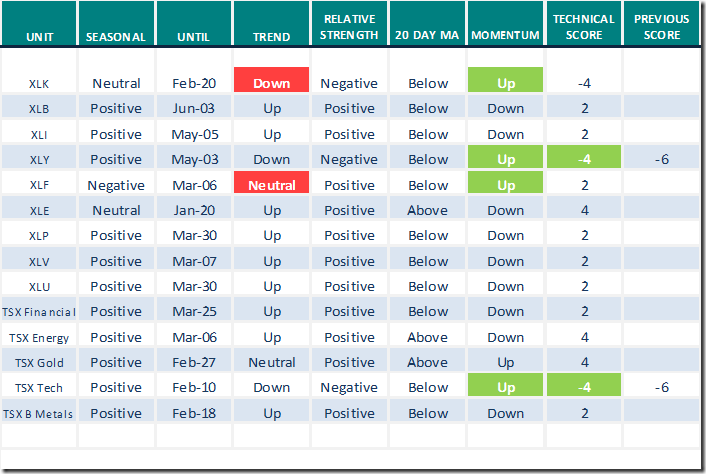

Sectors

Daily Seasonal/Technical Sector Trends for Jan.24th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 to 33.07 yesterday. It remains Oversold.

The long term Barometer added 1.40 to 54.51 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 3.95 to 32.13 yesterday. It remains Oversold.

The long term Barometer slipped 1.81 to 47.96 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.