by Don Vialoux, EquityClock.com

“You are never to old to set a new goal, or to dream a new dream.”

C.S. Lewis

Holiday Schedule

U.S. and Canadian equity markets are open tomorrow, closed on Monday and resume trading on Tuesday. Tech Talk reports also will appear tomorrow and will resume on Tuesday.

Technical Notes released yesterday at

Dow Jones Industrial Average $INDU closed at an all-time closing high, slightly higher than its previous record at 36,432.22 and slightly below its inter-day all-time high at 36,565.73.

Union Pacific $UNP an S&P 100 stock moved above $248.75 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/union-pacific-corporation-nyseunp-seasonal-chart

Agriculture iShares $COW.CA moved above Cdn$63.21 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to late February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/ishares-global-agriculture-index-etf-tsecow-to-seasonal-chart

Restaurant Brands International $QSR.CA a TSX 60 stock moved above Cdn$75.93 extending an intermediate uptrend. Seasonal influences are favourable to the end of February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/restaurant-brands-international-inc-tseqsr-to-seasonal-chart

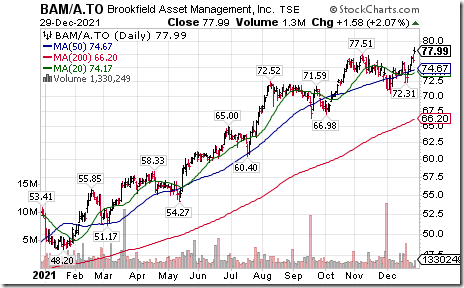

Brookfield Asset Management $BAM.A.CA a TSX 60 stock moved above Cdn$77.51 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to the end of February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/brookfield-asset-management-inc-seasonal-chart

Brookfield Infrastructure $BIP.UN.CA a TSX 60 stock moved above $76.24 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to early March. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/brookfield-infrastructure-partners-tsebipun-seasonal-chart

Interfor $IFP.CA moved above Cdn$38.50 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to at least mid-February and frequently to early April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/interfor-corp-tseifp-seasonal-chart

Trader’s Corner

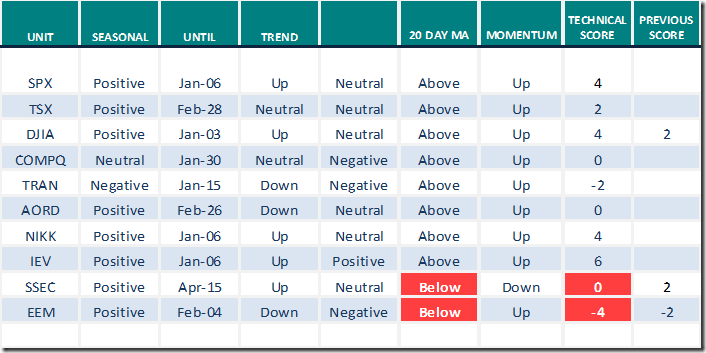

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.29th 2021

Green: Increase from previous day

Red: Decrease from previous day

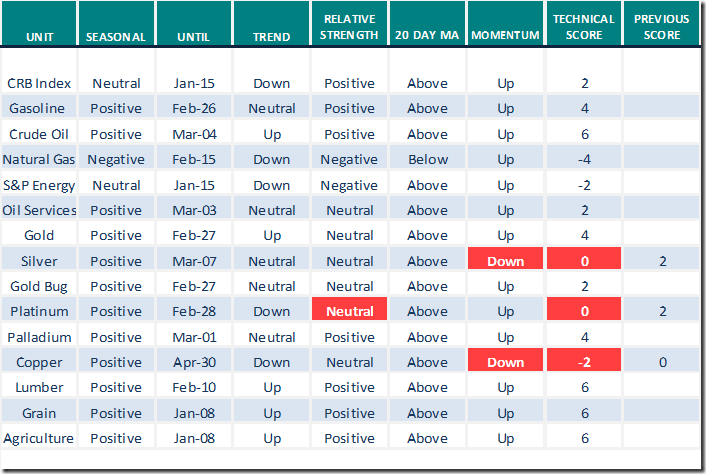

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.29th 2021

Green: Increase from previous day

Red: Decrease from previous day

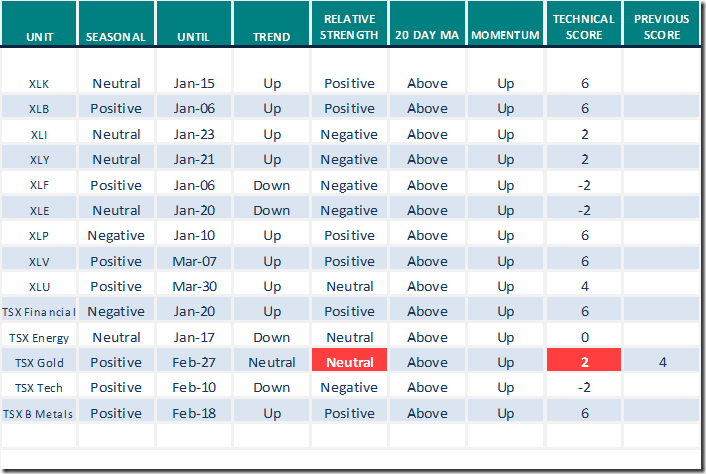

Sectors

Daily Seasonal/Technical Sector Trends for Dec.29th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from Valued Provider

David Keller from www.StockCharts.com comments on “Ten questions to ask yourself at year end” Following is a link:

Ten Questions To Ask Yourself At Year End | David Keller, CMT | The Final Bar (12.27.21) – YouTube

Watching currencies

The Euro is forming a possible intermediate base building pattern that is completed on a move above 113.83. Daily momentum indicators (Stochastics, RSI, MACD) have turned higher.

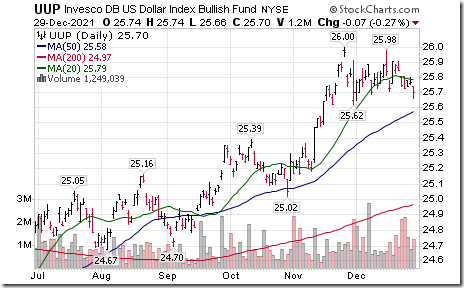

The U.S. Dollar Index and its related ETN are forming a possible double top pattern that is completed on a move below $25.62 by the ETN and by 95.54 by the Index. Daily momentum indicators (Stochastics, RSI, MACD) have turned lower.

Trading activity in currency markets this week is notoriously below average. However, a breakout by the Euro and/ or a breakdown by the U.S. Dollar, if it happens, will attract significant attention by technical traders. Strongest responses will occur in commodity prices, notably gold.

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 to 71.54 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 0.23 to 74.35 yesterday. It remains Overbought. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 3.74 to 50.00 yesterday. It remains Neutral. Trend remains up.

The long term Barometer added 0.71 to 61.50 yesterday. It remains Overbought. Trend remains up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.