by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

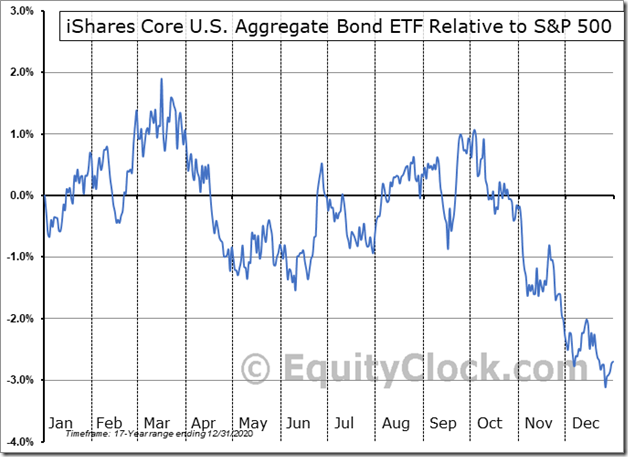

Reallocating the portfolio in stocks, commodities, and bonds for the Santa Claus Rally. equityclock.com/2021/12/22/… $AGG $GSG $SLV $GLD $SPY $MSFT $AAPL $FB $AMZN $NFLX $GOOGL

Canadian Financials iShares $XFN.CA moved above $50.43 to an all-time high extending an intermediate uptrend.

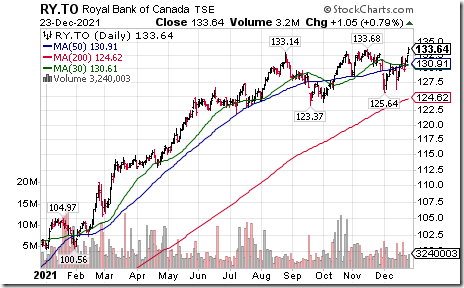

Royal Bank $RY.CA a TSX 60 stock moved above Cdn$133.68 to an all-time high extending an intermediate uptrend.

Couche Tard $ATD.CA a TSX 60 stock moved above $52.89 to an all-time high extending an intermediate uptrend.

West Fraser Timber $WFG.CA moved above $114.37 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable on a real and relative basis to the end of February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/west-fraser-timber-co-ltd-tsewfg-to-seasonal-chart

VeriSign $VRSN a NASDAQ 100 stock moved above $248.22 to an all-time high extending an intermediate uptrend.

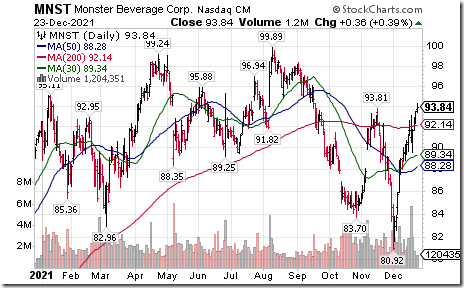

Monster Beverages $MNST a NASDAQ 100 stock moved above intermediate resistance at $93.81. Seasonal influences are favourable on a real and relative basis to next June. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/monster-beverage-corp-nasdmnst-seasonal-chart

Corn ETN $CORN moved above $21.99 extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable until at least mid-March. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/corn-futures-c-seasonal-chart

S&P 500 Index closed at a new all-time closing high at 4725.79.

Global Base Metals iShares $XBM.CA moved above $19.19 resuming an intermediate uptrend. Seasonal influences are strongly favourable on a real and relative basis between now and the third week in February. If a subscriber to EquityClock, see seasonality chart at

https://charts.equityclock.com/ishares-sptsx-global-base-metals-index-etf-tsexbm-to-seasonal-chart

Trader’s Corner

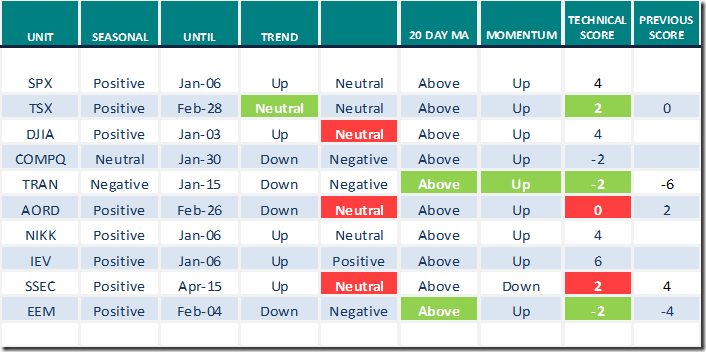

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

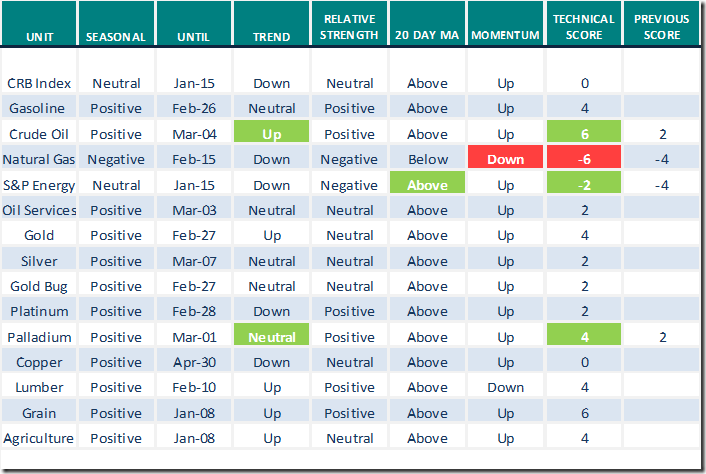

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

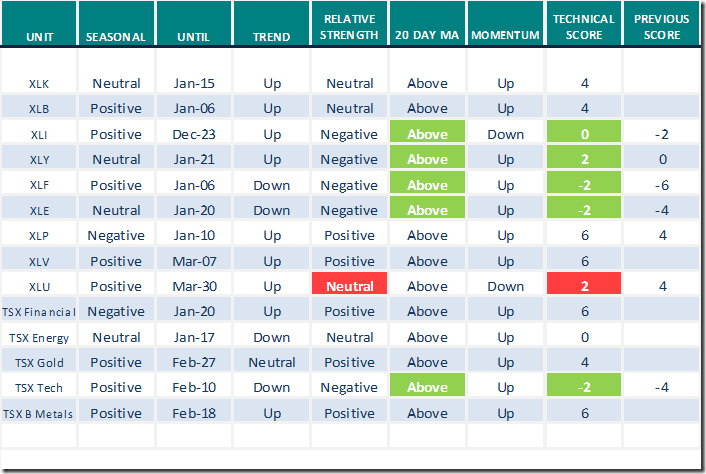

Sectors

Daily Seasonal/Technical Sector Trends for Dec.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Links offered by valued providers

Greg Schnell reviews “The roaring 20s: 2021 influential events”.

One of the biggest events of the year happened on the Nasdaq Exchange. Greg rolls through how this massive event came to be, how it rolled through the investing community and how things are setup to evolve in 2022. Following is a link:

The Roaring Twenties | Greg Schnell | 2021 Influential Events – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.61 to 61.92 yesterday. It changed from Neutral to Overbought on a move above 60.00. Trend remains up.

The long term Barometer added 2.81 to 71.14 yesterday. It remains Overbought. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 3.37 to 45.37 yesterday. It remains Neutral. Trend remains up.

The long term Barometer gained 5.09 to 60.79 yesterday. It changed from Neutral to Overbought on a move above 60.00. Trend remains up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.