by Gene Podkaminer, CFA, Franklin Templeton Investments

“Abenomics” – the policy package of former Prime Minister Shinzo Abe, had “three arrows” at its core – aggressive monetary policy, flexible fiscal policy, and growth, including structural reform. As newly elected Prime Minister Fumio Kishida takes office, we revisit the prospect of fiscal reform.

by Franklin Templeton Investment Solutions

Gene Podkaminer

Head of Research

Miles Sampson

Senior Research Analyst

Spencer Walling

Research Associate

Michael Kerwin

Senior Research Analyst

Ian Westley

Research Associate

Overview and Key Points

Japan’s economy is at the confluence of many macroeconomic trends, both local and global. Local elections have given way to a new Prime Minister, Fumio Kishida, and our attention is piqued as policy often leads macroeconomics. Globally, Japan has a unique exposure to two key themes: COVID-19 and global trade. Japan has emerged as a leader in COVID vaccination rates after initially lagging the broader world. Japan also has a front-row seat to the world’s global trade issues as its key export industries, like the automotive industry, are entangled in the global supply chain. This combination of local and global themes leads us to focus on Japan and further explore these topics and their multi-asset implications.

- Newly elected Prime Minister Fumio Kishida should continue to support easy monetary policy while aiming to employ expansionary fiscal policy by developing a considerable stimulus package.

- Japan’s rapid vaccination and macro momentum – Japan has evolved from a laggard to leader in COVID-19 vaccination rates. Substantial progress this summer led to the end of Japan’s State of Emergency lockdown in October. Since then, Japan has started to experience positive economic momentum. Our macro outlook for Japan is encouraging.

- Economic Momentum Meets Familiar Risks – Fiscal aspirations are not new to Japan, but most fiscal plans have fallen short over the past decade. Instead, aging demographics have proven to be a formidable headwind to growth. Additional economic risks revolve around global trade and rising energy prices.

- Multi-Asset Considerations – Japanese equities are relatively cheap, but that is nothing new. Equities could potentially benefit from an improving Japanese macro backdrop alongside strengthening corporate fundamentals. Government bond yields are expected to remain anchored by continued easy monetary policy from the Bank of Japan (BoJ), which is also a relative advantage to Japanese equities as interest rates lurch higher elsewhere. The yen has attractive defensive characteristics for a multi-asset portfolio but faces some headwinds from rising interest rate differentials and worsening terms of trade.

Kishida’s Growth Strategy: Near-Term Growth, Long-Term Redistribution

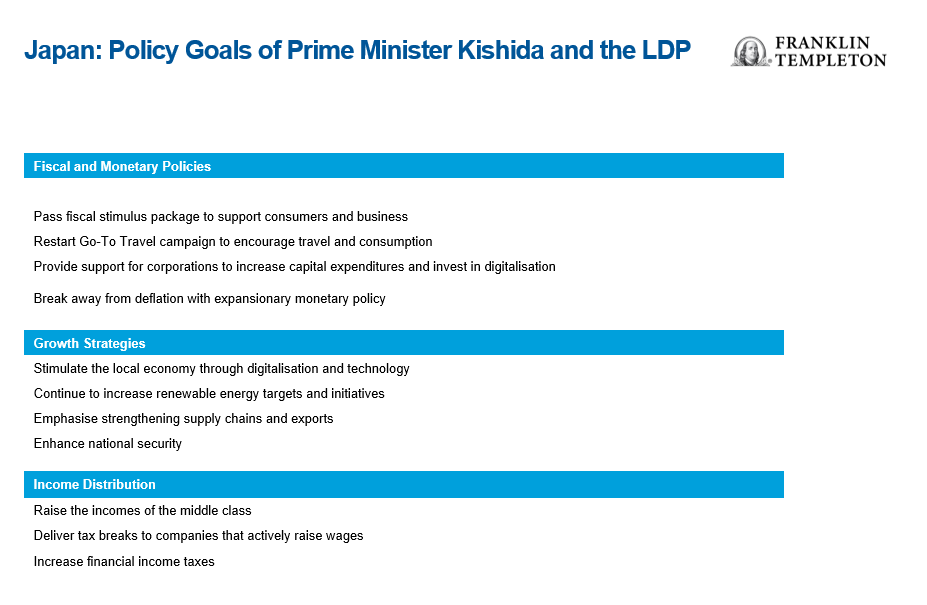

Fumio Kishida was elected Prime Minister of Japan in early October, and his Liberal Democratic Party (LDP) secured an absolute majority in the Lower House, which is a legislative body of the Japanese government. These results will give Kishida ample ability to start his agenda for expansive fiscal policy, which is anticipated to be about ¥40 trillion (US $350 billion, or ~7.3% of Japan’s gross domestic product [GDP]). Kishida’s primary goal is to help revitalise the domestic economy and stimulate growth. Like Japan’s previous Prime Minister Suga, policymakers will continue to push corporations to increase capital expenditures (capex) and promote digitalisation. Domestic manufacturing should benefit alongside rising productivity. Kishida’s fiscal plans are the latest attempt of policymakers to fight against the deflationary forces of Japan’s aging demographics and debt overhang.

Kishida’s goal of wealth redistribution initially had negative reactions, as the prospect of additional taxes on investment income scared investors; however, Kishida has since responded by saying that economic growth is his primary imperative before any redistribution can occur: “Unless there is growth there is nothing to distribute. It is important to seek growth first, and I will do my utmost to realise it.”

Japan’s Vaccination Campaign: From Laggard to Leader

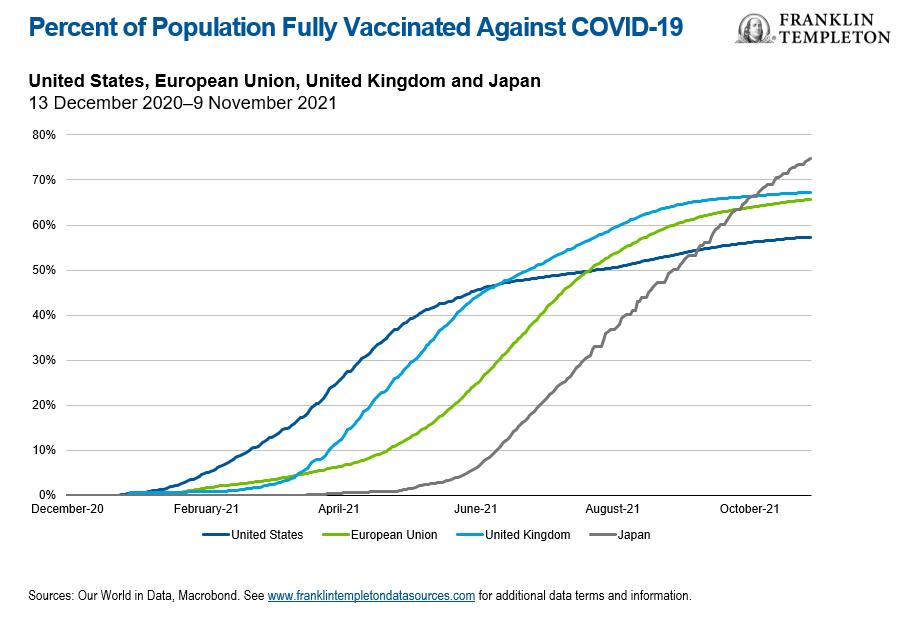

Japan has successfully positioned itself against a subsequent potential COVID-19 wave following the chaos that unfolded this summer, where Japan experienced an outbreak that heavily impacted the Olympic Games and resulted in a renewed State of Emergency lockdown. Since July 2021, Japan has leapt forward with its vaccination progress and has jumped from 20% of the population fully vaccinated up to the current 75% mark today.1

Japan has often been lauded as a nation with a lower susceptibility to another significant COVID-19 outbreak. As part of a larger joint-study, MIT conducted a survey wherein 95% of Japanese respondents wore masks (the survey ran from 6 July 2020 through 23 September 2020).2 Furthermore, Japan’s culture of cleanliness should limit the risk of additional COVID outbreaks in Japan.

Macro Momentum…

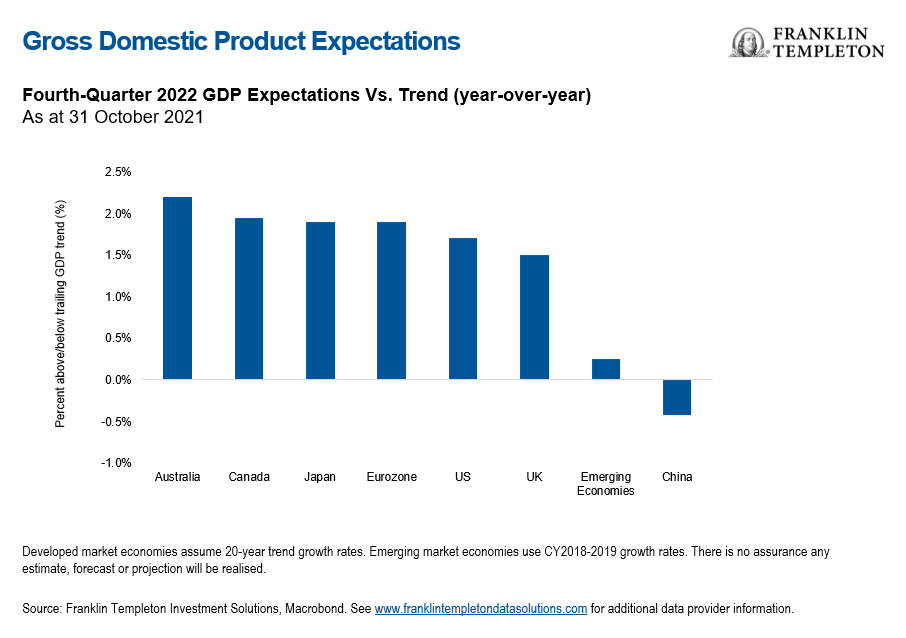

Meanwhile, from a macro perspective, Japan is already showing signs of life. Since Japan ended its State Emergency lockdown, mobility has begun to increase, and consumer confidence has risen to the highest levels since the pandemic started. Like many developed markets, Japanese households have excess savings that should support more consumption during the reopening of the economy. An additional fiscal package is expected to be launched by year-end at the earliest, which would include stimulus payments to support the health of consumers and provide measures to boost small and medium-sized enterprises3 (SMEs) that were affected by the lockdown over summer. Business confidence remains strong and capital expenditure intentions continue to grow as Japanese corporations collectively push for more digitalisation and higher productivity. Lastly, the continuation of the global economic recovery should also be a positive for Japanese exports as global growth remains above trend in most regions.

…Meet Familiar Risks

We recognise that Kishida is not the first prime minister to tout ambitious fiscal plans; many of his predecessors have echoed similar messages for promoting domestic growth and inflation that ultimately fell short. Kishida has also discussed the potential for wealth redistribution and investment income taxation, which may not be market friendly. We also acknowledge that increased consumption following the reopening of Japan may take some time to come together, particularly due to Japan’s older demographics.

As the global economic recovery took place throughout 2021, Japanese exports served as a significant driver of growth. However, net exports have recently been limited due to a few lingering downside risks. China’s slowing economy is a risk as China represents roughly 20% of Japanese total exports. The auto industry continues to suffer a shortage of semiconductors and faces supply-side constraints from Southeast Asia, although we expect to see increased production of autos going forward. For instance, Toyota recently announced it expects its production lines to operate normally in December, which would be the first time in seven months. Regarding imports, rising energy prices also should limit the upside of net exports, as Japan remains a significant oil importer.

Multi-Asset Considerations

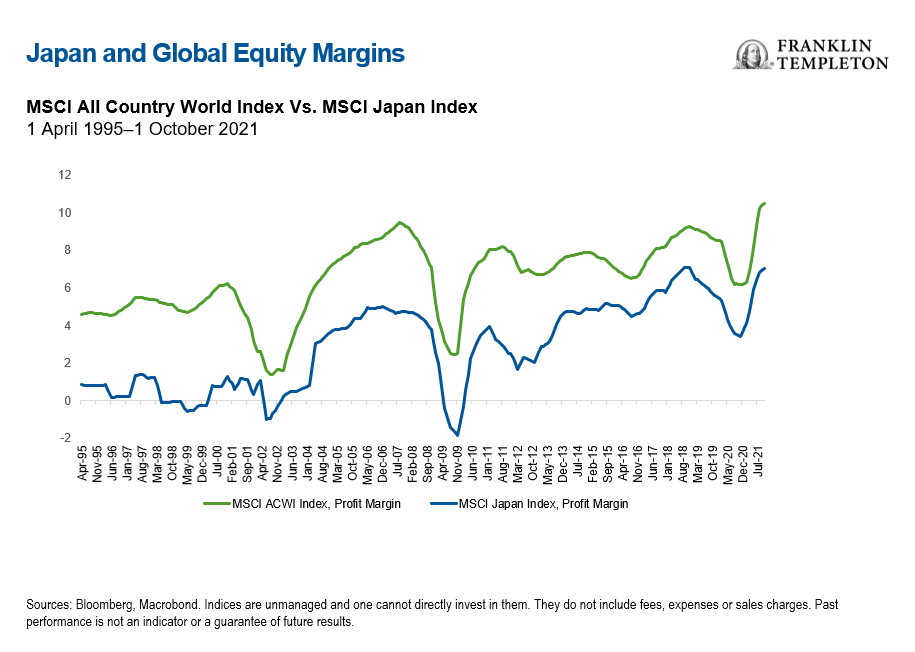

Equities: Japanese equities are attractively valued, in our view, trading on a trailing price-to-book discount of 52% relative to global equities (below its long-term average).4 Meanwhile, corporate fundamentals have been improving. Japan’s profit margins have improved from cyclical lows and should benefit from higher operating leverage. Structurally, margins continue to show an upward trend over the last few decades, which is in line with broader global equities, although Japanese profitability levels still lag global equities. Lastly, Japan’s improving corporate fundamentals provide the potential for further dividend hikes and buybacks.

There are a few global trends that are also positive for Japanese equities. Expanding global profit margins and free cash flow are leading companies to increase their capex plans, which complements Japan’s equity sector. Japan’s industrial sector composition makes it well-suited to leverage a broader global capex cycle due to exposures in machinery, automation and robotics. The International Federation of Robotics highlighted that Japanese robot manufacturers supplied over half of the world’s robots in 2018.5

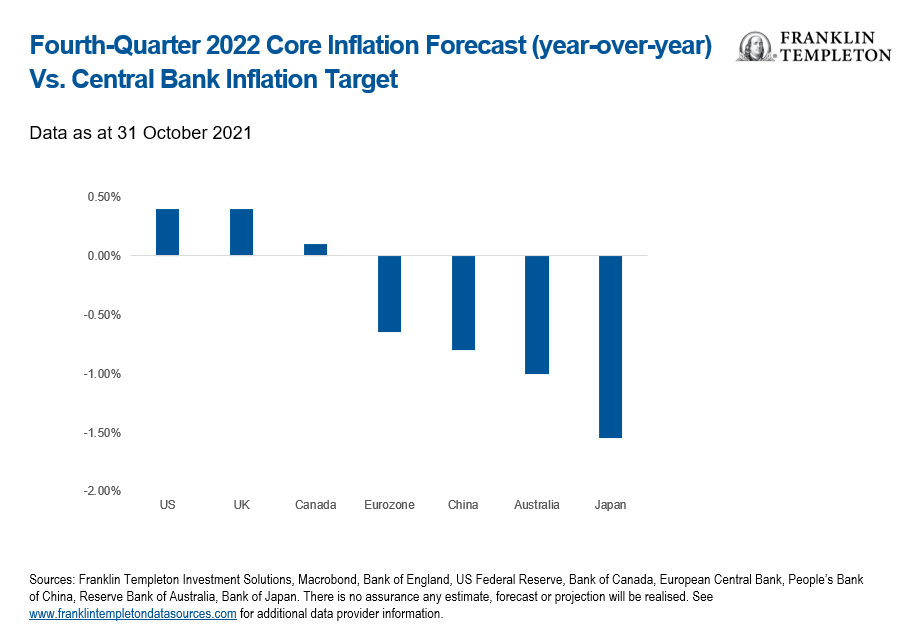

Fixed Income and Foreign Exchange: Despite the improving macro outlook and COVID situation, we expect the BoJ to be the last major developed market central bank to pivot away from its easing bias. This is largely a result of the BoJ’s elusive 2% inflation target which continues to remain a distant requirement. In the meantime, the BoJ’s yield curve control policy has contributed to its balance sheet rising to ~150% of GDP, a level unparalleled by any other major central bank. Despite the ballooning balance sheet, this policy is expected to persist, which will limit the threat of rising government bond yields and will support risk assets. Japanese government bonds are well-positioned to outperform in a rising rate market.

We appreciate the defensive characteristics of the yen from a portfolio perspective, and an improving Japanese growth outlook may also be supportive. However, the yen faces some headwinds due to our expectation for relative interest rate differentials to increase in favour of other markets. Additionally, rising global energy prices are weakening Japan’s terms of trade, as Japan remains a large oil importer.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_______________________

1. Source: NHK World – Japan, “75% of Japan’s population has received first shot,” 18 October 2021.

2. J. Lu, P. Jin, A. English. (2021). Collectivism predicts mask use during COVID-19. Proceedings of the National Academy of Sciences of the United States of America.

3. The definition of an SME is dependent upon two criteria—amount of capital and number of employees—the specific limits of which vary by industry. A company falls under the SME definition should it meet one of the two criteria for its industry.

4. Source: Bloomberg, as at 16 November 2021; MSCI Japan and MSCI AC World Index (ACWI). Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

5. Source: Muller, Christopher. IFR Secretariat Blog, October 2019.

The post Japan: A New Quiver of Arrows? appeared first on Beyond Bulls & Bears.

This post was first published at the official blog of Franklin Templeton Investments.