by Vaibhav Tandon, Senior Economist, Northern Trust

This week’s Federal Reserve meeting got substantial amounts of attention from markets. But the European Central Bank (ECB) and the Bank of England (BoE) also reached conclusions this week. One remained patient, while the other ran out of patience.

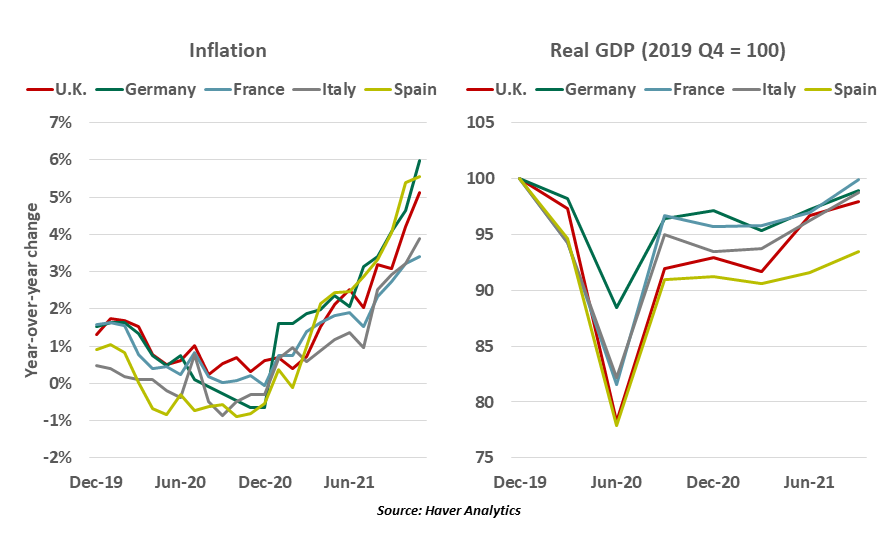

The debate over inflation has been heating up in Europe. Economic recovery has gathered steam during the second half of this year, leading inflation well above the central banks’ targets. Forecasts do not anticipate that inflation is likely to recede very soon.

The BoE was expected to be the first major central bank to raise interest rates. Prices are rising more rapidly in Britain than they are in other parts of Europe. While supply disruption is an inflationary force for all economies, Brexit has been a further complication for the U.K. Since leaving the common market, the U.K. has endured significant disruptions to flows of goods and people, leading to delays and shortages. Conditions seemed ripe for a December hike, until the Omicron variant led to more infections, fresh restrictions, and greater uncertainty.

The Bank of England has consistently struggled to give clear signals and follow through on them. After raising expectations for a hike in November, the bank surprised markets by not raising rates, pinning a dovish policy twist to an expected easing of supply blockages. Again in December, the BoE surprised its observers, by opting to hike the bank rate by 15 bps to 0.25%, even as the sweeping Omicron variant threatens to put the economy into reverse. Looking ahead, progress against the pandemic and trade relations with Europe will guide the pace of tightening. We now expect two more hikes next year.

For the ECB, policy making has been much more complicated. Structural headwinds differ among member states, and ECB members have differences of opinion about its use of unorthodox monetary policies. With inflation surging to record highs in member states like Germany (at 6%, the highest in three decades), clamor for tighter policy has been growing. At the same time, industrial economies like Germany are also struggling to cope with supply chain challenges. The Delta variant has been wreaking havoc in Europe, and the Omicron threat is real.

High inflation warranted scaling back policy support provided by the BoE and the ECB.

Against this backdrop, this week’s ECB meeting didn’t deliver any surprises. The ECB maintained that current price surges are largely transitory. It called time on the Pandemic Emergency Purchase Program (PEPP), but agreed to a temporary lift to asset purchases under the Asset Purchase Program (APP) to smooth the transition.

The ECB does not want to repeat its mistakes in the last cycle, prematurely tightening monetary policy and stalling the recovery. Rate hikes are years away. That said, playing a patient game also risks reacting too slowly to rising inflationary pressures. Some of the increases do seem more than transitory: producer prices in Germany, Spain and Italy are rising at over 20% on a year-over-year basis.

Continued recovery and surging inflation justify the withdrawal of some policy support, but two-sided uncertainty means that Europe’s leading central banks will have to proceed with extra care.

Don’t miss our latest insights:

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.