by Don Vialoux, EquityClock.com

The Bottom Line

Broadly based North American and European equity indices set all-time highs last week.

Observations

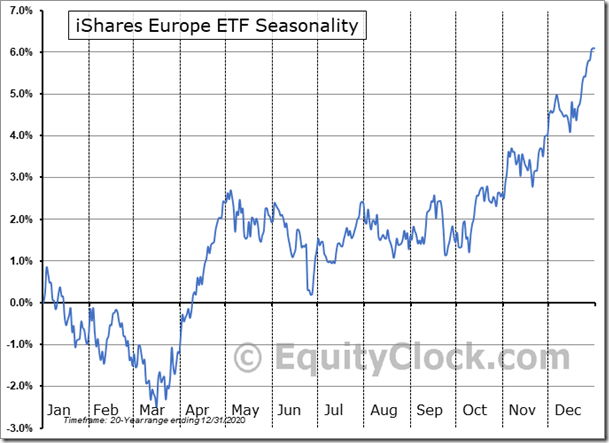

Most broadly based North American and European equity indices and their related ETFs stalled after reaching all-time highs early last week. All are following their historic seasonal pattern by moving higher during the twelve week period from mid-October to the first week in January.

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) were mixed last week.

Intermediate term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 50 day moving average) moved higher last week. It remained Overbought, but continued to trend higher. See Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 200 day moving average) moved higher last week. It remained Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors moved higher last week.

Intermediate term technical indicator for Canadian equity markets moved higher last week. It remained Overbought, but continued to trend higher. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (Percent of TSX stocks trading above their 200 day moving average) moved higher last week. It remained Overbought, but continued to trend higher. See Barometer charts at the end of this report.

Consensus estimates for earnings and revenues in 2021 by S&P 500 companies were virtually unchanged last week: 92% of S&P 500 companies have reported third quarter results to date. According to www.FactSet.com earnings in the third quarter on a year-over year basis are projected to increase 39.1% and revenues are projected to increase 17.5% (versus a previous estimate at 17.3%). Earnings in the fourth quarter are projected to increase 20.9% (versus 21.1% last week) and revenues are projected to increase 12.3% (versus 12.1% last week). Earnings for all of 2021 are projected to increase 44.7% (versus 44.6% last week) and revenues are projected to increase 15.6%

Consensus estimates for earnings and revenues by S&P 500 companies also was virtually unchanged last week. Consensus earnings on a year-over-year basis for the first quarter are projected to increase 5.8% and revenues are expected to increase 9.1% (versus 8.9% last week). Earnings in the second quarter are expected to increase 3.6% and revenues are expected to increase 7.1% (versus 7.0% last week). Consensus earnings in 2022 by S&P 500 companies are projected to increase 8.5% (versus 8.6% last week) and revenues are projected to increase

7.0%(versus 6.9% last week)

Economic News This Week

November Empire State Manufacturing Survey to be released at 8:30 AM EST on Monday is expected to increase to 20.50 from 19.80 in October.

U.S. October Retail Sales to be released at 8:30 AM EST on Tuesday is expected to increase 0.7% versus a gain of 0.7% in September. Excluding auto sales, October Retail Sales are expected to increase 1.0% versus a gain of 0.8% in September.

October U.S. Capacity Utilization to be released at 9:15 AM EST on Tuesday is expected to increase to 75.7% from 75.2% in September. October Industrial Production is expected to increase 0.7% versus a decline of 1.3% in September.

September Business Inventories to be released at 10:00 AM EST on Tuesday are expected to increase 0.6% versus a gain of 0.6% in August.

U.S. October Housing Starts to be released at 8:30 AM EST on Wednesday are expected to increase to 1.578 million from 1.555 million in September.

Canada’s October Consumer Price Index is to be released at 8:30 AM EST on Wednesday.

November Philly Fed Index to be released at 8:30 AM EST on Thursday is expected to slip to 22.0 from 23.8 in September.

Canada’s September Retail Sales to be released at 8:30 AM EST on Friday are expected to increase 2.0% versus a gain of 2.1% in August. Excluding auto sales, September Retail Sales are expected to increase 2.8% versus a gain of 2.8% in August.

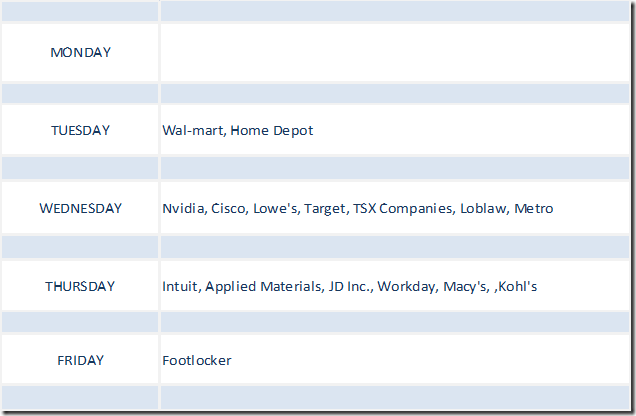

Selected Earnings News This Week

Another 15 S&P 500 companies are scheduled to release quarterly results this week. Focuses are on quarterly reports released by retail merchandisers and technology companies

Trader’s Corner

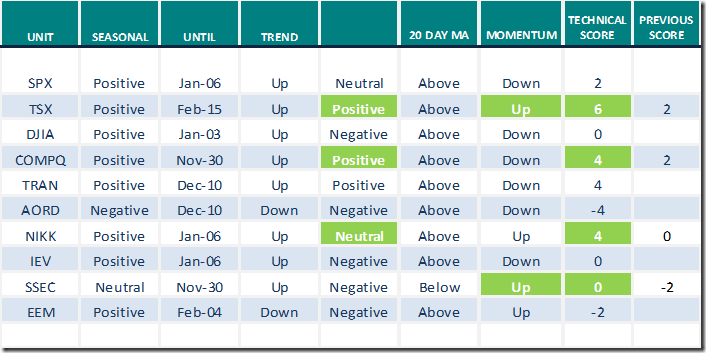

Equity Indices and Related ETFs

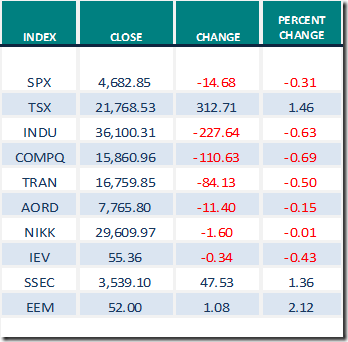

Daily Seasonal/Technical Equity Trends for Nov.12th 2021

Green: Increase from previous day

Red: Decrease from previous day

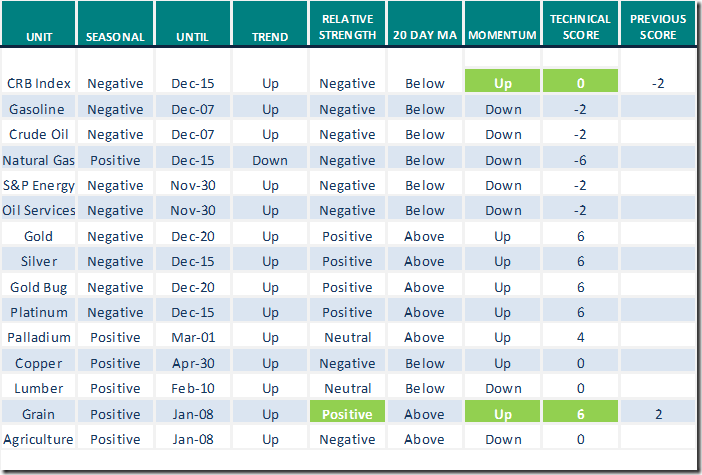

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.12th 2021

Green: Increase from previous day

Red: Decrease from previous day

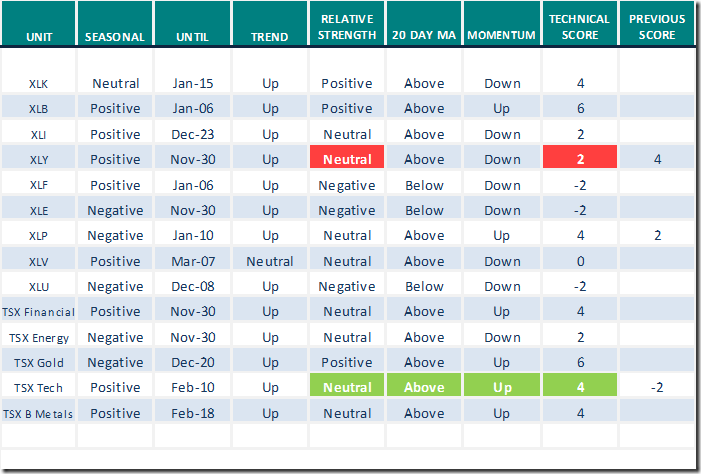

Sectors

Daily Seasonal/Technical Sector Trends for Nov.12th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

StockTwits.com@EquityClock

The Materials sector continues to make progress in record high territory a day following the inflation induced selloff. equityclock.com/2021/11/11/… $XLB $VAW $IYM $RTM

Coffee ETN $JJOFF moved above $17.80 and $18.25 extending an intermediate uptrend.

Metals and Mining SPDRs $XME moved above $47.67 to an all-time high extending an intermediate uptrend . Seasonal influences are favourable to January 6th. If a subscriber to EquityClock, see: charts.equityclock.com/spdr…

India ETF $PIN moved above $29.44 to an all-time high extending an intermediate uptrend.

Shopify $SHOP.CA a TSX 60 stock moved above $2,075.88 to an all-time high extending an intermediate uptrend.

Canopy Growth $WEED.CA moved above intermediate resistance at $18.06

Micron $MU a NASDAQ 100 stock moved above intermediate resistance at $76.92

Magna International $MG.CA s TSX 60 stock moved above $107.86 completing a reverse Head & Shoulders pattern.

MMM $MMM a Dow Jones Industrial Average stock moved above $183.82 completing a short term reverse Head & Shoulders pattern

Links offered by Valued Providers

Martin Pring says “Watch the Metal. It may soon be time to Pedal.

Watch the Metal; It May Soon Be Time to Pedal | ChartWatchers | StockCharts.com

Greg Schell says “Commodities swing wildly, but higher”

Commodities Swing Wildly, But Higher | ChartWatchers | StockCharts.com

Michael Campbell’s Money Talks for November 13th

November 13th Episode of MoneyTalks (mikesmoneytalks.ca)

Thank you to David Chapman and www.enrichedinvesting.com for a link to their weekly report:

To be added

Thank you to Mark Bunting and www.uncommonsenseinvestor.com to links to the following comments and video.

Chart Attack: Is This the Big One For Inflation? – Uncommon Sense Investor

13 Best Infrastructure Stocks for America’s Big Building Spend | Kiplinger

It’s time to buy U.K. stocks. Here are the 25 stocks to scoop up, says JPMorgan. – MarketWatch

10 Metaverse Stocks for the Future of Technology | Kiplinger

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 on Friday and 0.40 last week to 73.75. It remains Overbought and continues to trend higher.

The long term Barometer slipped 0.40 on Friday and 1.40 last week to 75.55. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.11 on Friday and added 2.15 last week to 74.53. It remains Overbought, but continues to trend higher.

The long term Barometer eased 1.08 on Friday and gained 7.38 last week to 75.00. It remains Overbought , but continues to trend higher

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.