by Russ Koesterich, CFA, JD, Portfolio Manager, Blackrock

For the first time in decades, investors need to focus on the impact of higher inflation. Portfolio Manager, Russ Koesterich, CFA, JD discusses how.

A generation of investors have never had to seriously worry about inflation. For more than two decades asset allocation and risk mitigation exercises have been more about protecting against too little growth, much less so about too much inflation.

Today, potential market headwinds are of a different sort. Rising prices of goods and services and their impact on both interest rates and profit margins have become the larger concern. The good news is that rising inflation does not necessarily mean the end of the bull market. However, the shift in the macro backdrop does necessitate a shift in security selection. Investors now need to ensure enough exposure to those stocks likely to benefit from accelerating inflation.

Macro unhinged

The abrupt and broad spike in prices has taken inflation to multi-decade highs, with core inflation in the U.S. rising at the fastest pace in 30 years and headline inflation near a forty-year high.

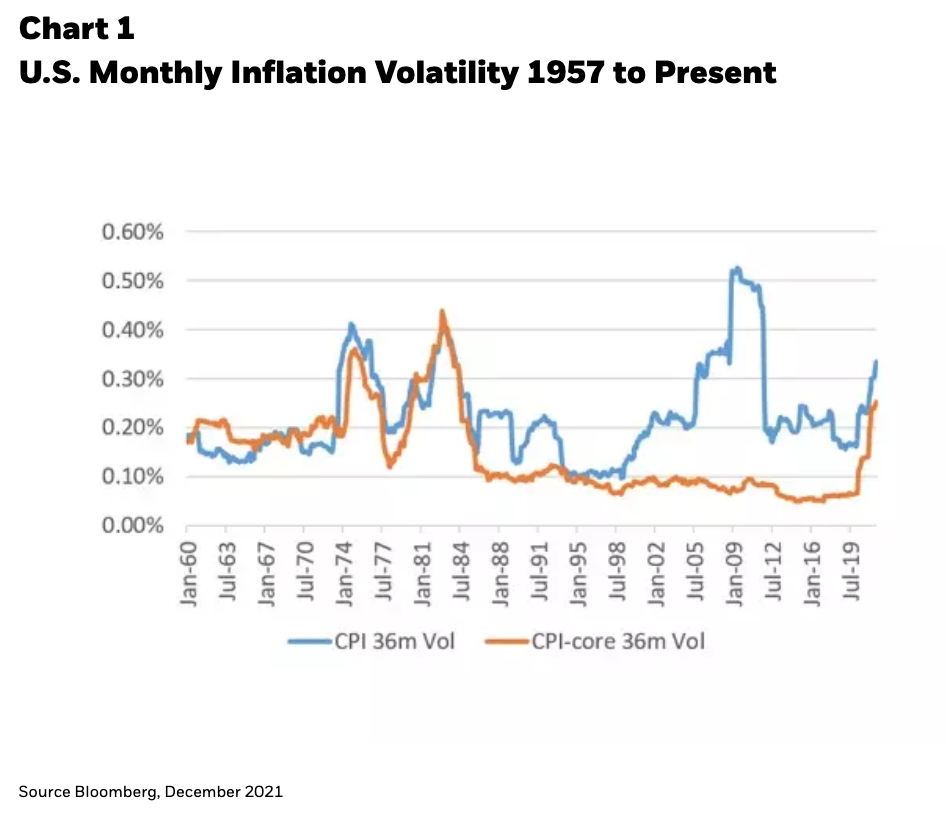

Not only is inflation higher, but it is also more volatile. During the “Great Moderation” of the last several decades, both growth and inflation remained low but stable. In the post-GFC period the standard deviation of monthly inflation readings was 0.07%, less than half the long-term average. Today, inflation volatility is at a multi-decade high and almost certain to continue to climb (see Chart 1).

While the link between market returns and inflation is less significant than many imagine, a more volatile inflation backdrop is a headwind when it comes to valuations. In the past, equity investors have been less willing to put a premium valuation on stocks when inflation volatility was elevated, as is the case today. And while historically low rates probably insulate stocks from significant multiple contraction, higher macro volatility will make higher valuations less likely.

Earnings carry the day

With multiple expansion harder to come by, earnings drive markets. We saw this dynamic play out in 2021; earnings, not multiples, were responsible for stock market performance. In this regime, the key will be finding industries and stocks that can use rising prices to their advantage.

Not surprisingly, the sectors with the best relative performance when inflation is accelerating are cyclicals, more specifically energy, material stocks and industrials. Interestingly, financials did not make the cut. One reason may be that while financials tend to outperform when rates are rising, as recent history has demonstrated, inflation and interest rates can diverge for extended periods.

Of the cyclical sectors where the relationship was significant, oil & exploration, metals & mining and transport were three of the industries that benefited the most from accelerating inflation. The take-away for investors is this: Inflation can be a headwind for the broader market, but it can also be a tailwind for the right stocks.

*****

Russ Koesterich

Russ Koesterich

Portfolio Manager

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.