by Don Vialoux, EquityClock.com

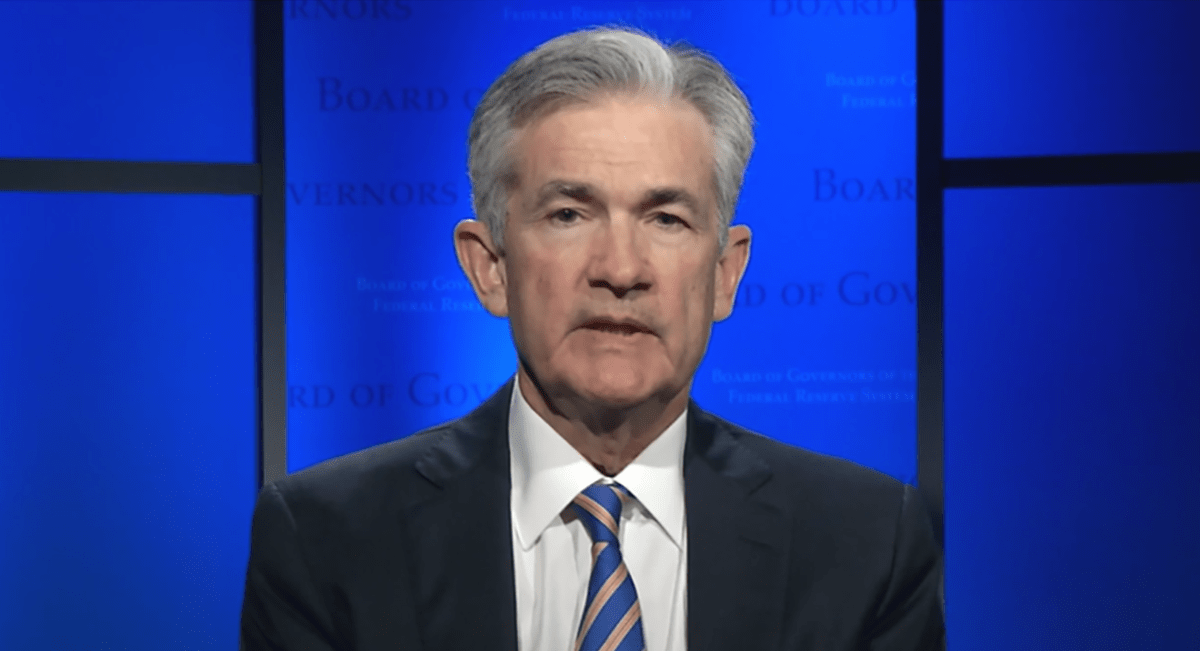

Responses to the FOMC decision at 2:00 PM EST yesterday.

The Fed maintained the Fed Fund rate at 0.00%-0.25%, but increased their monthly tapering from $15 billion to $30 billion. End of tapering changed from the end of June to the end of March. The announcement was in line with consensus. Reponses were as follows:

S&P 500 Index ($SPX) moved higher

Editor’s Note: The Index closed 3 points below its all-time closing high.

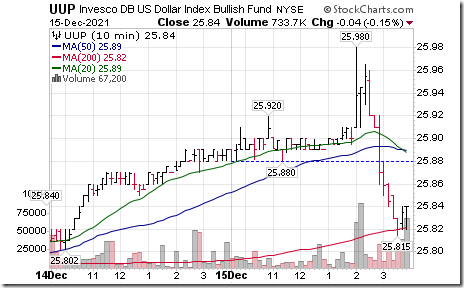

U.S. Dollar ETN (UUP) moved lower

10 year Treasury Bond Yield was mixed

Industrial commodity prices (GSG) moved slightly higher

Crude oil prices moved higher

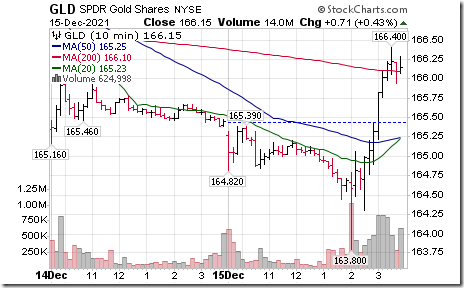

Spot Gold and Silver bullion ETNs moved higher

Precious metal stocks and ETFs (GDX) moved higher

U.S. Financials ETFs (KBE) were mixed.

Technical Notes released to 2:00 PM EST yesterday at

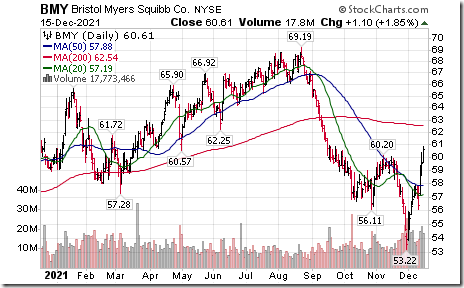

Bristol-Myers $BMY an S&P 100 stock moved above intermediate resistance at $60.20.

Platinum ETN $PPLT moved below $84.50 extending an intermediate downtrend.

Silver equities remain under technical pressure partially due to year end tax loss selling. Pan American Silver $PAAS moved below $22.19 extending an intermediate downtrend.

TCOM $TCOM a NASDAQ 100 stock moved below $23.61 extending an intermediate downtrend.

Berkshire Hathaway $BRK.B an S&P 100 stock moved above $295.65 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to mid-March. If a subscriber to EquityClock, see seasonality chart at :charts.equityclock.com/seas…

Cerner $CERN a NASDAQ 100 stock moved above intermediate resistance at $76.27.

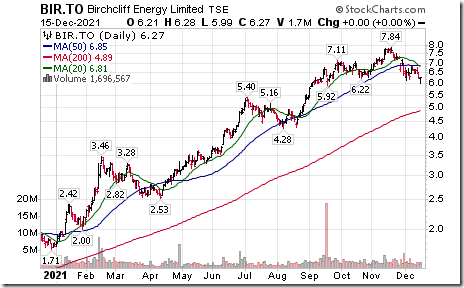

Birchcliffe Energy $BIR.CA a "gassy" Canadian energy stock moved below $6.22 and $6.13 completing a Head & Shoulders pattern.

Technical Notes recorded after 2:00 PM EST Yesterday

Amgen $AMGN an S&P 100 stock moved above $217.43 completing a double bottom pattern.

Cisco $CSCO a Dpw Jones Industrial Average stock moved above $59.87 to an all-time high extending an intermediate uptrend. Seasonal influences are strongly favourable to mid-January. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/cisco-systems-inc-nasdaqcsco-seasonal-chart

Incyte $INCY a NASDAQ 100 stock moved above $71.85 completing a base building pattern. Season influences are strongly positive to the end of January. If an EquityClock subscriber, see seasonality chart at: https://charts.equityclock.com/incyte-corp-nasdincy-seasonal-chart

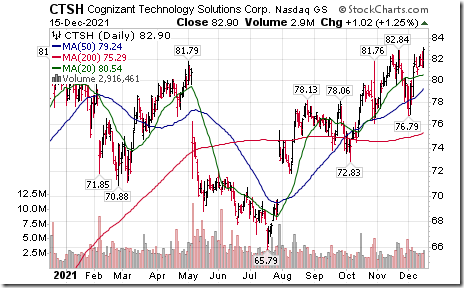

Cognizant $CTSH a NASDAQ 100 stock moved above $82.84 to an all-time high extending an intermediate uptrend. Seasonal influences are strongly positive to the end of February. If a subscriber to EquityClock, see seasonality chart at: https://charts.equityclock.com/cognizant-technology-solutions-corp-nasdaqctsh-seasonal-chart

Eli Lilly $LLY an S&P 100 stock moved above $274.98 to an all-time high extending an intermediate uptrend.

Nutrient $NTR.CA a TSX 60 stock moved above Cdn$91.15 to a multi-year high extending an intermediate uptrend. Seasonal influences are strongly positive to the end of February. If an EquityClock subscriber, see seasonality chart at: https://charts.equityclock.com/nutrien-ltd-tsentr-to-seasonal-chart

Trader’s Corner

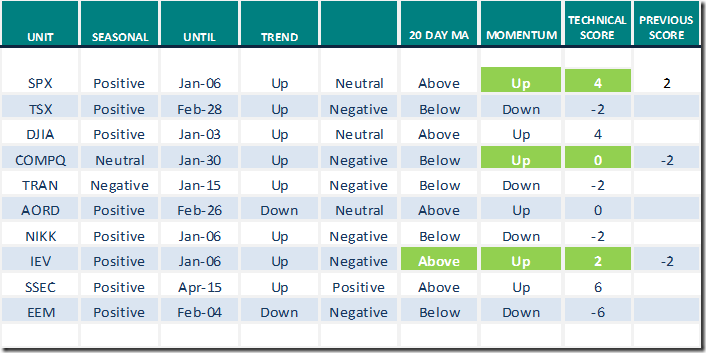

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.15th 2021

Green: Increase from previous day

Red: Decrease from previous day

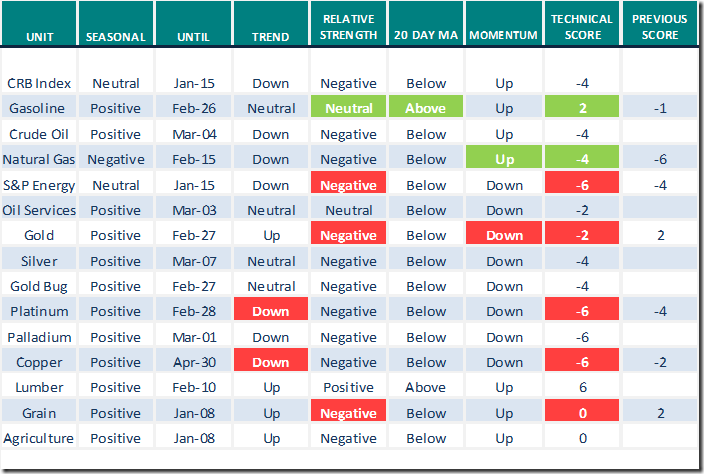

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.15th 2021

Green: Increase from previous day

Red: Decrease from previous day

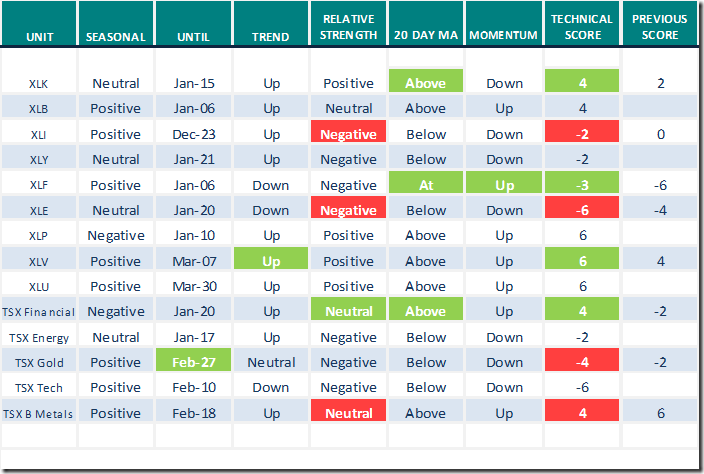

Sectors

Daily Seasonal/Technical Sector Trends for Dec.15th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Links offered by valued providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following link:

Top 10 Analyst-Ranked Dow Jones Stocks – Uncommon Sense Investor

Market Buzz by Greg Schnell

https://www.youtube.com/watch?v=wliA7ztRmu8

The Canadian Technician by Greg Schnell

Two Forces at Play | The Canadian Technician | StockCharts.com

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.21 to 55.11 yesterday. It remains Neutral.

The long term Barometer gained 1.20 to 69.54 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 1.70 to 30.73 yesterday. It remains Oversold.

The long term Barometer slipped 0.23 to 50.00 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.