by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Consumer Discretionary SPDRs $XLY moved below $189.90 completing a double top pattern. .

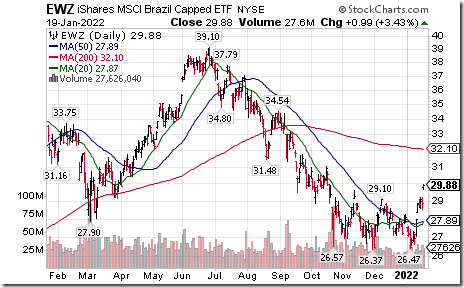

Latin America equity markets/ETFs such as $ILF recently have moved above base building patterns. Nice breakout by Brazil iShares $EWZ above $29.10 completing a double bottom pattern! Seasonal influences are favourable until early March. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/ishares-msci-brazil-capped-etf-nyseewz-seasonal-chart

Silver stocks and related equity ETFs $SIL are responding to higher silver prices. Silver bullion iShares $SVR.CA moved above $11.76. Notably stronger this morning is Hecla Mining $HL on a breakout above $5.38. Seasonal influences for Hecla and silver equities/ETFs are favourable until at least the end of February and frequently to May. If a subscriber to EquityClock, see seasonality chart on Hecla at https://charts.equityclock.com/hecla-mining-company-nysehl-seasonal-chart

Gold equity ETFs are moving above recent trading ranges setting intermediate uptrends. $GDX moved above $32.08, $GDXJ moved above $42.22. Seasonal influences are favourable to the end of February.

TSX Global Gold iShares $XGD.CA moved above intermediate resistance at Cdn$18.33. Seasonal influences are strongly favourable until late February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/ishares-sptsx-global-gold-index-etf-tsexgd-to-seasonal-chart

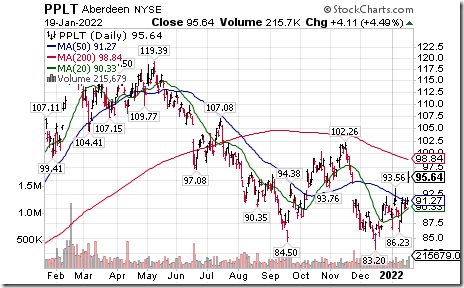

Other precious metals ETNs and futures also are recording impressive gains this morning. Platinum ETN $PPLT moved above $93.56 extending a short term uptrend. Seasonal influences are strongly positive to late February. If a subscriber to EquityClock, see seasonality chart at

https://charts.equityclock.com/etfs-physical-platinum-shares-nysepplt-seasonal-chart

Another precious metals breakout! Palladium ETN $PALL moved above $187.94 extending an intermediate downtrend. Seasonal influences are strongly positive until the end of February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/etfs-physical-palladium-shares-nysepall-seasonal-chart

Barrick Gold $ABX.CA and $GOLD moved above short term resistance at Cdn$24.25 following news that fourth quarter production exceeded consensus. Seasonal influences are strongly positive to the end of February. If a subscriber to EquityClock, see seasonality chart at

https://charts.equityclock.com/barrick-gold-corp-tseabx-seasonal-chart

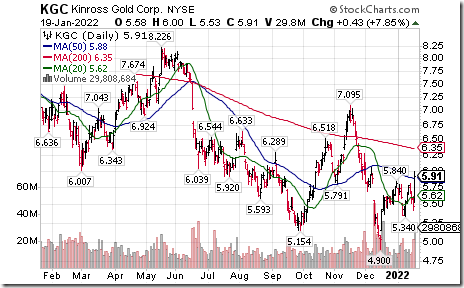

Another gold stock breakout! Kinross $K.CA and $KGC a TSX 60 stock moved above US$5.84 setting an intermediate uptrend. Seasonal influences are favourable until late February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/kinross-gold-corp-nysekgc-seasonal-chart

More gold stock breakouts setting intermediate uptrends! Yamana $YRI.CA moved above Cdn$5.39, Agnico-Eagle $AEM moved above US$53.83 and First Majestic Silver $AG moved above US$11.70

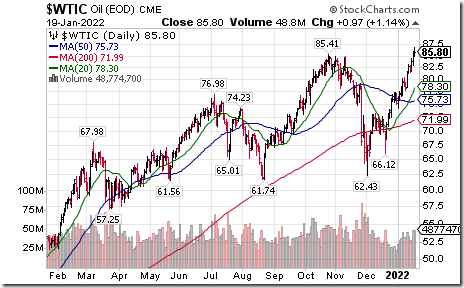

WTI crude oil $WTIC moved above $$85.41 to a seven year high extending an intermediate uptrend. Seasonal influences are favourable to early March and frequently to the end of June. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/crude-oil-futures-cl-seasonal-chart

Saputo $SAP.CA a TSX 60 stock moved below $27.36 extending an intermediate downtrend.

Trader’s Corner

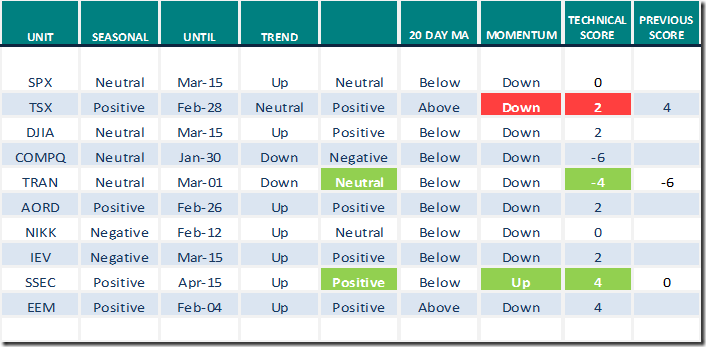

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.19th 2022

Green: Increase from previous day

Red: Decrease from previous day

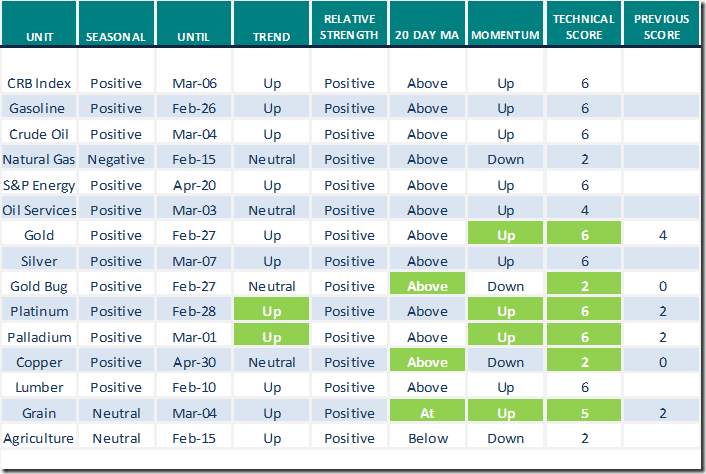

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.19th 2022

Green: Increase from previous day

Red: Decrease from previous day

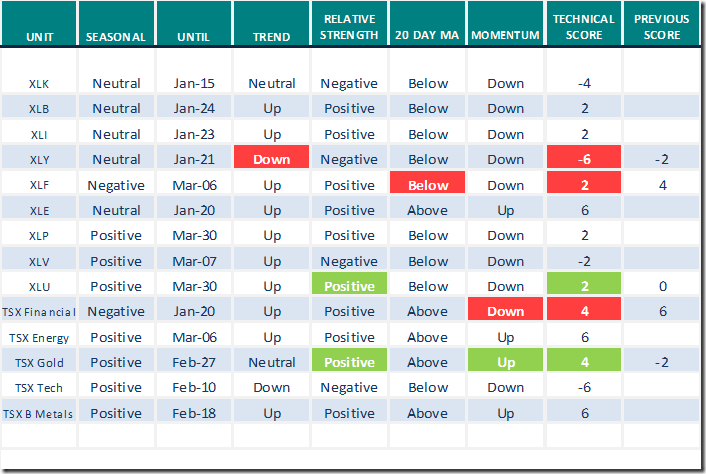

Sectors

Daily Seasonal/Technical Sector Trends for Jan.19th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following links:

Are You Ready If a Crash is Coming? – Uncommon Sense Investor

Six Reasons to Get Less Bullish on Banks – Uncommon Sense Investor

Greg Schnell discusses “Navigating down markets and weakness”

Navigating Down Markets and Weakness | Greg Schnell, CMT | Market Buzz (01.19.22) – YouTube

Greg Schnell asks “Is the market headed for a much bigger pullback”?

JC Parets discusses “Rotating into international markets”.

Rotation To International | JC Parets, CMT | All Star Charts (01.19.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 5.81 to 44.69 yesterday. It remains Neutral and trending down.

The long term Barometer slipped another 2.81 to 59.32 yesterday. It changed from Overbought to Neutral on a drop below 60.00 and continues to trend down.

TSX Momentum Barometers

The intermediate term Barometer added 4.37 to 53.24 yesterday. It remains Neutral.

The long term Barometer added 3.11 to 57.41 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.