by Abhishek Ashok, M.A., MFE, CFA® & Stephen Duench, CFA®, AGF Management Ltd.

Growing concerns about central bank tightening caused an extreme rotation in equity markets over the first few weeks of the new year. Namely, value stocks were bid up and outperformed relative to other factors such as momentum and growth, which have been two of the dominant trades for much of the past two years.

The reason? Not surprisingly, investors seem worried that potential rate hikes and a possible reduction in the U.S. Federal Reserve’s balance sheet will have a greater negative impact on earnings of long-duration growth stocks and have been selling them in favour of more value-oriented cyclical stocks with nearer-term cash flows that won’t be so impacted.

Yet, what is perhaps more critical about the recent rotation is the magnitude of it. According to our research, value’s relative performance to the rest of the U.S. market has rarely been more impressive when comparing weekly returns over the past 20 years. Moreover, this extreme is echoed to varying degrees in other large developed markets including Japan and Europe.

Two-Week Performance Spread of Cheapest Versus Expensive U.S. Stocks

Source: AGFiQ with data from FactSet as of January 14, 2021. Chart measures the rolling 2 week performance spread between the cheapest and most expensive (based on price-to-book ratio) quintiles of stocks within the largest 550 securities in the U.S. by market capitalization.

To be more exact, “cheap” stocks have rarely, if at all, performed this well versus expensive stocks as measured by value metrics such as price-to-book, free cash flow yield and forward price-to earnings. The only other times that even compare are the period near the very end of the Global Financial Crisis in 2009 and two other, more recent occasions, including March of 2020 following the initial COVID-19 pandemic selloff and when the first vaccine against the virus was approved for use by U.S. regulators later that same year.

Of course, whether this dynamic continues from here may largely depend on what happens to monetary policy and its impact on the economy going forward. After all, value tends to perform better in rising yield environments and during expansionary economic phases characterized by sustained Purchasing Manager Indexes.

At the same time, it’s interesting to note that value has become far less correlated to market moves than it was in the past and may now be considered by some investors as a way to hedge risk during the next downturn in markets.

Still, investors need to be careful either way. The entry point into value stocks broadly speaking is not nearly as attractive as it was just a short time ago and factor trades this extreme rarely persist and could be a signal of a near-term reversal.

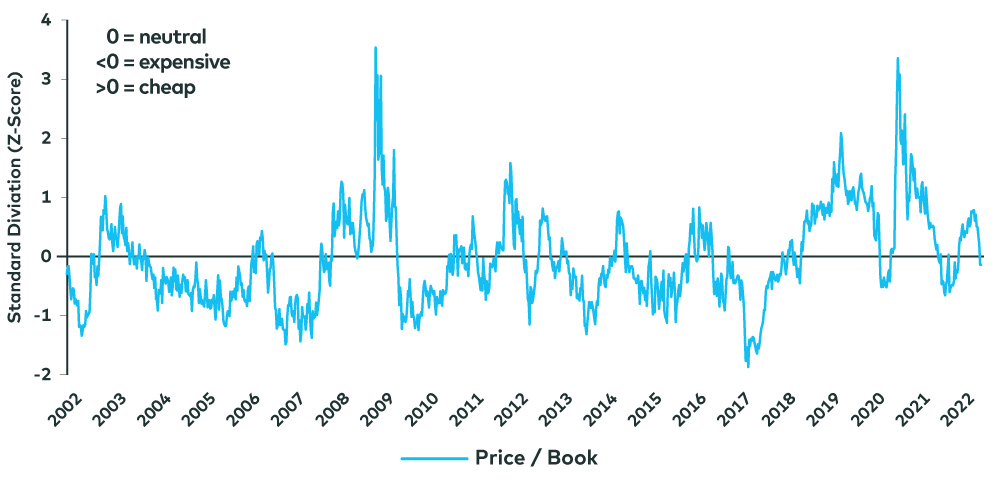

In fact, one indication that value’s outperformance may fade going forward is the narrowing valuation spread between cheap and expensive stocks as the result of recent returns. Again, based on our research, value is more neutrally priced today than it was a few weeks ago, while growth stocks are not nearly as expensive – at least on a relative basis – as they once were.

Valuation Spread of Cheapest Versus Expensive Stocks

Source: AGFiQ with data from FactSet as of January 14, 2021. Chart measures valuation spread (Z-score) between the cheapest and most expensive (based on price-to-book ratio) quintiles of stocks within the largest 550 securities in the U.S. by market capitalization.

Ultimately, the best option for investors now may be a blend of both value and growth stocks that have attractive valuations and exhibit high quality characteristics. This combination might help bolster returns over the next few months, but also mitigate some of the heightened market volatility that is widely expected at this juncture in the cycle.

Click to learn more about our Quantitative capabilities.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of January 17, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

References to specific securities are presented to illustrate the application of our investment philosophy only and do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by AGF Investments.

This document is intended for advisors to support the assessment of investment suitability for investors. Investors are expected to consult their advisor to determine suitability for their investment objectives and portfolio.

AGFiQ is a quantitative investment platform powered by an intellectually diverse, multi-disciplined team that combines the complementary strengths of investment professionals from AGF Investments Inc. (AGFI), a Canadian registered portfolio manager, and AGF Investments LLC (AGFUS), a U.S. registered adviser.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” and ™ “AGFiQ” logos are registered trademarks of AGF Management Limited and used under licence.

20220118-1993003

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2022 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.