When Value disappoints, markets are mad. When Growth disappoints, they are merciless.

Data through July 2021

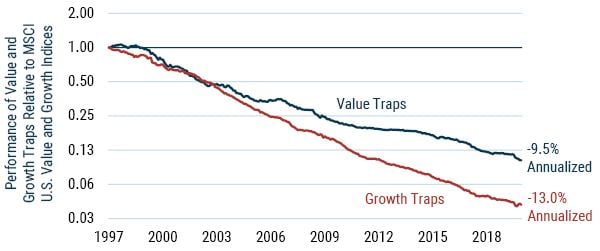

Capitalization weighted returns of growth and value traps against their relevant MSCI US style universes.

- Value traps are facts of life for value managers. A stock suffering from some temporary dark clouds appears temptingly cheap, and like the call of Sirens, it entices the intrepid Value manager. Alas, the company’s fundamentals disappoint yet again. It was a trap. The clouds were not temporary. And the market rightfully punishes the stock price further.

- Cautionary tales of Value traps are taught in finance texts around the world, and the term is a longstanding part of investment lexicon.

- Although most investors have never heard the term, “Growth traps” are even more insidious. The seduction is different, borne from grand narratives of disruptive technologies, hyper-growth, and breathtaking breakthroughs. But Growth stocks are no less prone to disappointment – there’s actually evidence they are slightly more likely to disappoint at certain points in the cycle1 – and their punishment can be even more dire.

- The chart above tracks a basket of Value and Growth trap stocks over 25 years.2 Value traps have underperformed their respective universe by a painful 9.5% per year. Growth traps have underperformed by an excruciating 13.0% per year.

- This makes sense: Growth stocks have lofty investor expectations, so when they fail to deliver, investors are merciless. Managers who get fooled are more likely to blow that name out of the portfolio, which is part of the reason we don’t hear much about them. Unfortunately, by then the damage is already done, and history shows there is a 30% to 40% chance that the stock will be replaced with yet another trap.3

- Why shine a light on growth traps today? Growth stocks around the world are priced with exceedingly high expectations.4 Recent names that have disappointed have been mercilessly repriced. What can you do about it? Lots. We’ve built a globally diversified short basket of stocks (part of a long-short strategy called Equity Dislocation) that is chock-full of candidates we believe are likely to fall short of the unrealistic expectations implied by their valuations. We have other strategies that can exploit this phenomenon in a multi-asset framework. Maintaining a Quality bias at a reasonable price is yet another way to play this. No matter, there are ways to navigate these dangerous waters.

Download article here.

Copyright © GMO Asset Allocation Team