by Don Vialoux, EquityClock.com

The Bottom Line

Broadly based North American indices moved higher last week while other world equity indices were mixed.

Observations

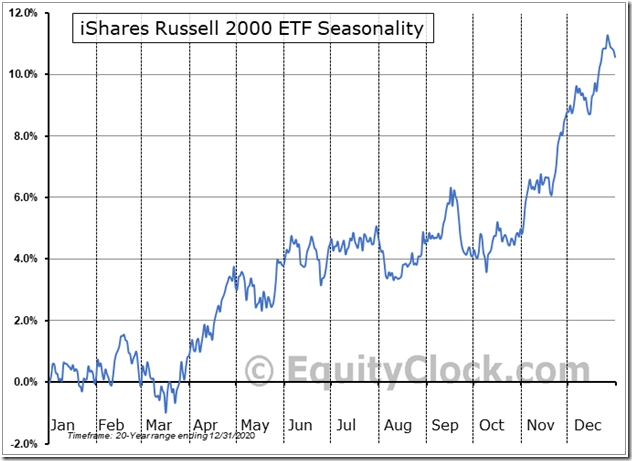

Strength in broadly based North American equity indices was extended last week. North American equity indices are following their historic seasonal pattern of moving higher during the twelve week period from mid-October to the first week in January. Strongest broadly based U.S. equity index last week was the small cap Russell 2000 Index and its related ETF, up 6.03 %.

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) moved higher last week.

Intermediate term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 50 day moving average) moved higher last week. It remained Overbought. See Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 200 day moving average) moved higher last week. It remained Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors moved slightly higher last week.

Intermediate term technical indicator for Canadian equity markets moved higher last week. It changed from Neutral to Overbought.. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (Percent of TSX stocks trading above their 200 day moving average) moved higher last week. It remained Overbought. See Barometer charts at the end of this report.

Consensus estimates for earnings and revenues in 2021 by S&P 500 companies were raised again last week following the release of better than consensus third quarter results reported by 89% of S&P 500 companies. According to www.FactSet.com earnings in the third quarter on a year-over year basis are projected to increase 39.1% (versus a previous estimate at 36.6% last week) and revenues are projected to increase 17.3% (versus a previous estimate at 15.8%). Earnings in the fourth quarter are projected to increase 21.1% (versus 21.6% last week) and revenues are projected to increase 12.1% (versus 11.9% last week). Earnings for all of 2021 are projected to increase 44.6% (versus 44.4% last week) and revenues are projected to increase 15.6% (versus 15.2% last week)

Consensus estimates for earnings and revenues by S&P 500 companies show continuing growth in 2022, but at a much slower rate. Consensus earnings on a year-over-year basis for the first quarter are projected to increase 5.8% and revenues are expected to increase 8.9% (versus 8.6% last week). Earnings in the second quarter are expected to increase 3.6% and revenues are expected to increase 7.0%. Consensus earnings in 2022 by S&P 500 companies are projected to increase 8.6% and revenues are projected to increase 6.9%.

Economic News This Week

October Producer Price Index to be released at 8:30 AM EDT on Tuesday is expected to increase 0.6% versus 0.5% in September. Excluding food and energy, October Producer Price Index is expected to increase 0.5% versus a gain of 0.2% in September.

October Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.6% versus a gain of 0.4% in September. Excluding food and energy, October Consumer Price Index is expected to increase 0.4% versus a gain of 0.2% in September.

November Michigan Consumer Sentiment Index to be released at 10:00 AM EDT on Friday is expected to increase to 72.5 from 71.7 in October.

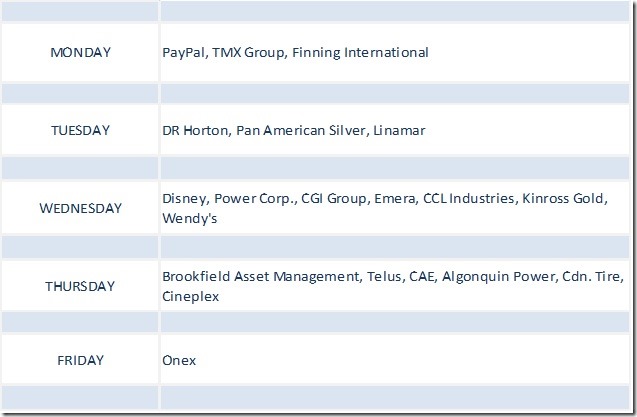

Earnings News This Week

Frequency of quarterly earnings reports by S&P 500 companies winds down this week. Another 13 companies (including one Dow Jones Industrial Average company: Disney) are scheduled to report. +

Frequency of quarterly reports by TSX 60 companies also has passed its peak.

Trader’s Corner

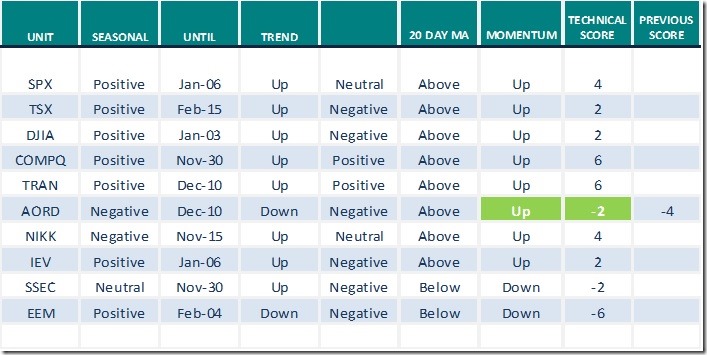

Equity Indices and Related ETFs

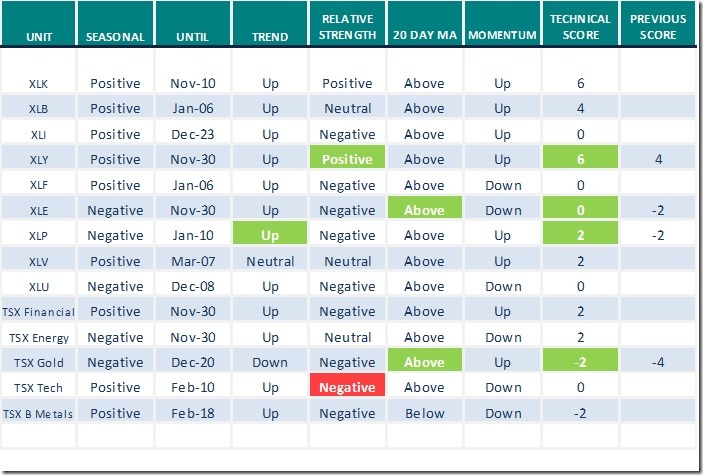

Daily Seasonal/Technical Equity Trends for Nov.5th 2021

Green: Increase from previous day

Red: Decrease from previous day

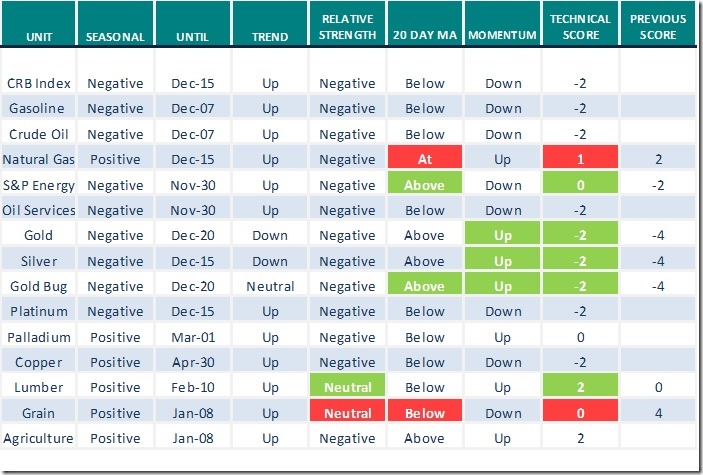

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.5th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for Nov.5th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

Treasury yields firmly lower, interest rate sensitive equities down sharply, and the US Dollar is jumping…What is going on?! equityclock.com/2021/11/04/… $TNX $IEF $TLT $XLU $XLRE $IYR $KBE $UUP $USDX

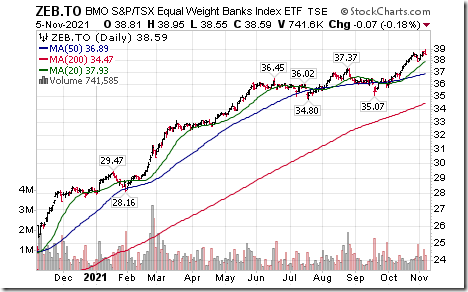

Canadian bank stocks are higher following news last night from OSFI that "moral suasion" on the Canadian banks to limit dividend increases and stock buy backs has been withdrawn. Financial services ETFs including ZEB.CA and XFN.CA have advanced to all-time highs. Banks reaching all-time highs this morning include $NA.CA BMO.CA and BNS.CA.

Editor’s Note: Seasonal influences on a real and relative basis for Canadian bank stocks and related ETFs are favourable until the end of November. If a subscriber to www.EquityClock.com see: https://charts.equityclock.com/bmo-sptsx-equal-weight-banks-index-etf-tsezeb-seasonal-chart

Industrial SPDRs $XLI moved above $106.13 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable on a real and relative basis to the first week in January. If a subscriber to www.EquityClock.com see:

https://charts.equityclock.com/industrial-select-sector-spdr-fund-nysexli-seasonal-chart

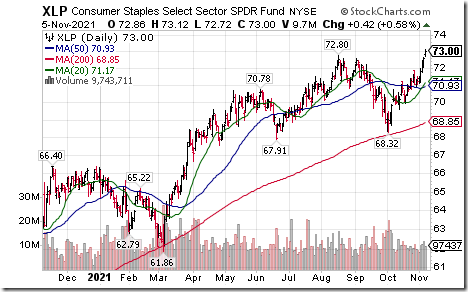

Consumer Staples SPDRs $XLP moved above $72.80 to an all-time high extending an intermediate uptrend.

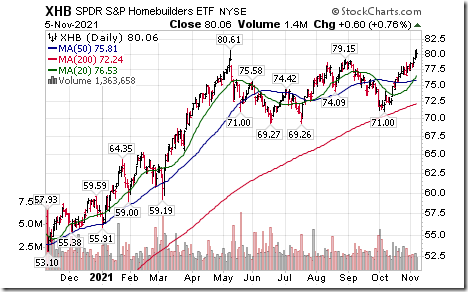

Home Builders SPDRs $XHB moved above $80.61 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable on a real and relative basis until at least mid-February and frequently to the end of April. If a subscriber to www.EquityClock.com see:

https://charts.equityclock.com/spdr-sp-homebuilders-etf-nysexhb-seasonal-chart

Travel and Leisure ETF $TRVL.TO moved above Cdn$23.00 extending an intermediate uptrend.

Biotech ETF $BBH moved below $189.88 extending an intermediate downtrend.

Amazon $AMZN a Dow Jones Industrial Average stock moved above intermediate resistance at 3,549.99.

Seasonal influences on a real and relative basis are favourable to the first week in January. If a subscriber to www.EquityClock.com see:

https://charts.equityclock.com/amazon-com-inc-nasdaqamzn-seasonal-chart

Booking Holdings $BKNG an S&P 100 stock moved above $2,540.00 to an all-time high extending an intermediate uptrend.

Seasonal influences on a real and relative basis are favourable to mid-January. If a subscriber to www.EquityClock.com see:

https://charts.equityclock.com/booking-holdings-inc-nasdbkng-seasonal-chart

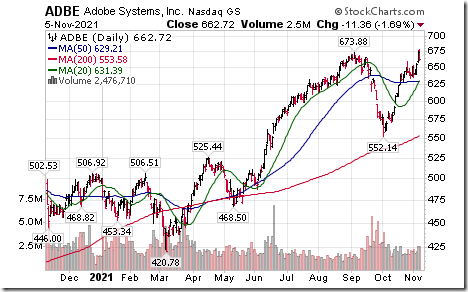

Adobe $ADBE a NASDAQ 100 stock moved above $673.88 to an all-time high extending an intermediate uptrend.

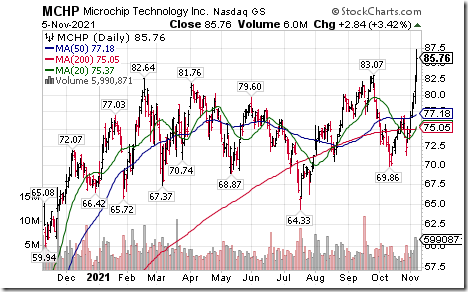

Microchip Technology $MCHP a NASDAQ 100 stock moved above $82.64 and $83.07 to an all-time high

Seasonal influences are favourable on a real and relative basis until at least mid-February. If a subscriber to www.EquityClock.com see:

https://charts.equityclock.com/microchip-technology-inc-nasdaqmchp-seasonal-chart

QualComm $QCOM an S&P 100 stock moved above $165.52 to an all-time high extending an intermediate uptrend.

Coca Cola $KO an S&P 100 stock moved above $57.13 to an all-time high extending an intermediate uptrend.

KraftHeinz $KHC an S&P 100 stock moved above $37.79 resuming an intermediate uptrend.

Seasonal influences are favourable on a real and relative basis to the third week in January. If a subscriber to www.EquityClock.com see:

https://charts.equityclock.com/kraft-heinz-co-nasdkhc-seasonal-chart

Peloton $PTON a NASDAQ 100 stock moved below $80.48 and $81.04 on a revenue and earnings warning setting an intermediate downtrend.

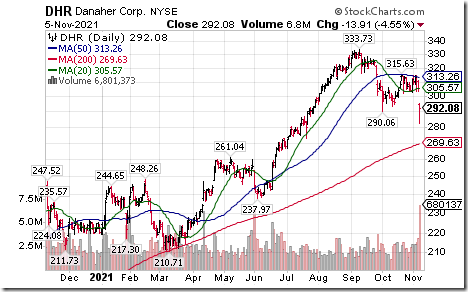

Danaher $DHR an S&P 100 stock moved below $290.06 completing a double top pattern.

Links offered by Valued Providers

Links offered by Valued Providers

Greg Schnell says”There are exit signs at Costco”. Following is the link:

There Are Exit Signs At Costco | The Canadian Technician | StockCharts.com

Michael Campbell’s Money Talks weekly show on November 6th

November 6th Episode of MoneyTalks (mikesmoneytalks.ca)

Registration for Michael Campbell’s World Outlook Financial Conference: February 4-5

World Outlook Conference 2022 (mikesmoneytalks.ca)

Technical Scoop: Weekly comment by David Chapman and www.EnrichedInvesting.com

Links offered by Mark Bunting and www.uncommonsenseinvestor.com

10 Small Cap Ideas with As Much As 99% Upside – Uncommon Sense Investor

This Economic Data is Indisputably Bullish For Stocks – Uncommon Sense Investor

12 of the Best Stocks You Haven’t Heard Of | Kiplinger

Tune Up Your Stock Portfolio for 2022 | Kiplinger

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.27 on Friday and12.11 last week to 73.36. It remains Overbought and trending up.

The long term Barometer gained 3.26 on Friday and 4.86 last week to 76.95. It remains Overbought and trending up.

TSX Momentum Barometers

The intermediate term Barometer added 2.38 on Friday and 13.84 to 72.38 last week. It changed from Neutral to Overbought on a move above 60.00.

The long term Barometer added 1.90 on Friday and 4.89 last week. It remained Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.