by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

CVS Health $CVS an S&P 100 stock moved above $96.57 to an all-time high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to mid-May. If a subscriber to EquityClock, see: https://charts.equityclock.com/cvs-caremark-corporation-nysecvs-seasonal-chart

Couche Tard $ATD.CA a TSX 60 stock moved above Cdn$52.30 to an all-time high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to the beginning of March. If a subscriber to EquityClock, see: https://charts.equityclock.com/alimentation-couche-tard-inc-tseatd-b-seasonal-chart

Trader’s Corner

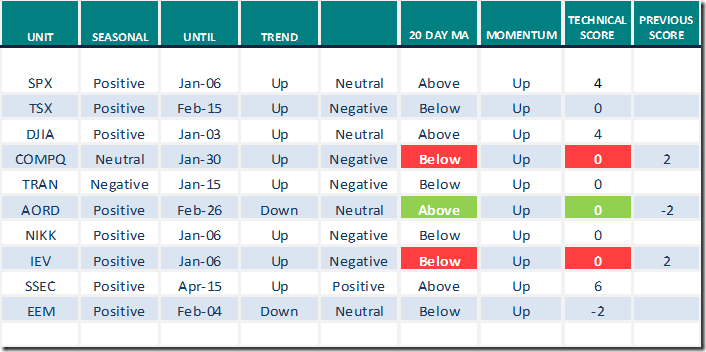

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.9th 2021

Green: Increase from previous day

Red: Decrease from previous day

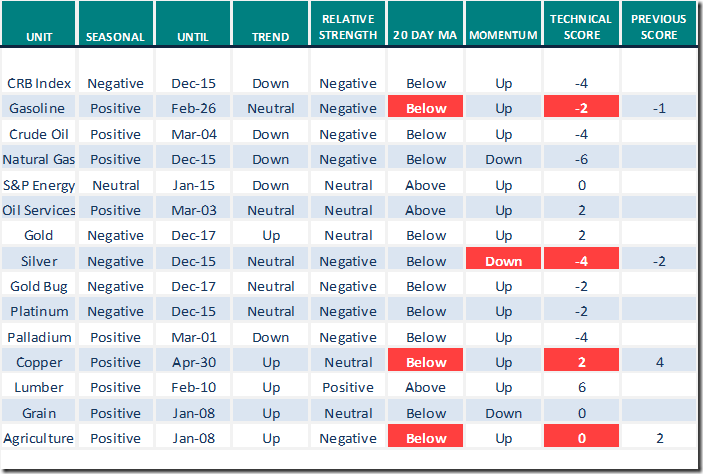

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.9th 2021

Green: Increase from previous day

Red: Decrease from previous day

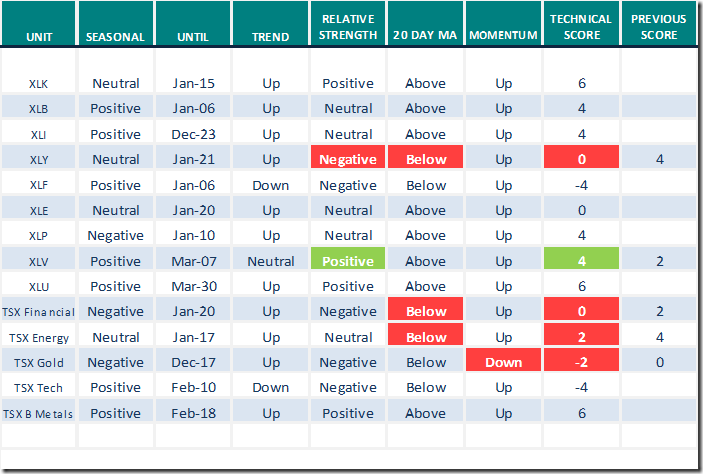

Sectors

Daily Seasonal/Technical Sector Trends for Dec.9th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

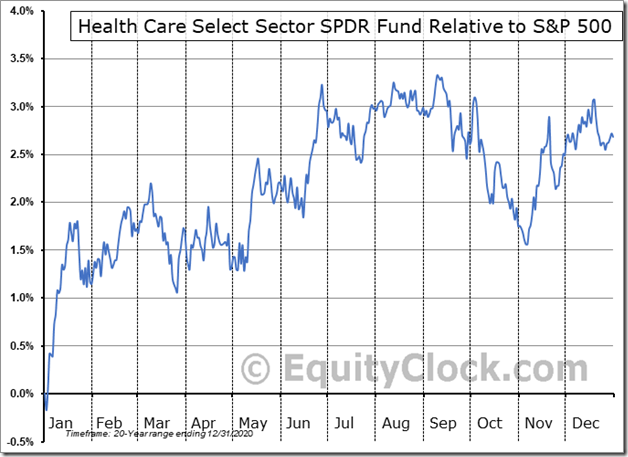

Seasonality Chart of the Day from www.EquityClock.com

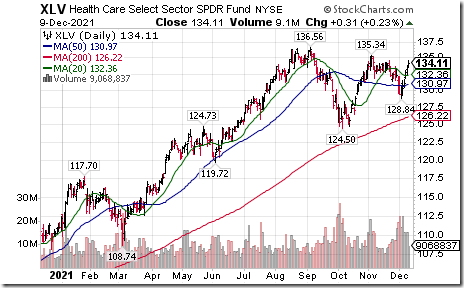

Seasonal influences on a real and relative basis for U.S. Healthcare SPDRs are favourable to mid-January in anticipation of good news at the annual JP Morgan Healthcare conference in San Francisco. The 2022 conference is held between January 10th and January 13th .

Units have a positive technical profile. Intermediate trend is neutral, but units recently moved above their 20 and 50 day moving average and daily momentum indicators (Stochastics, RSI, MACD are trending higher. Yesterday, units began to outperform the S&P 500 Index. A move above $135.34 and $136.56 will attract technical buying.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 5.61 to 58.12 yesterday. It changed from Overbought to Neutral on a drop below 60.00.

The long term Barometer eased 0.60 to 69.94 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 1.84 to 39.17 yesterday. It changed from Neutral to Oversold on a move below 40.00.

The long term Barometer dropped 4.15 to 53.00 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.