by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

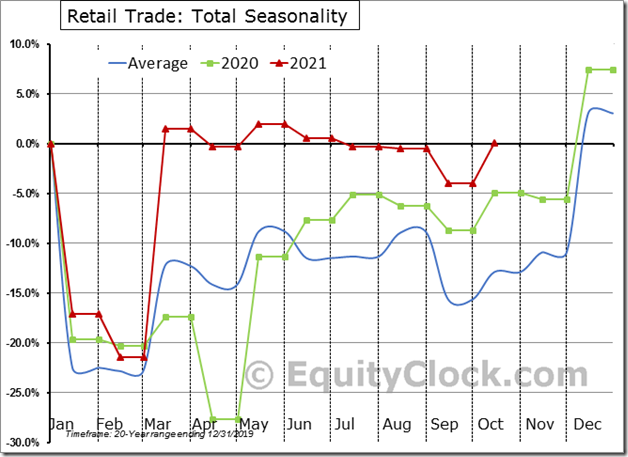

Retail Sales in the US jumped by 4.3% (NSA) in October, much stronger than the 3.4% rise that is average for this time of year. $MACRO $STUDY $XRT $RTH #Economy #Consumer

Strong consumer + robust manufacturing demand = remaining exposed to cyclical segments of the equity market. $MACRO $STUDY $XRT $XME $XLE $XLB $XLI

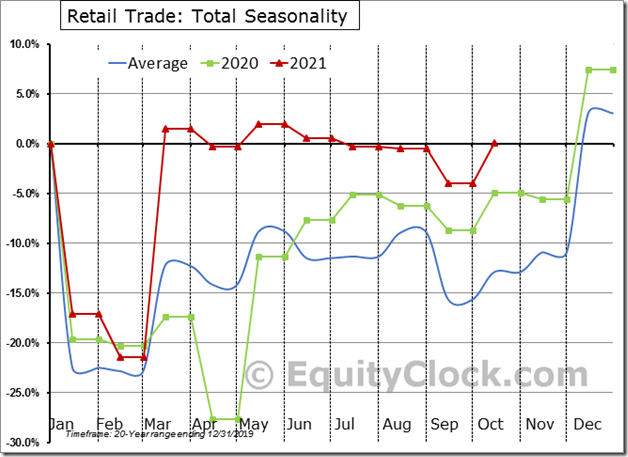

Taiwan iShares $EWT moved above $65.69 to an all-time high extending an intermediate uptrend.

Netflix $NFLX a NASDAQ 100 stock moved above $690.97 to an all-time high extending an intermediate uptrend.

General Motors $GM an S&P 100 stock moved above $64.30 to an all-time high extending an intermediate uptrend.

BHP Group, a major base metals producer moved below $52.31 extending an intermediate downtrend.

Biogen $BIIB an S&P 100 stock moved below $259.63 extending an intermediate downtrend

Activision $ATVI a NASDAQ 100 stock moved below $64.55 extending an intermediate downtrend.

Trader’s Corner

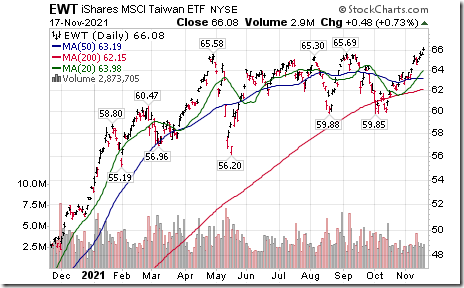

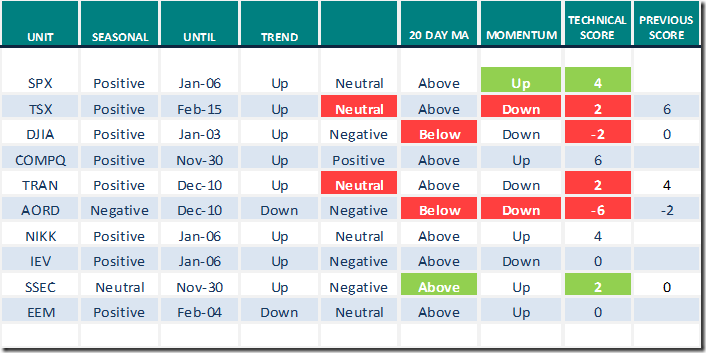

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Nov.17th 2021

Green: Increase from previous day

Red: Decrease from previous day

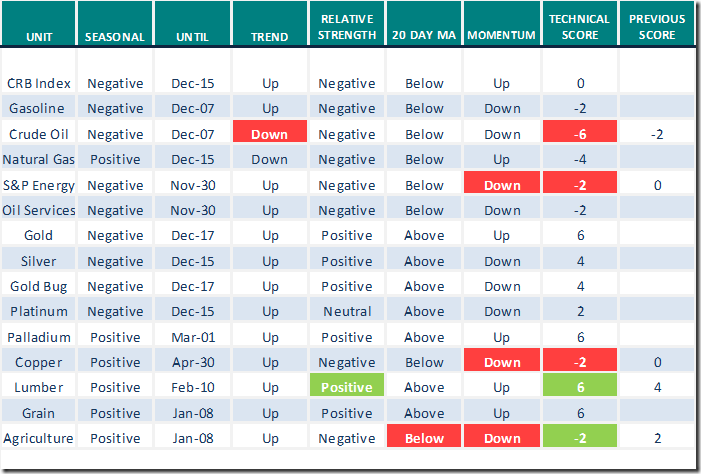

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.17th 2021

Green: Increase from previous day

Red: Decrease from previous day

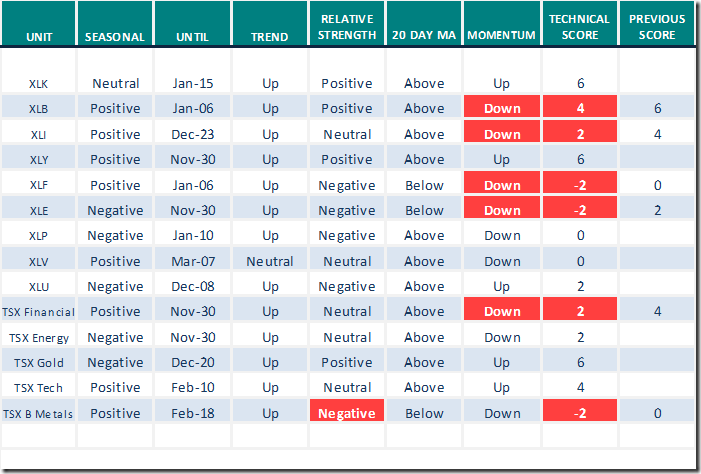

Sectors

Daily Seasonal/Technical Sector Trends for Nov.17th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Links offered by Valued Providers

Market Buzz

Greg Schnell discusses “Changes impacting Markets in 2022”. Comments favour the long term outlook for energy and materials. Following is a link:

Changes Impacting Markets in 2022 | Greg Schnell, CMT (11.17.21) – YouTube

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following comments:

Will 2022 Be a Year of Living Dangerously For Investors? – Uncommon Sense Investor

Michael Campbell’s World Outlook Financial Conference: February 4th and 5th

Early bird registrants are offed a discount deal. Following is the link:

The “early bird special” is on now until November 26th – a quick way to save $50 from the regular ticket price. So why not take advantage of it by going to the 2002 World Outlook website and clicking on the BUY ACCESS PASS NOW button.

S&P 500 Momentum Barometers

The intermediate Barometer dropped 5.01 to 70.14. It remains Overbought and showing early signs of rolling over.

The long term Barometer slipped 0.80 to 73.75. It remains Overbought and has rolled over.

TSX Momentum Barometers

The intermediate term Barometer added 0.47 to 73.11. It remains Overbought.

The long term Barometer was unchanged at 72.64. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.