by Ido Cohen, Senior Portfolio Manager, Invesco Canada

Senior Portfolio Manager Ido Cohen1 discusses the impact of online shopping, COVID-19, inflation and supply chain disruptions on this year’s holiday shopping season, and where his team is seeing opportunities in the consumer sector.

Black Friday was once considered to be the beginning of the U.S. holiday shopping season. Scheduled on the day after Thanksgiving, many people would swap family time for long lines at the mall, as retailers pulled out all the stops to entice shoppers into their stores. This usually translated into a day of big discounts and heavy foot traffic for brick-and-mortar stores.

While few countries celebrate Thanksgiving, Black Friday has since been adopted in many other parts of the world. In the early noughties, Canadians used to flock across the border to nab great deals, but retailers at home soon ran discounts of their own. Online retailers then introduced the concept of Black Friday – and its newer cousin Cyber Monday – to more distant places across the globe.

As investors in the consumer sector, we understand the frenzy around these ‘shopping holidays’ very well. However, even though such events can provide short-term tailwinds for many retailers, they have little impact on our investment decisions. Our aim is to find companies that are well-positioned to benefit from secular changes in consumer behaviour. Some of them may well be crowned the winners of this year’s Black Friday, but the truth is they’ve been winning the retail game for some time now, because the world is becoming increasingly connected.

Online shopping will continue to take share

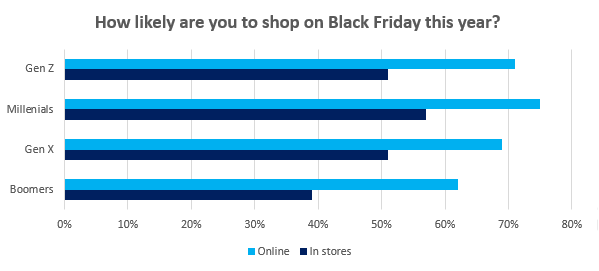

We believe that eCommerce will continue to take share from traditional brick-and-mortar retail and that the magnitude of that share shift is still underappreciated. We only have to look at how consumers plan to shop on Black Friday this year to see this trend – while 52% of surveyed shoppers from key economies have shown interest in shopping inside stores, more of them (71%) have indicated they’re likely to shop online instead. What’s more, the trend remains the same, even after dividing the survey results by age group (Figure 1).2

Figure 1: Black Friday shopping intent 2021

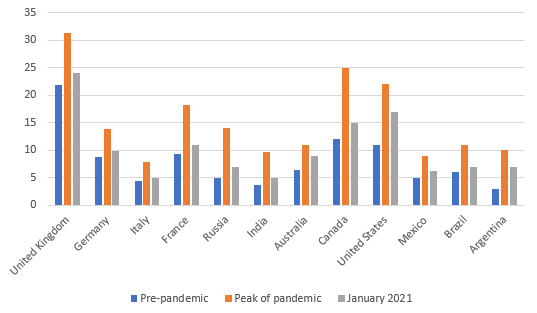

In our view, companies that rely heavily on brick-and-mortar presence and mall foot traffic for sales, but lack presence on large eCommerce platforms, are ultimately swimming against the tide, as consumers shift an ever-larger share of their spending to eCommerce. Covid-19 has only served to accelerate this move. Many people have had to shift their shopping online during the pandemic, and we expect that some of them will have become ‘sticky customers’ (Figure 2).

Figure 2: eCommerce share of retail sales before and after Covid-19

There are numerous tailwinds on the horizon for eCommerce. There are large retail categories to attack (such as food and consumables, auto and luxury goods), while improving user interfaces and rapidly evolving fulfilment networks could make ordering online feel even more seamless than it does now.

Can inflation pressures dampen the holidays?

Due to pandemic-related supply-chain shortages across a range of products and inputs, shipping bottlenecks and higher commodity prices, this holiday shopping season is likely to see continued inflation pressures.

History tells us that inflation disproportionally hits lower-income consumers the most. They spend a large amount of their earnings on essentials, such as food and energy, and the current spike in inflation may feel like a double blow to some of them: food and energy prices have risen just in time for the cold winter season, while much of their savings may have sadly been eroded by the pandemic.

However, there’s also strong pent-up demand from other consumers. Prior to the pandemic, these consumers would have spent some of their income on overseas travel, upmarket clothes or live entertainment. As this type of expenditure may have been curtailed or deemed unnecessary during the pandemic, these consumers now have significant excess savings estimated to be at least $5.6 trillion USD globally, and $2.6 trillion USD in the U.S. alone.3 A release of this savings could spur inflation further, but it also tells us that there’s still a lot of scope from a consumer demand perspective, regardless of inflation.

Finding opportunities in a world running out of things

Supply disruption inevitably favour eCommerce platforms to brick-and-mortar retailers. Quite frankly, eCommerce platforms are experts at sourcing products and getting them to the consumers that want them. Recommendation engines that help consumers find substitutes for out-of-inventory items should also see more demand due to supply disruptions than brick-and-mortar stores.

The areas we think are vulnerable to supply disruptions (and hence inflation) include auto, apparel, and durable goods. But given the transitory nature of many of these disruptions, we’re watching these areas closely for potential opportunities.

In-person events, movies and travel are still recovering from Covid-19 headwinds. However, they have little exposure to supply-chain disruption and many currently have excess capacity to offer consumers returning to these activities as economies reopen.

Meanwhile, in the gaming space, while new consoles from Microsoft’s Xbox and Sony’s PlayStation are still hard to obtain, the software downloads (i.e. video games) are not subject to supply-chain disruptions, and these tend to be the key drivers of revenue in the space.

To recap, we believe that consumer demand remains very strong. In aggregate, consumer spending power appears to be elevated, given the high excess savings and low debt levels. We’re quite bullish on the consumer’s ability to spend through 2022 even as GDP growth slows. Eventually, we believe the consumer may return to favouring ‘experiences’ over ‘things’ as the re-opening continues and the threat of the pandemic is reduced.

1 Ido Cohen is Senior Portfolio Manager for Invesco large-cap growth equity strategies and is the Lead Manager for Invesco consumer trends products.

2 Source: Criteo. Black Friday 2021: Consumer Survey Insights.

3 Source: Moody’s Analytics and Bloomberg as at November 4, 2021.

This post was first published at the official blog of Invesco Canada.