by Don Vialoux, EquityClock.com

Holiday Schedule

Tech Talk will appear tomorrow and Monday. Toronto Exchange closes tomorrow at 12:50 PM EST and is closed on Monday and Tuesday. The New York Stock Exchange and NASDAQ Exchanges are open today, but the bond market is closed at 2:00 PM EST. Both exchanges are closed on Friday and are open on Monday and Tuesday.

Technical Notes released yesterday at

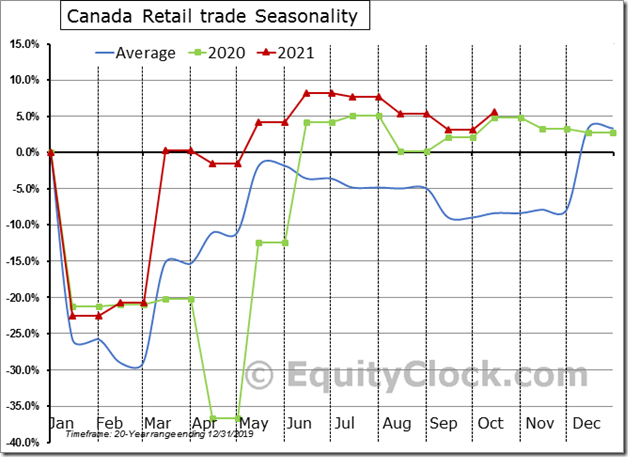

The year-to-date change of retail sales in Canada remains record setting, but comparisons are going to be tough to match in the year ahead, potentially resulting in sluggish equity market performance through the first half of 2022. $STUDY $MACRO #CDNecon #CAD #Retail

Reopening plays snap-back as we prepare for the Santa Claus rally. equityclock.com/2021/12/21/… $JETS $PEJ $XLE $XRT $XLY $STUDY

Grain ETN (Corn, Soybeans, Wheat) $JJGTF moved above $30.01 resuming an intermediate uptrend.

Paychex $PAYX a NASDAQ 100 stock moved above $126.82 to an all-time high extending an intermediate uptrend.

Imperial Oil $IMO.CA a TSX 60 stock moved above $45.20 and $45.32 extending an intermediate uptrend. Seasonal influences are favourable to the first week in March. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/imperial-oil-limited-tseimo-seasonal-chart

Trader’s Corner

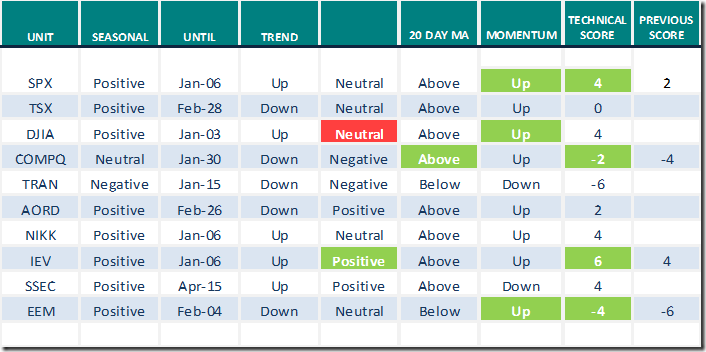

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

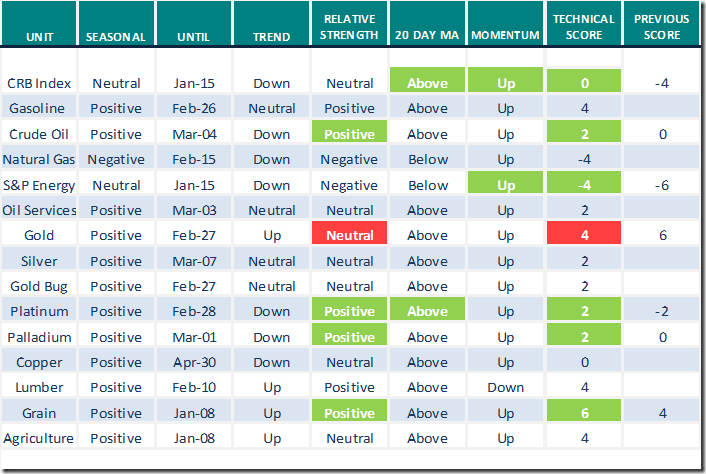

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

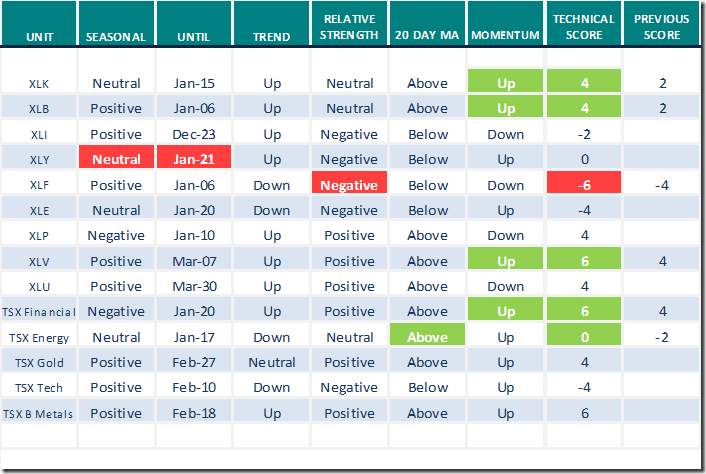

Sectors

Daily Seasonal/Technical Sector Trends for Dec.22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Links offered by valued providers

Greg Schnell discusses “A bizarre oil market”

The Bizarre Oil Market | Greg Schnell, CMT | Market Buzz (08.11.21) – YouTube

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following:

Six Best Cloud Computing Stocks to Buy Now – Uncommon Sense Investor

17 Questions to Ask Yourself – Uncommon Sense Investor

Be Your Own Investment Composer & Beware Foolish Advice – Uncommon Sense Investor

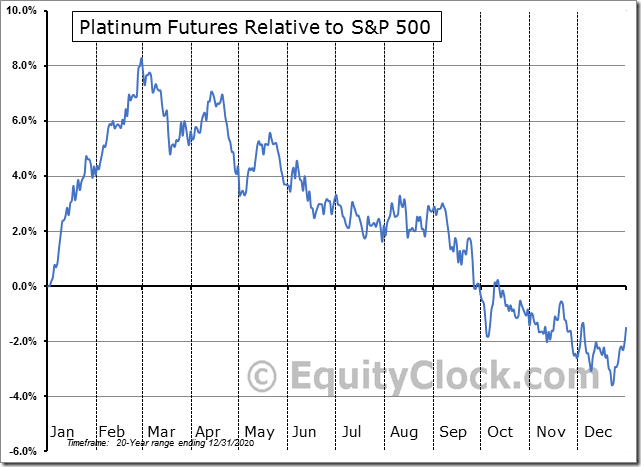

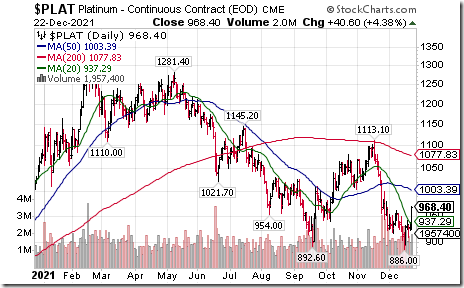

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences on a real and relative basis for Platinum Futures and related ETN, PPLT are favourable between now and the end of February.

Technicals have started to improve just as seasonal influences turn favourable. Yesterday, strength relative to the S&P 500 Index changed from Neutral to Positive, futures moved above their 20 day moving average and short term momentum indicators moved higher.

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.81 to 57.31 yesterday. It remains Neutral.

The long term Barometer added 0.40 to 68.34 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate Barometer advanced 6.85 to 42.01 yesterday. It changed from Oversold to Neutral on a move above 40.00 and is trending higher.

The long term Barometer added 2.28 to 55.71 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.