by Don Vialoux, EquityClock.com

Hap Sneddon from CastleMoore on Market Call

Hap is available to answer your investment questions on BNNBloomberg’s Market Call today at 12:00 Noon

Technical Notes released yesterday at

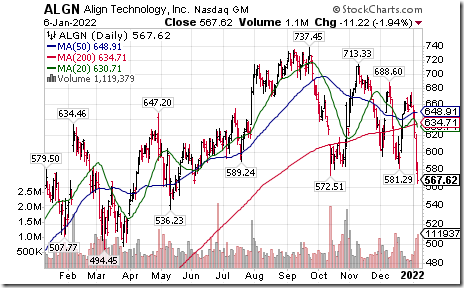

Align $ALGN moved below $572.51 extending an intermediate downtrend.

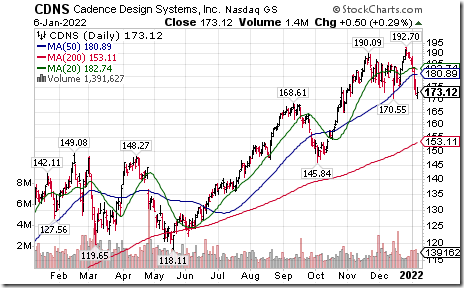

Cadence Design $CDNS a NASDAQ 100 stock moved below $170.55 completing a double top pattern.

The Technology sector ETF could fall an additional 6% and still maintain its trend of higher-highs and higher-lows. equityclock.com/2022/01/05/… $XLK $VGT $IYW $QQQ $COMPQ

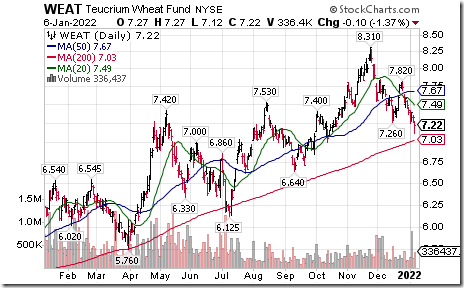

Wheat ETN $WEAT moved below $7.26 setting an intermediate downtrend.

Moderna $MRNA a NASDAQ 100 stock moved below $210.96 extending an intermediate downtrend.

IDEXX $IDXX a NASDAQ 100 stock moved below $575.59 extending an intermediate downtrend.

Blackrock $BLK an S&P 100 stock moved below $884.33 completing a double top pattern.

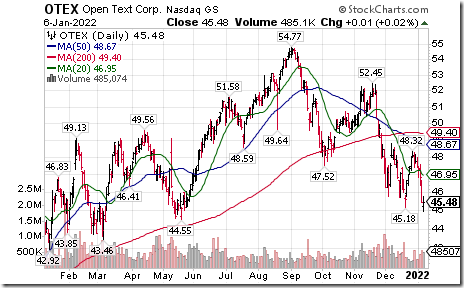

Open Text $OTEX a TSX 60 stock moved below US$45.18 extending an intermediate downtrend

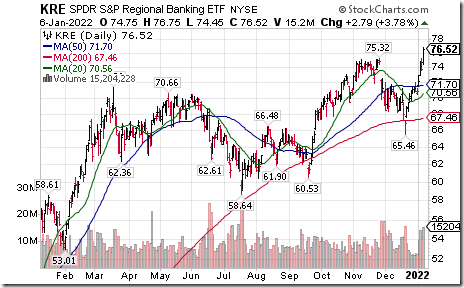

Regional Bank SPDRs $KRE moved above $75.32 extending an intermediate uptrend.

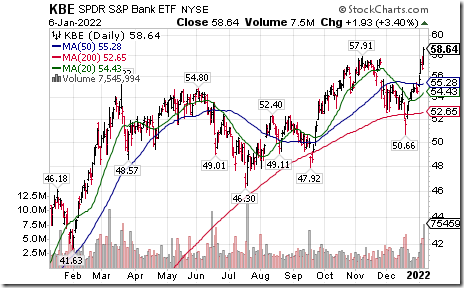

Major U.S. bank SPDRs $KBE moved above $57.91 to an all-time high extending an intermediate uptrend.

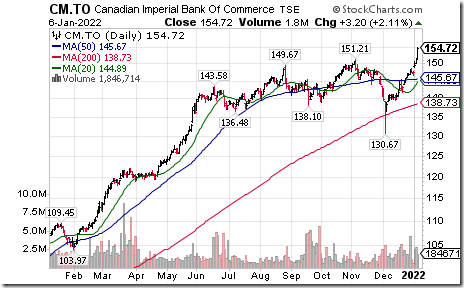

Commerce Bank $CM.CA a TSX 60 stock moved above $151.21 to an all-time high extending an intermediate uptrend.

Trader’s Corner

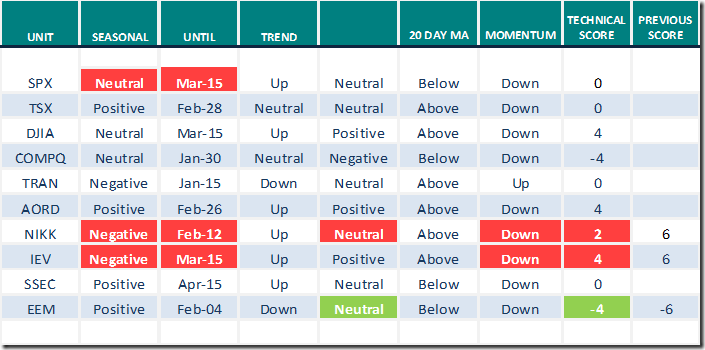

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.6th 2022

Green: Increase from previous day

Red: Decrease from previous day

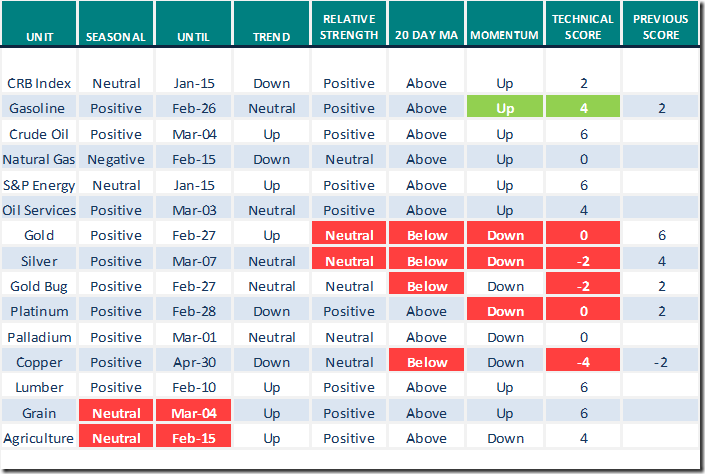

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.6th 2022

Green: Increase from previous day

Red: Decrease from previous day

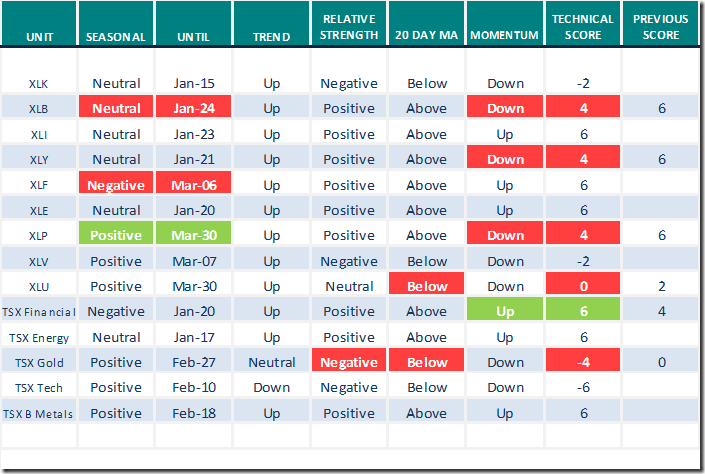

Sectors

Daily Seasonal/Technical Sector Trends for Jan.6th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Greg Schnell discusses “Goldilocks and The Three Bears

Goldilocks And The Three Bears | The Canadian Technician | StockCharts.com

Greg Schnell discuss “New Names Rotating into 2022”.

New Names Rotating Into 2022! | Greg Schnell, CMT | Market Buzz (01.05.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.20 to 67.94 yesterday. It remains Overbought and showing early signs of rolling over.

The long term Barometer slipped 1.40 to 71.14 yesterday. It remains Overbought and showing early signs of rolling over.

TSX Momentum Barometers

The intermediate term Barometer added 3.15 to 50.00 yesterday. It remains Neutral.

The long term Barometer was unchanged at 58.11 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.