by Don Vialoux, EquityClock.com

The Bottom Line

The Santa Claus rally continued last week in U.S., Far East, Emerging and European equity markets. On Thursday, the S&P 500 Index reached an all-time high at 4,808.93 and the Dow Jones Industrial Average reached an all-time high at 36,679.44. Historically, the Santa Claus rally has extended to the end of the first week in January.

Economic News This Week

December ISM Manufacturing PMI to be released at 10:00 AM EST on Tuesday is expected to slip to 60.2 from 61.1 in November.

December ISM Non-Manufacturing PMI to be released at 10:00 AM EST on Wednesday is expected to drop to 67.0 from 69.1 in November.

November U.S. Trade Balance to be released at 8:30 AM EST on Thursday is expected to increase to a deficit of $70.00 billion from a deficit of $67.10 billion in October.

November Canadian Trade Balance to be released at 8:30 AM EST on Thursday is expected to slip to a surplus of 2.06 billion from a surplus of $2.07 billion in October.

November Factory Orders to be released at 10:00 AM EST on Thursday are expected to increase 1.3% versus a gain of 1.0% in October.

December Non-farm Payrolls to be released at 8:30 AM EST on Friday is expected to increase 400,000 versus a gain of 210,000 in November. December Unemployment Rate is expected to remain unchanged from November at 6.0%. December Average Hourly Earnings are expected to increase 0.4% versus a gain of 0.3% in November.

December Canadian Employment to be released at 8:30 AM EST on Friday is expected to increase 27,500 versus a gain of 153,700 in November. The December Unemployment Rate is expected to remain unchanged from November at 6.0%.

Selected Earnings News This Week

Thursday: Constellation Brands, Walgreens Boots, ConAgra, Bed Bath & Beyond

Trader’s Corner

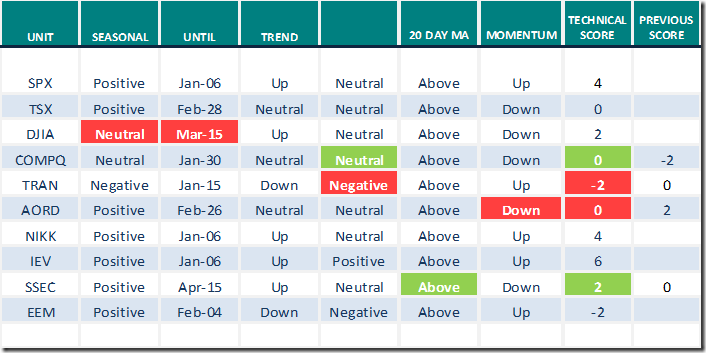

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

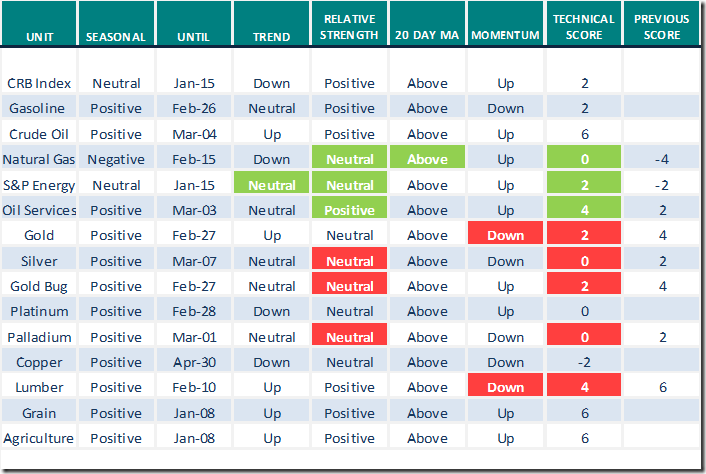

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

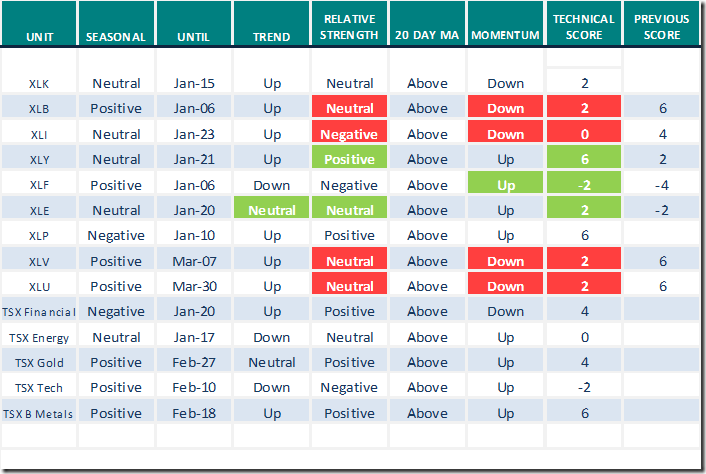

Sectors

Daily Seasonal/Technical Sector Trends for Jan.3rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Greg Schnell talks about”One of greatest rallies of all time”. Following is a link

One of the Greatest Rallies of All Time | The Canadian Technician | StockCharts.com

Mark Leibovit asks “Could first five days of January predict the entire year for stock markets”?

One of the Greatest Rallies of All Time | The Canadian Technician | StockCharts.com

Technical Notes released yesterday at

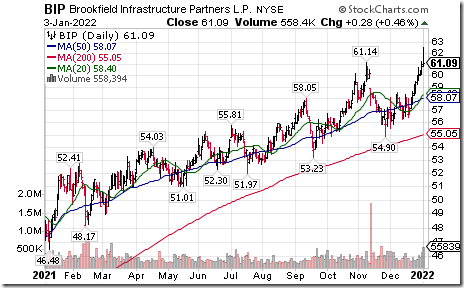

Brookfield Infrastructure $BIP a TSX 60 stock moved above US$61.14 extending an intermediate uptrend. Seasonal influences are favourable until at least mid-February and frequently to the end of March. If a subscriber to EquityClock, see seasonality chart at charts.equityclock.com/broo…

Apple $AAPL a Dow Jones Industrial Average stock moved above $182.13 to an all-time high extending an intermediate uptrend.

Dupont $DD an S&P 100 stock moved above $81.25 extending an intermediate uptrend.

Chevron $CVX an S&P 100 stock moved above $119.26 extending an intermediate uptrend.

Ford $F an S&P 100 stock moved above $21.49 extending an intermediate uptrend.

MasterCard $MA an S&P 100 stock moved above intermediate resistance at $371.13.

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.00 to 72.95 yesterday. It remains Overbought and trending higher.

The long term Barometer added 1.60 to 75.95 yesterday. It remained Overbought and trending higher.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.