by Howard Marks, Oaktree Capital

The last 20 months have been a most unusual period, thanks primarily to the pandemic, yet many things feel like they haven’t changed over that time span. Each day seems like all the others. Nancy and I mostly stay home and deal with email and Zoom calls – whether relating to work matters or grandchildren. Weekdays don’t feel that different from weekends (this was especially true pre-vaccine, when we rarely ate out or visited others). We’ve had only one one-week vacation in two years. The best way to sum it up is through a comparison to Groundhog Day: every day feels a lot like the day before.

What has changed in our environment in the last 12 months? We’ve seen an election and change of president, as well as increased sensitivity on issues of race, inequality and climate change – but so far with few tangible results. Fortunately, vaccines were developed, approved and distributed. Thus, Covid-19 subsided, but there was a reemergence spurred by the Delta variant, and there might be more.

In the business world, there’s little that’s new:

-

The economic resurgence that began in the third quarter of 2020 – with the greatest quarterly GDP gain in U.S. history – remains underway.

-

The securities markets, which began to rally in March 2020, have continued to rise.

-

Worry about rising inflation has turned out to be well founded thus far, but there is still no consensus as to its primary cause (Federal Reserve policy or supply chain/labor market bottlenecks?) or whether it will prove transitory or long-lasting.

All three of the conditions listed above were present months ago, and they’re little changed today. Thus, in the investment environment, it’s still Groundhog Day. Yet there are changes taking place, and they’ll be the subject of this memo. My focus isn’t the “little macro” changes, like what will happen to GDP, inflation and interest rates next year, but rather the “big macro” changes that will have an impact on our lives for many years. Many aren’t actionable today, but that doesn’t mean we shouldn’t bear them in mind.

The Changing Environment for Investing

As I’ve written before, the world I remember of 50, 60 and 70 years ago was a pretty static place. Things didn’t seem to change very much or very fast. The homes, cars, reading matter, business technology and general environment of 1970 weren’t very different from those of 1950. We were entertained by broadcast TV and radio, drove gasoline-powered cars dependent on carburetors, did most calculations on paper, composed documents on typewriters (with copies made using carbon paper), communicated via letters and phone calls, and got information primarily from books housed in libraries. The four-function calculator, personal computer, cellular phone, email and Internet didn’t yet exist, and some of them wouldn’t for a good while longer. I describe this environment as a mostly unchanging backdrop – I think of it as scenery in the theater – in front of which events and cycles played out.

One of the biggest changes that did take place in the 1960s was the emergence of “growth investing” via fast-growing companies, many of which were quite new. The “Nifty Fifty” I talk about so much ruled the stock market in the late 1960s: this group included office equipment manufacturers IBM and Xerox, photography titans Kodak and Polaroid, drug companies like Merck and Eli Lilly, tech companies including Hewlett Packard and Texas Instruments, and advanced marketing/consumer goods companies such as Coca-Cola and Avon.

These companies’ stocks carried very high price/earnings ratios, reaching up to 80 and 90. Obviously, investors should only pay multiples like these (if ever) if they’re sure the companies will be preeminent for decades to come. And investors were sure. In fact, it was widely believed that nothing bad could happen to these companies and they could never be disrupted. This was one of post-war America’s first major brushes with newness and – in a good example of illogicality – investors embraced these companies, with their revolutionary newness, but somehow assumed that a newer and better new thing could never come along to displace them.

Of course, those investors were riding for a fall. If you bought the stocks of “the greatest companies in America” when I started working in 1969, and held them steadfastly for five years, you lost almost all your money. The first reason is that the multiples in the late 1960s were far too high, and they were gutted in the subsequent market correction. But, perhaps more importantly, many of these “forever” companies turned out to be vulnerable to change.

The companies of the Nifty Fifty represented the first flowering of change in the new world, and many of them went on to be its early victims. At least half of these supposedly impregnable companies have either gone out of business or been acquired by others. Kodak and Polaroid lost their raison d’etre when digital cameras appeared. Xerox ceded much of the dry copying business to low-priced competition from abroad. IBM proved vulnerable when decentralized computing and PCs took over from massive mainframes. Seen any door-to-door salespeople lately? No, and we don’t hear much about “Avon ladies.” And what about one of the darlings of the day: Simplicity Pattern? Who do you know today who makes their own clothes?

The years since then have seen a massive shift in our environment. Today, unlike in the 1950s and ’60s, everything seems to change every day. It’s particularly hard to think of a company or industry that won’t either be a disrupter or be disrupted (or both) in the years ahead. Anyone who believes all the firms on today’s list of leading growth companies will still be there in five or ten years has a good chance of being proved wrong.

For investors, this means there’s a new world order. Words like “stable,” “defensive” and “moat” will be less relevant in the future. Much of investing will require more technological expertise than it did in the past. And investments made on the assumptions that tomorrow will look like yesterday must be subject to vastly increased scrutiny.

The Changing Nature of Business

Increasingly, U.S. business is virtual, digital and information-oriented, no longer devoted to agriculture or to manufacturing physical products. Even those companies that do produce physical goods or services increasingly employ information products and other aspects of technology. These elements will have a profound impact on which legacy businesses will survive, which moats will hold up, and which newcomers will supplant the incumbents, as well as what our world will look like ten or twenty years from now.

In my January memo, Something of Value, I described some of the changes technology is making in the business world. They included:

-

the exceptional profitability of information-based businesses;

-

these companies’ low cost of incremental production, relative ease of scaling, and ability to see margins rise as the business expands, rather than suffer diminishing returns;

-

their modest need for additional capital and bigger plants as they grow, and

-

their reliance on a relatively small number of educated coders rather than masses of manual or unskilled workers.

Not only do these factors have the potential to create massive winners and bring down others, but they have profound implications for the overall economy. I think about one of them more than the rest. (Since Oaktree and I generally don’t invest in technology, I’m not required to have opinions on much of the foregoing.) That one is the fact that as technology and information play a bigger role in business and our lives, labor becomes less necessary.

One hundred years ago, the U.S. was an agricultural powerhouse, and agriculture was highly labor-intensive. Thus large numbers of unskilled workers were employed on U.S. farms, largely in the South and Midwest. With the invention of machine-powered equipment, the need for labor in agriculture declined. Large numbers of workers displaced by tractors made their way to the upper Midwest to work in plants producing newly invented automobiles and household appliances. Thus workers who were displaced from one field found employment in another – there were industries on the way up as well as on the way down.

Fast forward to the 21st century. The industries to which those workers and their descendants shifted are in turn losing jobs, this time due to the importation of foreign goods made with cheap labor and, especially, automation. With manufacturing on the decline in the U.S., it’s technological industries – in fields such as information, artificial intelligence, communications and entertainment – that are rising to take the place of metal-bending. And as mentioned above, tech firms can increase their production and sales without a proportional increase in the number of workers employed.

The optimists say, “some new need for labor always pops up” (as it did in manufacturing between 1920 and, say, 1970). But (a) you can’t see much sign of that in the tech-based industries that are on the rise – they’re just not labor-intensive – and (b) the workers that technological industries require are generally better educated than those cut adrift from the manufacturing sector. This latter element is especially worrisome given the declining quality of public education available in the U.S. (There is, however, room for growth in jobs in the service sector.)

I worry about where the workers no longer needed in manufacturing will find employment. For those who look to government for solutions, the most likely answer is support payments designed to guarantee everyone a living wage. But can we afford to support growing numbers of unemployed workers and their families? And how will we replace the non-monetary benefits from work: things like having a place to go each day and satisfaction with a job well done. Is sitting on the porch really a viable substitute for a job? I believe the opioid epidemic, for example, is highly correlated with job losses. Government largesse isn’t an adequate substitute for jobs.

Inflation/Deflation

I’ve written extensively on the subject of inflation of late, especially in Thinking About Macro four months ago. Since our knowledge of the future is so limited, there’s little for me to add on the subject. But what about the possibility of deflation? People have been warning about both inflation and deflation for the last several years. The only thing I’ve been confident about is that we’re unlikely to have both at the same time.

I recently came across a video of Cathie Wood speaking on the subject of deflation. For those who don’t know, Cathie is the investor who gained great fame in 2020 for having been heavily concentrated in the FAANGs, Tesla and other tech stocks, which vastly outperformed the rest of the stock market (in 2020, the average return on five of her seven ETFs was 141%). In the video, Cathie says:

We’ve been saying for some time that the risk to the economy is more on the side of deflation than inflation. So, as Covid created all the destruction that it did and with supply chains really being thrown off, we’ve been through a period here of inflation which I think investors are baking into the cake. . . .

. . . I was in college [during the 1970s], when inflation was raging, so I know what that is, and I truly believe we are not going back there, and that anyone planning for it is probably going to be making some mistakes. . .

On the innovation side, technologically enabled innovation – we are in a period today like we have never been. Never! I mean you have to go back to the telephone, electricity and the automobile to see three major technologically enabled sources of innovation evolving at the same time. Today we have five platforms: DNA sequencing, robotics, energy storage, artificial intelligence and blockchain technology, all of which are deflationary, and not just by a little bit, either. (Emphasis added)

She goes on to cite Jeff Gundlach, Ray Dalio and me, and maybe Stan Druckenmiller, as being concerned about a deflationary bust. (To be honest, my only comment possibly relevant to that assertion was to say that technological gains can be a deflationary factor – not that the overall result would be deflation.) She continues:

We think [the deflationary bust] is going to be balanced by a deflationary boom, so that’s where we differ. But where we agree is that there are companies who thought the world would never change and have been catering to short-term shareholders who wanted that extra penny or two in earnings and so got it by having the companies lever up and take more debt and shrink the number of shares, and they’ve also been focused on dividends. They are probably saddled with products and services that will become obsolete because of the record-breaking amount of innovation taking place today. And in order to service their debt, they are going to have to cut prices and move those goods and services that are on their way out anyway. . . So what it will mean is that the traditional GDP numbers we’re going to be seeing are going to be very low and growth will seem very scarce. . . .

There will be a lot of job displacement, there will be, no question about it. In fact, when we started our company in 2014, Oxford University had just put out a piece that said 47% of all jobs in the United States would be lost to automation and artificial intelligence by 2035. And they left it there. Hair on fire, headlines screaming, a lot of fear about automation. We got the question in every meeting. And what they had neglected to do – which we did – was finish the story.

With automation and artificial intelligence, productivity is going to go up dramatically. We think more than it ever has, certainly in modern times. And with productivity increases comes more wealth creation, and more GDP creation, and according to our estimates, in the year 2035, because of automation and artificial intelligence, we believe that GDP here in the United States will not be $28 trillion, which, if you drew linear growth, that’s where it would be, but instead will be $40 trillion . . .

Before I move on, I want to spend a minute on exactly what Cathie Wood said: technology will prove deflationary, and its positive impact on productivity will contribute to a jump in GDP. But GDP is the product of the number of hours worked times labor productivity per hour. Thus, if technology produces a big increase in output per hour worked, GDP can grow even if the number of hours worked declines. In other words, technology has the potential to boost GDP while adding to unemployment.

We don’t hear much these days about the possibility of deflation, and it certainly seems unlikely to arise. We also don’t hear much about the deflationary impact of technology, but we shouldn’t dismiss the idea.

The Outlook for Work

While on the subject of work, I want to mention a few changes that could add up to a sea change (“a profound or notable transformation”). Whereas religious observance had long made it traditional for workers to have a day off on their Sabbath, in the early 1900s Henry Ford began to give his workers both Saturday and Sunday off. (He wasn’t motivated solely by generosity. He wanted to sell cars and figured people would buy more of them if they had two-day weekends during which to enjoy them.) That was a major innovation, but today having Saturday and Sunday off is so universal that few people wonder how weekends came to be.

Now, we might be in for another major change in work patterns. It wasn’t long ago that most people wanted full-time employment and pursued careers affording opportunities for advancement. Now, however, a lot of that is out the window.

-

Computers made it easier to track people who wanted to work irregularly – a day or two here and a few hours there – and “gig work” such as driving for Uber became popular.

-

The pandemic made working from home commonplace and the requirement to work in an office five days a week less of a default solution.

-

Millions of people have left jobs over the last year as part of the “Great Resignation”: 4.4 million in September alone.

-

Many people seem to attach less importance to lifetime careers and advancement.

-

The unemployment rate is quite low, even as millions of jobs are unfilled. Per the October Institute for Supply Management report on services: “Labor is still an issue, as it’s hard to find and get people who want to work, especially in services, trucking and warehouse fulfillment.”

These changes have important implications: work arrangements are less standardized, workers seem less enthralled by a steady paycheck, and many employees expect to be allowed to work from home. In 2020 we saw a drop in the labor force participation rate (the percentage of working-age Americans employed or looking for work) from 63.4% to 60.2%, and it has since rebounded to only 61.1%. What’s behind these developments? Since economic phenomena aren’t governed by physical laws, precise causes are hard to ascertain. In this case, I can think of a large number of possible explanations:

-

The slower economic growth seen since roughly 2000 reduced the rate of job creation and advancement, and this may have made concepts like career and long-term employment less appealing to some young people.

-

Along similar lines, some members of younger generations may have become disaffected because of the increase in income inequality and decrease in prospects for economic mobility.

-

Many people can afford not to work – at least for a while – perhaps because they’ve made more money not working than they did working (thanks to stimulus checks and/or expanded unemployment benefits). Money from these sources piled up in savings accounts, and it may not have been entirely spent yet.

-

Homeowners may be reveling in the paper appreciation on their homes and borrowing against it to allow them to forgo a paycheck.

-

The extensive work-from-home experience during the pandemic got people out of the habit of “going to work” and made doing so less automatic. The experience may also have highlighted how unpleasant commuting is, reducing some people’s willingness to reengage in it.

-

The ebullient markets may have encouraged some to quit their jobs in order to take up day trading or cryptocurrency investments.

-

Some people moved during the pandemic, whether to escape Covid-19 or simply because WFH permitted it. Now some don’t want to return. In particular, WFH reduced the need for some to live near jobs in urban areas with a high cost of living. Others may have enjoyed spending time with family and decided to switch to jobs permitting them to do more of it.

-

Having seen how good it is for kids to have parents around, some families may have opted to become one-worker households, giving up on the fast track and potentially higher standards of living facilitated by two incomes.

-

People nearing retirement may be choosing to start it now rather than seek a job for the interim.

- Labor shortages (e.g., involving truck drivers) have increased workers’ bargaining power and given them the ability to move to better-paying jobs.

-

Employers’ desperate straits have caused some to lower job requirements, enabling workers to move up from low-paying jobs.

-

People wanting to return to work may be having trouble finding childcare, since low-paid childcare workers may be able to find jobs that pay more.

-

Finally, some people may still be prevented from returning to work by fear of Covid-19.

To sum up, many workers experienced a “timeout” during the pandemic – not working, working part-time, working from home, and/or certainly not traveling on business. For many, this may have occasioned a reset, giving them an opportunity to conclude, “You know, my career isn’t everything; family and quality of life count for more. I’m going to reorient my life and put less emphasis on work.”

At the present time, roughly 7.4 million Americans are unemployed and there are 11.2 million job openings. Sounds like it should be easy to put everyone to work and fill those positions. But the people who aren’t employed may lack the required qualifications, may be unwilling to accept a job that doesn’t allow them to work from home, may not want to adhere to fixed schedules, or may be unable to pass drug tests, etc. Just as with the supply chain, it may take a while to get all the moving parts to the right place.

I’ve listed a large number of changes here, mostly stemming from the pandemic. Some may disappear in the coming months as things get “back to normal.” But others may turn out to be permanent and in five or ten years cause us to say, “Remember how different things were before 2020?”

The Outlook for Democracy

There’s a great but little-used word to describe the state of U.S. politics and governance: parlous. Google defines it as “full of danger or uncertainty; precarious.” The country is highly divided in terms of politics, and discourse seems to move further toward the extremes with the passage of time.

Part of the blame goes to the media (including social media). The explanation is simple but unfortunate: a few entrepreneurs figured out that there’s money in division. At the birth of television, as I understand it, the people who ran the national networks established the news division as a public service that ran losses. In TV’s early decades (through the 1970s), the main networks did balanced, objective reporting – led by august figures such as Walter Cronkite, Chet Huntley and David Brinkley – and these networks pretty much still do. But over the last 20 years, some media outlets have increased their profits by catering to one side or the other, often in an inflammatory manner. More recently, we’ve heard about social media driving traffic by appealing to highly partisan audiences and disclaiming responsibility for content. The truth is, discord sells (how often does your daily newspaper lead with a positive headline?).

The result is very harmful. It’s bad enough that some cable news stations and social media sites deliver only one side of the argument on many issues. But increasingly, they provide “alternative facts” that allow Americans to inhabit different realities. This leads to further polarization and to hostility toward those with whom one disagrees. It doesn’t take long for disagreement to turn into dislike. Without a commonly agreed-on set of facts, it’s easy to doubt the good faith of those with contrary views, undermining the very basis of our democracy.

Today, Americans are more likely to live near people who share their political views, express similar opinions, and favor candidates who fully back their party’s agenda. Because which party will win the general election is a foregone conclusion in the vast majority of congressional elections, the real competition is in the primary election for the dominant party’s nomination, which often goes to a candidate espousing an extreme version of the party’s dogma. The winner – typically chosen by the small number of partisans who vote in primaries – almost always goes on to win the general election, creating a Congress heavily weighted with extremists from both parties.

Some politicians not only contribute to the division we’re seeing but also benefit from it in the form of increased campaign contributions and media attention. The non-competitive nature of many congressional elections encourages behavior that in the past was considered unacceptable: acting in an uncivil manner, attacking colleagues, expressing opinions that were previously taboo, and advocating extreme measures. Many elected officials appear to follow a variation on “all’s fair in love and war”: all tactics are okay if they motivate my supporters, get me reelected and help my party gain or retain power.

One might conclude that all the above is innocuous – something like a TV drama. It contributes to gridlock, and there are people who believe gridlock is the best we can hope for from Washington, because so many of the government’Some politicians not only contribute to the division we’re seeing but also benefit from it in the form of increased campaign contributions and media attention. The non-competitive nature of many congressional elections encourages behavior that in the past was considered unacceptable: acting in an uncivil manner, attacking colleagues, expressing opinions that were previously taboo, and advocating extreme measures. Many elected officials appear to follow a variation on “all’s fair in love and war”: all tactics are okay if they motivate my supporters, get me reelected and help my party gain or retain power.s active decisions are flawed. But these trends have worrisome implications.

Competition in the political arena has moved from intellectual/ideological to personal. As recent voting shows, our country is splitting in two, including in terms of demographics. This may be nothing new, but the forces of division are getting stronger. I believe “clustering” – the tendency to live near people like oneself – is growing, and along with it the level of dislike, disrespect and resentment toward “the other.” The political impact of clustering can be exacerbated by gerrymandering, which gives the dominant party seats and power disproportionate to its share of voters. (In many states, the drawing of voting districts is in the hands of the state legislature, where the dominant party can use its ability to gerrymander, or manipulate voting district boundaries, to perpetuate and perhaps increase its hold on power.)

These things complicate life in our so-called democracy (per Oxford University’s online dictionary Lexico, “a system of government by the whole population or all the eligible members of a state” or “control of an organization or group by the majority of its members”). When I was a kid, we settled schoolyard disputes by insisting “majority rules.” When we look at the U.S. system, however, we see numerous ways in which our form of government violates principles like representative democracy, majority rule, and “one person, one vote.” For example:

-

Whereas seats in the House of Representatives are allocated to the states in proportion to their populations, each state has two seats in the Senate. California, with 39 million people, has the same clout in the Senate as Wyoming with its 578,000. Thus the 26 smallest states, with only 57.6 million people (17.7% of the total U.S. population), theoretically could elect 52 senators and control the Senate.

-

U.S. presidents aren’t chosen on the basis of who gets the most popular votes, but by who gets a majority in the Electoral College. The 538 electors in the College are apportioned to the states on the basis of population, which is democratic, but in 48 states the Electoral College votes go to candidates on a winner-take-all basis, which is not. Thus, a candidate could win by one vote in each of the 39 least-populated states and Washington, D.C. (receiving 47.0 million out of their combined 93.9 million votes if all the registered voters went to the polls); get all 270 of their electors; and win the presidency even if another candidate got 100% of the 120.0 million votes in the 11 most populous states. In other words, in this extreme example, a U.S. president can be elected with just 47.0 million votes (22.0% of the total) versus 166.9 million for his or her opponent. (Note that if the percentage turnout in the least-populated states were lower than in the others, the former could elect a president with an even smaller percentage of the total popular vote.)

In the last 100 years, presidents have often been elected with significant majorities of the popular vote. The highest were for Lyndon B. Johnson – 61.1% in 1964; Franklin D. Roosevelt – 60.8% in 1936; Richard Nixon – 60.7% in 1972; and Ronald Reagan – 58.8% in 1984. But the winner of the last eight presidential elections only received between 43.0% and 52.9% of the vote, and presidents were elected twice with fewer popular votes than the loser.

These anti-democratic aspects of our system of government have been present for centuries. But the U.S. version of democracy generally worked because people and parties generally: (a) recognized that democracy is fragile and can only survive if most citizens feel the system is fair and legitimate; (b) believed that majority rule should be tempered by respect for minority rights; and (c) valued progress for the country at least as highly as political power. Thus, political leaders played by unwritten rules and hewed to traditional norms of behavior intended to foster a stable democracy. For most of our history, only fringe voices suggested our elections could be conducted dishonestly or questioned the outcome. Now, this thinking is going mainstream. I worry about this trend.

Clustering and gerrymandering increase the already-substantial influence of one party or the other in many states, and state legislatures’ control over elections opens the door for possible shenanigans. Secretary of state and membership on boards of elections have historically been non-partisan positions (and pretty boring). Increasingly, appointment or election can put partisan officials in charge of the election process. Both new laws and new political norms seem to have opened the door for legislators and election officials to behave in ways that were previously unthinkable. Ultimately, there’s nothing to keep state legislatures from appointing slates of electors who will vote for the dominant party’s nominee regardless of the popular vote in their states. Serious potential threats to our democracy exist, and no one can say what the future holds in this regard.

I’ve written in the past about my involvement with the group No Labels and its backing of bipartisan solutions to our nation’s problems. Our organization brings together both Democrats and Republicans – as well as both senators and representatives, who heretofore rarely spoke to each other – and I think No Labels deserves credit for some of the important laws that have been enacted this year on a bipartisan basis, most notably the infrastructure bill President Biden just signed into law.

In the six years I’ve been an active member of No Labels, my eyes have been opened to something I wasn’t aware of. In short, I think very few people appreciate how undemocratic Congress is. As I see it, each house of Congress has been firmly under the control of the leader elected by the majority party. On matters of importance, if the Speaker of the House or Majority Leader of the Senate wanted something to happen, it generally happened. And if a leader didn’t want something to happen, it generally didn’t happen. This one-person rule (a) seems highly suspect in what purports to be a democracy and (b) makes you wonder why we send senators and representatives to Washington (that is, if the leader can set the agenda and tell the members how to vote, why not just let the leader in each house run the whole thing?). And if the legislators on the two opposing sides follow the instructions from their leaders, which presumably are on a strict party-line basis, by definition there can’t be bipartisan legislation.

And I think bipartisan government and bipartisan legislation are absolutely essential for the health of our democracy. The alternative is that the majority party does what it wants, including passing laws with no concurrence from the other party. (Some measures can be passed in the Senate with as few as 51 votes under a process called “reconciliation,” overcoming resistance via filibuster – see below). When either party passes legislation on a straight party-line vote:

-

The legislation doesn’t have to be moderate enough to attract votes from the other side.

-

It’s easy for the minority party to vilify the new law and the people behind it.

-

There’s every likelihood that the minority party will reverse it when they gain a majority – to the detriment of Americans who need a stable, predictable environment in which to live and do business.

And that brings me to the infrastructure bill signed into law on November 15 and the unusual course it took in contrast to what I just described. First, it passed in the Senate on August 10 with support from all 50 Democrats but also 19 Republicans (in this case, Minority Leader Mitch McConnell freed his members to vote their conscience). But the bill encountered resistance in the House, where so-called progressive Democrats refused to vote for it unless the House first passed a “Build Back Better” bill, with trillions of dollars for safety-net programs unrelated to physical infrastructure. That became the basis for the intricate kabuki theater that played out over the last three months.

The infrastructure bill approved by the Senate could have been passed in the House in August. But partisan squabbles imperiled it, since most Republicans didn’t want to give President Biden’s Democratic administration a victory and some progressive Democrats wanted to use their leverage to hold the bill hostage until the moderates voted for theirs. Rather than call a vote immediately on the infrastructure bill, House Speaker Nancy Pelosi (perhaps wanting to placate the progressive members of her Democratic caucus) tied the two bills together, even though the BBB bill had yet to be fleshed out, debated, or “scored” in terms of its effect on the federal budget. Later, under pressure, she agreed in writing to work to pass the infrastructure bill and hold a vote on it by September 27, but she failed to do so (with no consequences).

What ensued was a real game of chicken. The Speaker demanded that the moderates commit to vote for the BBB bill first, but a small number of moderates (enough to prevent Democrats from achieving the necessary 218-vote majority threshold for passing a bill) refused to do so and demanded a vote on the infrastructure bill first. The moderates’ action felt like an uprising against the House leadership of a sort that has rarely been seen in recent years. But then on November 2, Democrats lost the governorship in Virginia and nearly lost it in highly Democratic New Jersey. The Biden administration’s resultant need for a “win” caused the bill to be brought to the House floor just three days later, where it was approved by all the Democrats except for six progressives, as well as by 13 moderate Republicans. The result was passage by a vote of 228 to 206, an outcome achieved despite resistance from the Speaker up to the last moment.

It’s easy for legislators who don’t want to support a bill to find provisions they say are objectionable, and they did so in this case. But I believe that on balance the provisions of the infrastructure law will help the vast majority of congressional districts; thus I suspect some of the 206 representatives who voted against it may have done so at the expense of potential benefits for their constituents. What’s the word for that? My answer is “politics,” which is, in part, defined by Oxford as “the debate or conflict among individuals or parties having or hoping to achieve power.”

Widespread dissatisfaction with both major parties could conceivably lead to the creation of a third party to appeal to Americans in the middle. But with more than two main parties dividing up the votes, there would be significant obstacles to any one of them achieving a clear win. And that’s where the complications set in. Under the U.S. form of government, it’s doubtful that minority party candidates can be elected and coalitions formed. More importantly, if candidates from more than two major parties vie for the presidency, it would be difficult for one to achieve a majority in the Electoral College. In that case, the election would be decided by the House of Representatives, with each state having one vote regardless of population. Thus, we’d be back to the problem regarding the Senate described on page eight: 26 states with a tiny share of the total population could end up appointing the president. While my examples describe extreme hypothetical outcomes, these are not imaginary concerns.

Finally under the heading of politics, I’ll touch on the filibuster. For those who are unfamiliar with it, the filibuster is a procedural tool that allows the minority in the Senate to bottle up legislation and require 60 votes for passage, rather than a simple majority of 51. Because the party in power usually has fewer than 60 seats, as is the case today (seats are 50/50), the filibuster often gives the minority party a veto over legislation. And whereas the parties have always done battle over policy, today things are so politicized that the minority party often has no goal other than to thwart the majority party’s agenda.

Because of Republicans’ opposition to many Democratic priorities, there is growing pressure within the Democratic party to use their slim majority in the Senate to eliminate the filibuster (the vice president presides over the Senate, meaning today’s Democratic vice president has the ability to break the 50/50 tie).

Will the Democrats eliminate the filibuster? Should they? And if they do, how will they feel when the Republicans someday are in the majority and are no longer constrained by the filibuster? Without rehashing the entire debate, I’ll merely point to the dilemma involved. Proponents of the filibuster argue that it requires the party in power to shape legislation capable of attracting minority-party support and that this prevents the passage of extreme laws. But opponents point out that these days, with the minority often dedicated to nothing but obstruction, the existence of the filibuster merely ensures inaction. (Note, however, that the results with the infrastructure bill show that bipartisan action isn’t entirely impossible, and a lot of minor legislation is passed that way with little attention.) The ability to pass laws with a one-seat majority facilitates the tyranny of the majority. But the ability of 41 Senators to halt a bill’s progress permits the tyranny of the minority. Which is worse? Obviously, this choice of tyrannies is one of the challenges faced in our democracy. There are no easy answers. (And if Democratic traditionalists refrain from eliminating the filibuster, what’s to keep Republicans from getting rid of it the next time they have a majority?)

Generational Inequity

In 2037 and 2026, respectively, Social Security and Medicare, benefit programs that aid older Americans, will likely become unable to continue paying today’s benefits. And yet we don’t hear any discussion of the benefit cuts, delayed eligibility, tax increases, or means testing that would have to be part of any solution. In fact, in the last 18 months Washington has approved more than $9 trillion of spending on Covid-19 relief and infrastructure, but we haven’t heard a word from either party about fixing these essential programs. That’s presumably because the party that trims these programs would likely be penalized at the polls.

The 71.2 million members of the Baby Boom generation (people born between roughly 1946 and 1964) are triple the 23.0 members of the Silent Generation that preceded them and 10% more than the 65.0 million Generation Xers that followed. The magnitude of the Boomers’ votes and financial resources have given them enormous political influence over the last 40 years. The result has been extensive deficit spending on things the Boomers want and a failure to modify benefit programs that need fixing, all at the expense of future generations.

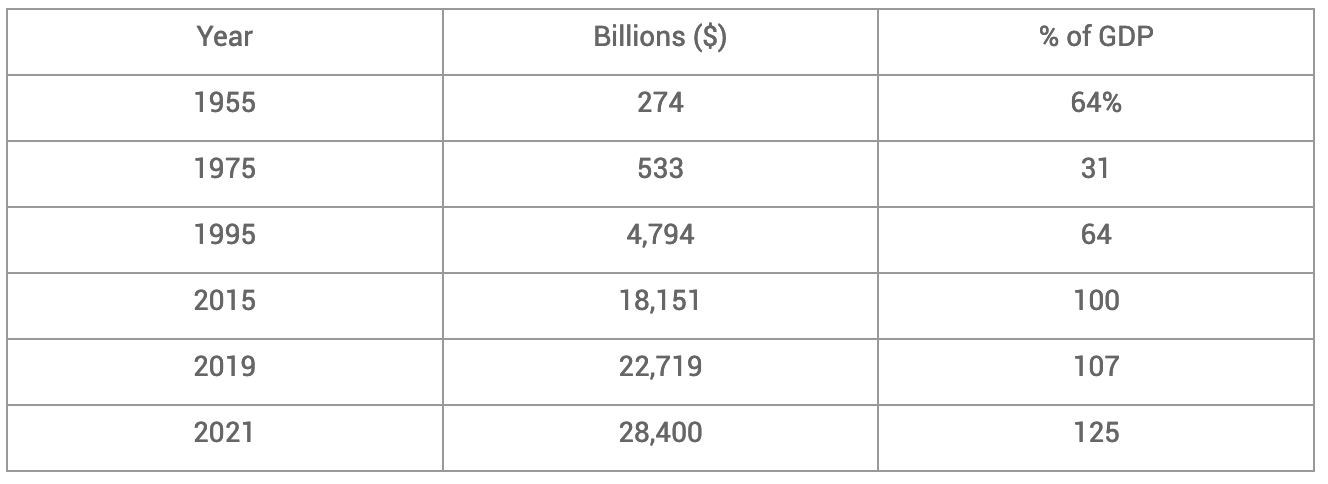

This is an example of the generational unfairness that has been perpetrated in recent decades. In short – in a way that many Americans probably don’t recognize – administrations of both parties have been (and still are) spending vast amounts, taxing less than they should relative to their spending (thus incurring deficits), and running up the national debt, largely favoring the Baby Boomers who are now America’s very numerous retirees. Here’s the history of the U.S. national debt:

In short, the Baby Boomers have been and still are consuming more than their fair share of the pie. This will leave future generations saddled with substantial debt stemming from expenditures they didn’t benefit from proportionally..

Social Security, while not part of the federal budget, provides a good example. It wasn’t set up as a funded program, but as an insurance scheme operating on a pay-as-you-go-basis, under which current receipts from workers are used to make payments to retirees. Social Security tax receipts aren’t added to an endowment, other than on a temporary basis, and benefits are paid out of current taxes on workers, not endowment income. But nowadays we have fewer people working for each retiree they support, and retirees are living longer than they used to. These trends endanger the system. Changes have to be made, but they’re not. Thus, 16 years from now (if not before), Social Security taxes will have to be raised, benefits (or at least their rate of increase) will have to be trimmed, and/or Social Security will have to become a federal obligation rather than a self-sustaining insurance scheme, adding to the deficit. This is only one of the many ways in which future generations will be penalized for the overspending my generation engaged in.

Foundations and universities have rules governing endowment spending, the main purpose of which is to balance the interests of the current generation against those of generations to come. This is a prime fiduciary responsibility of endowed institutions. Likewise, most of today’s parents won’t spend their way to unreasonable credit card balances and saddle their heirs with debt. While the significance of national debt is debatable, as is the question of how much debt is “too much,” it’s hard to argue that recent administrations in Washington have been appropriately balancing the interests of all generations. (And, by the way, today’s generations have been happy to consume an unsustainable share of the earth’s resources to fuel their lifestyles, which is certain to leave future generations with a degraded environment. This is another profound aspect of generational inequity.)

In August 2008, on the way to ending my memo What Worries Me, I included a passage from the 2004 book Running on Empty by Pete Peterson (for those who weren’t in the business world in the 20th century, Pete held important positions in government and co-founded Blackstone with Steve Schwarzman):

. . . while our problems are not yet intractable, both political parties are increasingly incorrigible. They are not facing our problems, they are running from them. They are locked into a politics of denial, distraction, and self-indulgence that can only be overcome if readers like you take back this country from the ideologues and spin doctors of both the left and the right. . . .

With faith-driven catechisms that are largely impervious to analysis or evidence, and that seem removed from any kind of serious political morality, both political parties have formed an unholy alliance – an undeclared war on the future. An undeclared war, that is, on our children. From neither party do we hear anything about sacrificing today for a better tomorrow. In some ways, our most formidable challenge may be our leaders’ baffling indifference to our fiscal metastasis. (Emphasis added)

The good news is that we’ve muddled through and enjoyed a good measure of prosperity despite the existence of these issues. The bad news is that little or nothing has been done about them.

The Role of the Fed

I won’t spend a great deal of time on this subject since everyone knows the story. But it has to be part of a memo that purports to discuss important changes that are underway.

Historically, the job of central banks has been to control the level of inflation and make sure the economy grows fast enough to create “full employment.” In recent years, however, the Fed seems to have taken on the additional task of keeping the securities markets on an upward trajectory. This has been achieved through the radical lowering of interest rates and the injection of massive amounts of liquidity into the economy.

The Fed funds rate – the bellwether of short-term interest rates in the U.S. – was reduced to zero for the first time during the Global Financial Crisis of 2008-09. And it worked – what followed was the longest economic recovery in U.S. history. But rates weren’t raised when the recovery was at its strongest, and when they finally were raised in 2017-18, the markets threw a tantrum and the Fed backed down, cutting rates instead.

Now the Fed funds rate is zero again, the markets are far higher than they were in the last decade, and we’re seeing serious inflation. The Fed has announced that it’s going to “taper” its stimulative program of bond buying, and it is widely expected that it will begin to raise interest rates next year. Will the impact on the economy be highly negative? Will the markets revolt again, and will a market correction convince the Fed to go back to a low-interest-rate regime? Will the Fed keep asset prices rising in perpetuity as the optimists think is now its job?

For me, the expectation that the Fed can keep the economy and markets rising without interruption is too good to be true. And I continue to believe the economy will perform best in the long run if it’s a free market economy, which does the best job of moving resources to their optimal use. As Richard Masson, my Oaktree co-founder, wrote in 2008, “Creative destruction and a functioning market economy assure change toward the best solution over time.” We could use a free market in money.

Larry Goodman, president of the Center for Fiscal Stability, recently wrote as follows:

Since [2010], Fed purchases of Treasury debt have funded as much as 60% to 80% of the entire government borrowing requirement. In other words, Fed actions have crowded out private-sector price discovery for more than 10 years, pushing yields to lows and stock prices to record highs. . . .

In fiscal 2021, the Fed purchased $1 trillion in Treasury debt, and the Treasury drained $1.6 trillion from its savings account at the Fed. These actions covered nearly the entire budget deficit, equal to . . . nearly all the pandemic-related government borrowing. Based on monthly estimates, there was actually a funding surplus this past summer. It is no wonder the 10-year Treasury yield reached a low of 1.17% in August despite high inflation rates. (The Wall Street Journal, November 18, 2021)

So guess what: The U.S. is still able to issue debt at low interest rates, a ringing endorsement of its creditworthiness from buyers. And who’s the main buyer supplying that endorsement? The U.S.

By the way, a few progressive Democrats have announced their opposition to the reappointment of Jerome Powell as Fed chair, because they think he’s not active enough in addressing climate change. So now we have a Fed that’s supposed to control inflation, foster growth and employment, support markets, and fight climate change. How many roles can one institution have and still maintain a coherent effort?

Developments in China

In the 43 years since the Maoist period ended in 1978, China has been the fastest growing major economy in the world. And it continued to grow in 2020, when no other large economies did. Will the superior growth continue? Will China become the world’s biggest economy? The answers to these questions will be very important.

My key observation is that China has had to navigate an unusually large number of transitions:

-

from farm to city,

-

from agriculture to manufacturing and services,

-

from mass poor to a significant middle class,

-

from economic reliance on exports to domestic consumption,

-

from growth based on capital investment to more organic growth, and

-

from emerging nation to world power.

As these processes move forward in the years ahead, China will have to balance central control and free enterprise (for which they understand the need). At the same time, the country has to respect the rule of law but still enact the policies it wants. And I believe it will have to eliminate the reliance on bailouts from Beijing and put up with bankruptcies, the resultant losses and, dare I say, economic cyclicality.

The question I find most interesting is how China simultaneously manages central control of the economy and private enterprise, while both pursuing economic efficiency and upholding socialist ideology. This has puzzled me throughout the 15 years I’ve been going there. The Chinese people have great respect for the Communist Party, and it and its leaders have a lot of levers to pull, free of the impediments that come with that cumbersome thing called democracy. But the private sector is full of entrepreneurship and seems to run very well.

Within the last year, President Xi has cracked down on financial celebrities, economic inequality and industries considered unhealthy for society, such as for-profit education. Nevertheless, I believe everyone in a position of power has taken note of the economic miracle that followed the elimination of Maoism and the substitution of the profit motive for quotas and equal sharing. It’s my guess that China’s “dual system” will continue to function well and private enterprise will continue to be respected, as long as it operates in a way consistent with “Xi Jinping Thought.”

The transitions listed above are already underway. Tackling all of them simultaneously has to be seen as a daunting task. But China has extensive resources as well as strong centralized control. No one can prove they will pull it off or that they won’t – the best we can have on questions like this is a hunch. Mine is that the Chinese economy will continue to grow faster than the rest of the world and may well become the largest economy. I believe with time we’ll see all the above transitions take place. The process just won’t be smooth and free of glitches.

For the last few years, I’ve been a member of the Shanghai International Financial Advisory Council. This has permitted me to see the extent to which China is dedicated to attracting foreign capital and making Shanghai a world financial center, and I believe China understands that doing so will require adherence to the rule of law and good conduct as a member of the global community. Hopefully that means the worst fears regarding its behavior won’t be realized.

The T-Word

As best I can tell, 2020 was the first year the word “trillion” came into common use. Everett Dirksen (R-IL) is described (perhaps apocryphally) as having said, “A billion here, a billion there, and pretty soon you’re talking real money.” Now billions have been reduced to pocket change, and it takes trillions to amount to “real money.”

I doubt most people could actually explain what a trillion is (that is, they likely have no idea that it’s a thousand billion, or a million million). And the scale of a trillion is almost incomprehensible. I was struck 30-40 years ago to learn that whereas a million dollars is $10 a second for 28 hours, a billion dollars is $10 a second for 38 months. Now let’s think about a trillion: $10 a second for more than 3,000 years. As I said, almost incomprehensible.

Elected officials throw around the term trillions (and spend trillions) without a way to really appreciate the implications. What’s next? I saw a great cartoon the other day that consisted of a drawing of the Capitol dome and the caption “What comes after trillions?” If we live long enough, I’m sure we’ll find out.

* * *

With all these significant changes underway, it’s easy to think the world is unusually complicated these days and to long for the way things were in the old days. On the other hand, at times like this I think back to something former Dallas Cowboys quarterback Don Meredith once said while providing commentary on Monday Night Football: “They don’t make ’em the way they used to. But then again, they never did.” Current times usually seem difficult, and we fondly remember the halcyon earlier days. But the past certainly wasn’t as comfortable as we remember it, and there were more challenges than we often recall.

Senior economics consultant Neil Irwin summed up our situation very well in The New York Times on April 16, 2020 (I borrowed this quote for inclusion in my May 2020 memo Uncertainty.):

The world economy is an infinitely complicated web of interconnections. We each have a series of direct economic interrelationships we can see: the stores we buy from, the employer that pays our salary, the bank that gives us a home loan. But once you get two or three levels out, it’s really impossible to know with any confidence how those connections work. . . .

In the years ahead we will learn what happens when that web is torn apart [by the pandemic and resultant lock-down], when millions of those links are destroyed all at once. And it opens the possibility of a global economy completely different from the one that has prevailed in recent decades.

All I have to add to that is my usual observation regarding the future: We’ll see.

November 23, 2021

Legal Information and Disclosures

This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree Capital Management, L.P. (“Oaktree”) believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Oaktree.

©2021 Oaktree Capital Management, L.P.