by Alessio de Longis, Invesco Canada

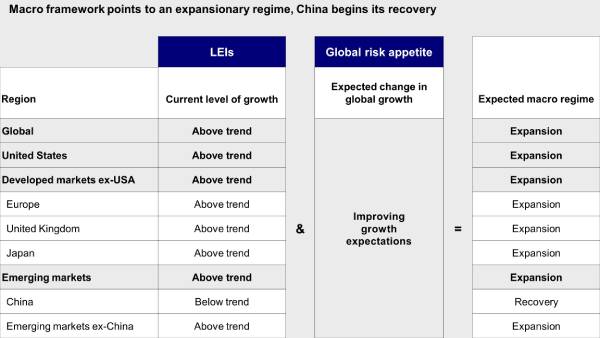

Alessio de Longis believes current market dynamics are consistent with expectations for a short tightening cycle and a return to the low-growth, low-inflation, post-global financial crisis (GFC) world. Our framework still points toward an expansionary regime. However, hawkish monetary policy repricing and flattening of global yield curves is a reminder of rising slowdown risks into 2022.

Macro update

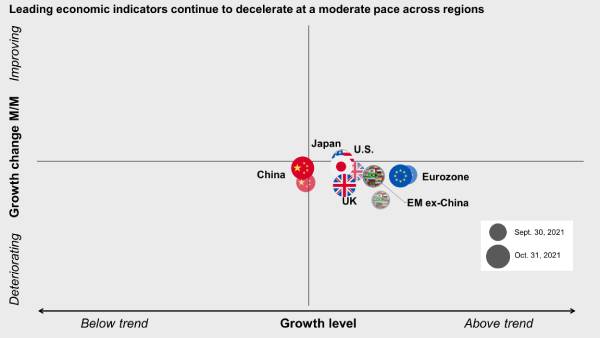

Leading economic indicators continue to decelerate at a moderate pace across regions. In the United States, weakness remains concentrated in consumer sentiment surveys, while business surveys, manufacturing activity, and housing indicators remain resilient.

In the eurozone and the UK, slowing manufacturing demand expectations, rising inventories, and weak consumer confidence confirm the slowdown of the past few months.

While China’s activity is likely to remain below trend growth in the near term, the negative momentum in manufacturing and real estate surveys is dissipating, suggesting some stabilization, while monetary and credit conditions are gradually improving.

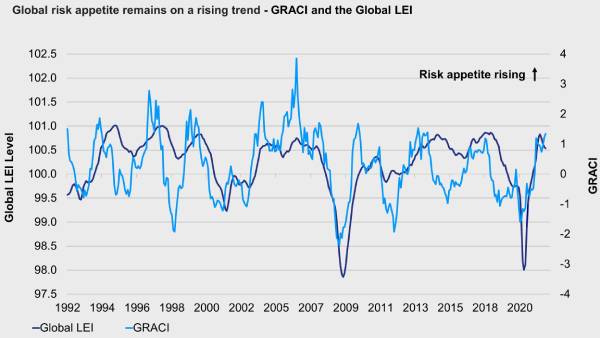

Our macro regime framework remains in an expansionary regime, with global economic activity above its long-term trend and global risk appetite improving (Figure 1a, 1b, and 2).

Figure 1a: Macro framework points to an expansionary regime, China begins its recovery

Figure 1b: Leading economic indicators continue to decelerate at a moderate pace across regions

Figure 2: Global risk appetite remains on a rising trend

The repricing of monetary policy expectations in the past few weeks across both developed and emerging markets has been impressive, and it is signaling a consistent view by market participants that impending tightening cycles are likely to be front-loaded and short-lived. Rate hike expectations have increased meaningfully, triggered by above-target inflation and ongoing concerns about supply chain bottlenecks. The current policy stance of central banks is being challenged.

In the U.S., bond markets are pricing in the first hike by mid-2022, much sooner than current Federal Reserve (Fed) projections. The Bank of Canada has brought quantitative easing (QE) to a premature end, and local bond markets have front-loaded two rate hikes within a year. The Reserve Bank of Australia has effectively given up on its yield curve control strategy, allowing two-year bond yields to rise to 80 basis points (bps) compared to a policy target of 10bps.1 Hawkish repricing has occurred for European and UK yield curves as well.1

However, in a somewhat unprecedented fashion, this hawkish repricing has not led to a rise in long-term bond yields. On the contrary, yield curves have been flattening aggressively, with the long end unchanged or lower over the past few months. These dynamics are consistent with market expectations for a short-lived tightening cycle and a return to the low-growth, low-inflation, post-GFC (global financial crisis) world, where the equilibrium level of interest rates remains low.

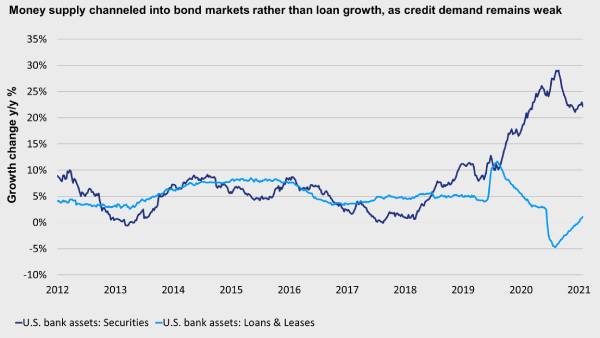

Downward pressure on long-term bond yields is indicative of persistently large precautionary savings in the private sector. Demand for credit remains weak despite abundant credit availability and easy financial conditions. Thus far, the strong money supply growth of the past few years is channeling into financial assets rather than consumption and investments.

As shown in Figure 3, U.S. bank holdings of financial assets (mainly U.S. Treasury and agency securities) have grown by over 20% year-on-year, while loan growth is flat.2 As the fiscal impulse begins to wane in 2022, private sector demand needs to make up the slack, but evidence in the economy thus far suggests this may be a challenging transition. Global yield curves are repricing accordingly.

Figure 3: U.S. money supply channeled through bank balance sheets into bond markets rather than loan growth, as credit demand remains weak

While we remain today in an expansionary regime, these developments increase the likelihood of a cyclical peak in the near term. When global market sentiment begins to discount a deceleration in growth more broadly across both fixed income and equity markets, our framework will transition to a more defensive asset allocation stance.

Investment positioning

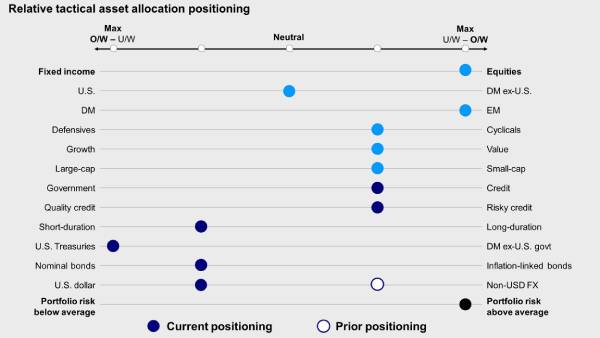

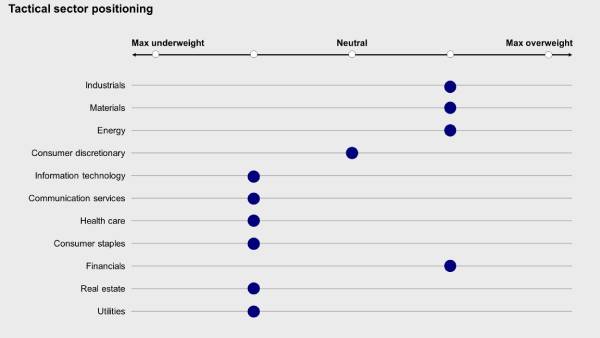

- Within equities, we favour emerging markets, driven by above-trend global growth, rising risk appetite, and expensive U.S. dollar valuations, which tend to support non-U.S. earnings and equity prices over the medium term. We remain tilted in favour of (small) size and value across regions. In addition, we are tilted in favour of momentum, which currently captures value and smaller-capitalization equities, therefore concentrating risk in cyclical factors and reducing factor portfolio diversification relative to the past few years. (Figures 4 and 5)

- In fixed income, we favour risky credit despite tight spreads, seeking income in a low-volatility environment. We are overweight high yield, bank loans, and emerging markets debt at the expense of investment grade credit and government bonds. We favour U.S. Treasuries over other developed government bond markets given the yield advantage. (Figure 4)

- In currency markets, we have further reduced our exposure to foreign currencies and moved to an overweight exposure to the U.S. dollar, as negative growth surprises outside the U.S. provide some near-term risk to foreign currencies despite attractive valuations. Within developed markets, we favour the euro, the yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar. In emerging markets, we favour high yielders with attractive valuations such as the Russian ruble, the Indian rupee, the Indonesian rupiah, and the Brazilian real.

Figure 4: Relative tactical asset allocation positioning

Figure 5: Tactical sector positioning

1 All policy pricing references as of Nov. 1, 2021.

2 Source: Federal Reserve, Assets and Liabilities of Commercial Banks in the United States – H.8, Oct. 29, 2021

This post was first published at the official blog of Invesco Canada.