by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

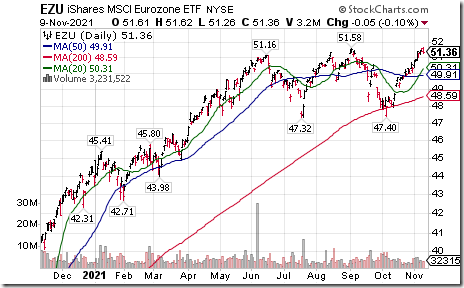

Eurozone iShares $EZU moved above $51.58 to an all-time high. Seasonal influences on a real and relative basis are favourable to January 5th. If a subscriber to EquityClock, see seasonality chart at charts.equityclock.com/isha…

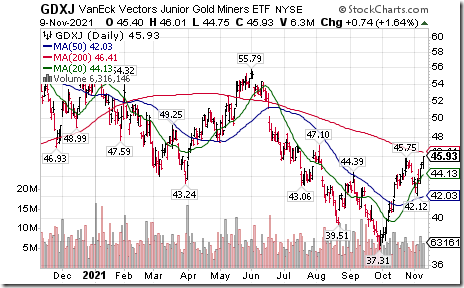

Junior Gold ETF $GDXJ moved above $45.75 setting an intermediate uptrend.

Infrastructure beneficiaries were the big winners during Monday’s session, just in time for the start of the optimal holding periods for each around the middle of November. equityclock.com/2021/11/08/… $SLX $XME $PKB

General Electric $GE moved above $115.02 and $115.14 extending an intermediate uptrend. The company announced a restructuring into three new entities.

Trader’s Corner

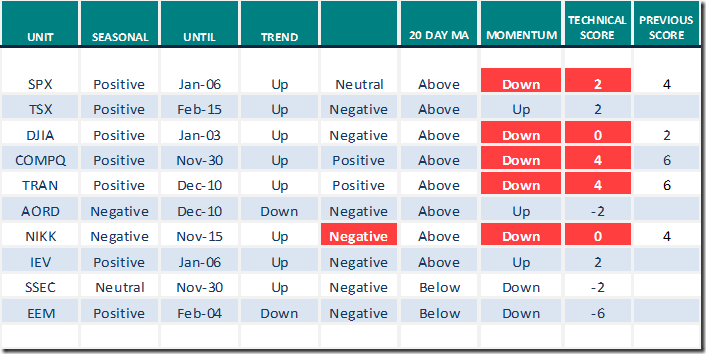

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Nov.9th 2021

Green: Increase from previous day

Red: Decrease from previous day

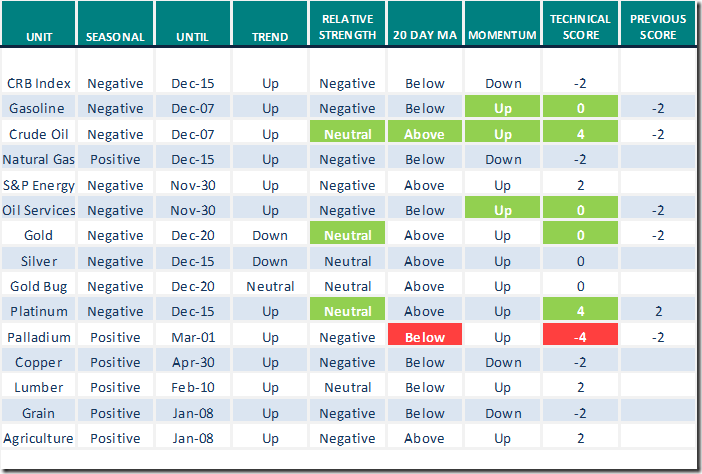

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.9th 2021

Green: Increase from previous day

Red: Decrease from previous day

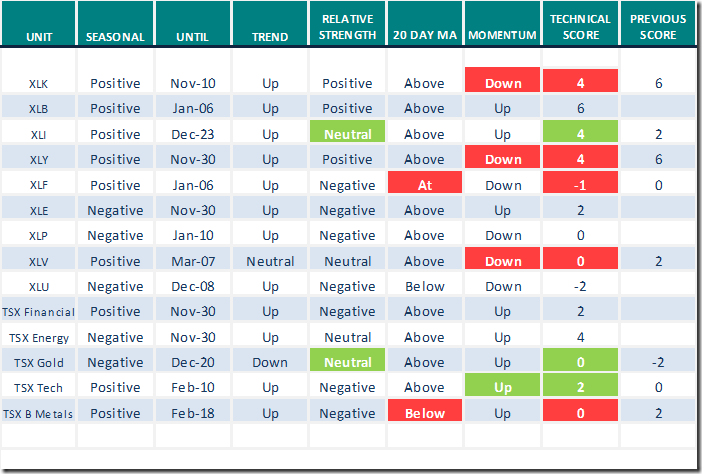

Sectors

Daily Seasonal/Technical Sector Trends for Nov.9th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

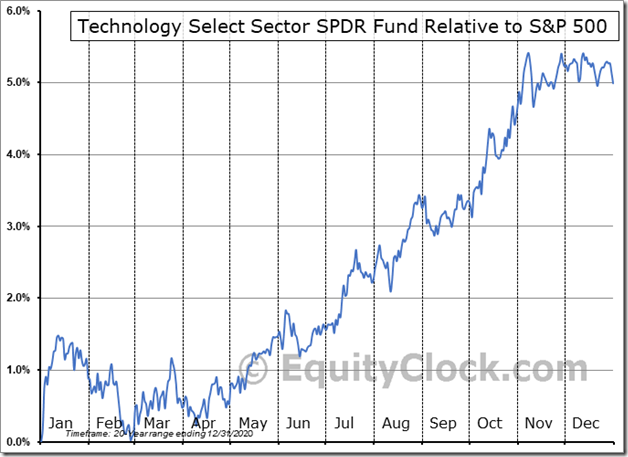

Seasonality Chart of the Day from www.EquityClock.com

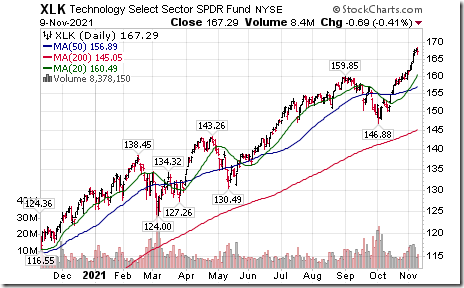

Seasonal influences for Technology SPDRs (Symbol: XLK) relative to the S&P 500 Index changes from Positive to Neutral from November 10th to January 15th

XLK remains in an intermediate uptrend. However, daily momentum indicators (i.e. Stochastics, RSI and MACD) are Overbought and rolling over.

S&P 500 Barometers

The intermediate Barometer slipped 0.60 to 73.15 yesterday. It remains Overbought.

The long term Barometer added 0.20 to 76.15 yesterday. It remains Overbought.

TSX Barometers

The intermediate Barometer slipped 0.96 to 76.08 yesterday. It remains Overbought.

The long term Barometer added 0.48 to 71.29 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.